Launch costs in North America, and the ongoing losses in Europe caused what GM maintains is a temporary setback in earnings.

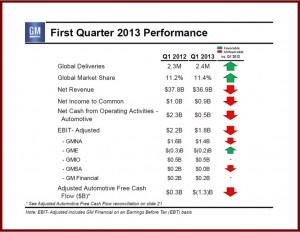

General Motors Company (NYSE: GM) today announced first quarter net income of $0.9 billion, or $0.58 per fully diluted GM share, down from $1 billion in the prior year quarter. The results include a net loss from special items that reduced net income by $0.2 billion, or $0.09 per fully diluted share.

Revenue dropped during the first quarter of 2013 to $36.9 billion, compared to $37.8 billion in the first quarter of 2012. Earnings before interest and tax adjusted was $1.8 billion, compared to $2.2 billion the first quarter of 2012. First quarter EBIT-adjusted results for 2013 include the impact of $0.1 billion in restructuring costs.

In talking about the chart at the top of this story, CEO Dan Akerson said: “Despite the mix of red and green arrows, this was a solid quarter for GM, and we are much more of a formidable competitor now than we have been in more than a generation. We are very much on plan financially as well despite the competitive landscape, the volatility that we have seen in several currency markets, and Europe’s ongoing challenges.”

Nevertheless, the GM financial results by region were lackluster:

- GM North America reported EBIT-adjusted of $1.4 billion, compared with $1.6 billion in the first quarter of 2012.

- GM Europe reported an EBIT-adjusted of $(0.2) billion, compared with $(0.3) billion in the first quarter of 2012.

- GM International Operations reported EBIT-adjusted of $0.5 billion, compared with $0.5 billion in the first quarter of 2012.

- GM South America broke even on an EBIT-adjusted basis, compared with EBIT-adjusted of $0.2 billion in the first quarter of 2012.

- GM Financial earnings before tax was $0.2 billion for the quarter, compared to $0.2 billion in the first quarter of 2012.

“We are pleased with our progress, but we are still losing money in Europe, a lot of money,” said Akerson.

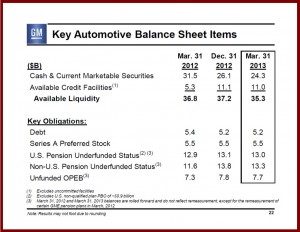

GM ended the quarter with liquidity of $35.3 billion. Automotive cash and securities were $24.3 billion compared with $26.1 billion at year-end 2012.

GM’s automotive cash flow from operating activities was $0.5 billion and automotive free cash flow adjusted was $(1.3) billion. The change in year-over-year cash flow was primarily the result of lower earnings and a series of timing-related items that GM said it expects to reverse during the balance of the year. Q1 is traditionally the weakest for cash flow in the automobile business, so stay tuned.

GM ended Q1 with liquidity of $35.3 billion. Automotive cash and marketable securities was $24.3 billion compared with $26.1 billion at year-end 2012.