GM replaced its $5 billion revolving line of credit with two new credit lines totaling $11 billion in Q4. It’s a sign of market confidence in a strengthening balance sheet.

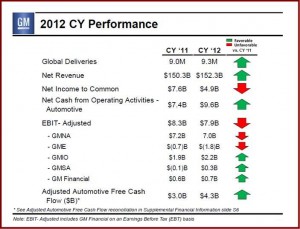

General Motors Co. (NYSE: GM) today announced 2012 calendar-year earnings of $4.9 billion, or $2.92 per fully diluted share, down from $7.6 billion, or $4.58 in 2011. The company sold 9.3 million vehicles during 2012; and the earnings, while positive for the third straight year, were hurt by deepening losses in Europe, which has cost GM -$18 billion since 1999. GM wrote down more than $5 billion in assets in the Eurozone, and it also wrote off more than half the value of its PSA Citroen stock (-$220 million) acquired latest year in what GM said was a collaboration that would, eventually, save billions. North American costs also increased, resulting in flat earnings for GM’s most profitable market. GM did however pick up 4 points of market share in China, the world’s largest auto market.

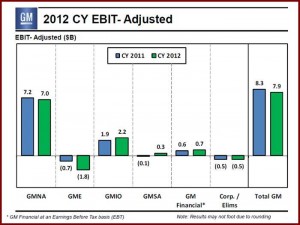

The GM drop came on revenues that increased 1% to $152.3 billion, but special restructuring charges of -$500 million or $0.32 per share hurt especially when compared to 2011 when special items added $1.2 billion to earnings. Full-year earnings before interest and tax (EBIT) adjusted was $7.9 billion, compared with $8.3 billion in 2011. GM also made an accounting change in Q4 of 2012 that resulted in a $26 billion charge – actually a positive sign that it expects to be profitable again in 2013. However, no dividend is in sight for common shareholders. (Read AutoInformed on GM Posts Record $9.1 Billion Profit in 2011 – $7.6B on Common and Toyota Ousts GM from Global Auto Sales Leadership. VW Third)

The GM recovery continues. New pickup trucks – full and mid-size this year in North America should boost profits.

GM North America (GMNA) reported EBIT-adjusted of $1.4 billion in the fourth quarter of 2012 compared with $1.5 billion in 2011 as costs rose and competition, especially form the resurgent Japanese, intensified. Full-year EBIT-adjusted was $7 billion in 2012 compared to $7.2 billion in 2011. Based on GMNA’s 2012 financial performance, the company will pay profit sharing of up to $6,750 to 49,000 eligible GM U.S. hourly employees.

GM Europe (GME) reported EBIT-adjusted of -$0.7 billion in the fourth quarter of 2012, compared to -$0.6 billion in 2011. Full-year EBIT-adjusted was -$1.8 billion in 2012, compared with -$0.7 billion in 2011.

GM was passed by Toyota Motor in global sales during 2012 for the Number One spot; Volkswagen Group is a close third.

GM International Operations (GMIO) reported EBIT-adjusted of $0.5 billion in the fourth quarter of 2012 compared with $0.4 billion in 2011. Full-year EBIT-adjusted was $2.2 billion in 2012 compared with $1.9 billion in 2011.

GM South America (GMSA) reported EBIT-adjusted of $0.1 billion in the fourth quarter of 2012, compared with -$(.2) billion in 2011. Full-year EBIT-adjusted was $0.3 billion in 2012 compared with EBIT-adjusted of -$0.1 billion in 2011.

GM Financial reported EBT of $0.1 billion in the fourth quarter of 2012, compared with $0.2 billion in 2011. Full-year EBT was $0.7 billion, compared to $0.6 billion in 2011.

GM’s U.S. defined benefit pension plans earned asset returns of 11.6% and ended the year 84% funded worth $13.1 billion, slightly improved from the prior year. As previously announced, during 2012 GM settled approximately $28 billion of its U.S. salaried pension liability through a combination of lump sum offers and annuity payments, which were transferred to Prudential insurance in November. GM said it expects no mandatory contributions to U.S. defined benefit pension plans for at least five years. (Read AutoInformed on GM Pension Buyout Financial Engineering or Coup?)

“Our aggressive vehicle launch cadence and focus on improving the top line, combined with rigorous cost discipline will help us continue to generate strong business results moving forward,” said Dan Ammann, senior vice president and CFO.

| GM Results | Q4 2011 | Q4 2012 | Year 2011 | Year 2012 |

| Revenue $ billions |

$38.0 |

$39.3 |

$150.3 |

$152.3 |

| Net income common shares |

$0.5 |

$0.9 |

$7.6 |

$4.9 |

| earnings per share (EPS) fully diluted |

$0.28 |

$0.54 |

$4.58 |

$2.92 |

| special items EPS fully diluted |

-$0.11 |

$0.06 |

$0.70 |

-$0.32 |

| EBIT-adjusted |

$1.1 |

$1.2 |

$8.3 |

$7.9 |

| automotive net cash $ billions |

$1.2 |

$0.5 |

$7.4 |

$9.6 |

| adj. automotive free cash flow $ billions |

-$0.2 |

$1.1 |

$3.0 |

$4.3 |

See also:

- GM Annual Report Says No Dividend is Planned for Common

- Toyota Ousts GM from Global Auto Sales Leadership. VW Third

- Ford Motor Doubles Quarterly Dividend for Q1 2013 to $0.10

- GM U.S. Sales Up 16% in January, a Bit More than Market Gain

- Toyota Led all Makers in U.S. Sales Gains During January of 2013

- Chrysler Group Posts 2012 Net Income of $1.7 Billion

- General Motors Sells 300,000 Vehicles in China – All Time Record

- Toyota Quadruples Q3 Earnings despite Yen, China Woes. Raises Forecast