General Motors (NYSE: GM) today reported Q1 net earnings of $ 2,939,000,000 on $11 billion in revenue, with a Net Income margin of 8.2%, down 1.1 ppts. GM’s Q1 market share was 9% on sales of 1.4 million units. Market share was down YoY due to semiconductor shortages and availability of dealer inventory.

Increased production and robust customer demand from the Biden Administration recovery in North America played a significant part in a decent (So-so? It was basically the same as last year.) financial performance that nonetheless was down for shareholders – at $1.35 per share, off $0.68 compared year-over-year. Consider: For Q1 2022 Tesla reported $3.22 earnings per share, and revenue of $18.76 billion. Vehicle sales were 310,048. Moreover, Tesla reported record automotive margins of 32.9%.

“We are now in a rapid launch cycle thanks to investments and initiatives we have undertaken across our entire company over the last several years,” said CEO and Chair Mary Barra in a letter to shareholders released with the earnings. Notably, 50% of GM’s North American and Chinese “footprint” will be converted to EVs by 2030. It’s a big bet necessary for survival.

“They have allowed us to establish an unparalleled foundation on which to execute and scale. We have taken the time to do EVs right, so we can create value for shareholders, our customers and all our other stakeholders. We are united around our EV leadership plan and we execute against it every day,” Barra said. (GM expects to double revenue to $275B-$315B by 2030. Yes, an electric Corvette is coming next year, but the upcoming Hummer EV is likely the one that will produce big earnings. )

GM Forecast

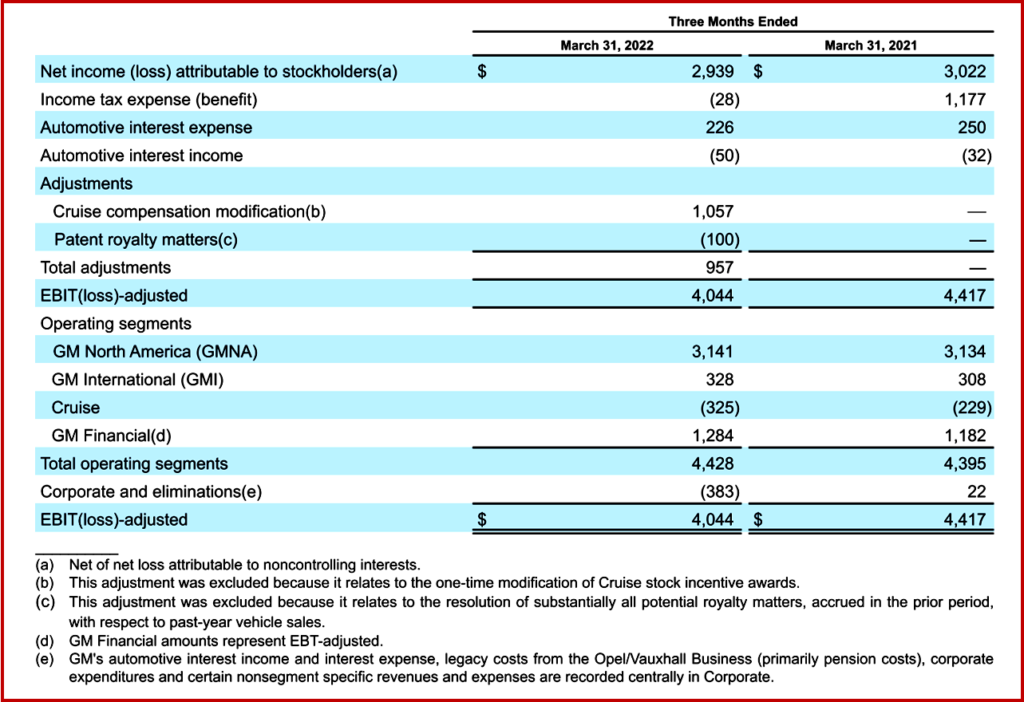

GM expects full-year 2022 net income in a range of $9.6 billion-$11.2 billion and reaffirmed its earnings guidance of EBIT-adjusted in a range of $13.0 billion-$15.0 billion. It expects to expand margins to 12%-14% by 2030 with automotive margin expansion as EVs scale and battery costs decline. New businesses margins in excess of 20% are predicted.

GM’s Reasons for Optimism

- Rapid acceleration of G EV capacity in North America with plans to produce 400K EVs over the course of 2022 and 2023.

- GMC HUMMER EV has more than 70K reservations across the SUT and SUV models.

- Cadillac LYRIQ production at Spring Hill will accelerate through the second half of the year and into 2023.

- Restarted Chevrolet Bolt EV/EUV production in April.

- Silverado EV has ~140K reservations, including nearly 400 fleet operators.

- Cruise is now operating in ~70% of San Francisco and is moving towards operating across the entire city later this year.

- Battery production starting mid-2022 at the Ultium Cells LLC manufacturing plant in Lordstown, Ohio.

- Additional BrightDrop Zevo (sic) production begins at CAMI in late 2022 – launching with annual capacity of 30K units and the ability to nearly double production by mid-decade.

Pingback: Adopt a Charger, Rivian Installing EV Chargers in Michigan Parks | AutoInformed

Pingback: GM 2021 Sustainability Report – Equitable Climate Actions | AutoInformed