General Motors Co. (NYSE: GM) has completed the sale of its 8.5% ownership in Ally Financial, formerly GMAC for $900 million. GM expects to record a gain of approximately $500 million, which will be treated as a special item in the fourth quarter of 2013.

Ally Financial leads all auto-lending firms because the taxpayer-owned company extended credit on 1.5 million new and used vehicles through franchised and independent dealers last year.

“This transaction releases capital from a non-core asset and further enhances our financial flexibility,” says Dan Ammann, GM executive vice president and chief financial officer. “Ally continues to play an important role in financing our dealers and customers in the United States.”

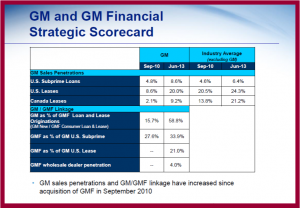

GM’s plan is to put back in place a GMAC-like operation, dubbed GM Financial, with many of the companies coming from Ally, which was GMAC and went bankrupt at the onset of the Great Recession because of its reckless home lending practices. A controversial U.S. taxpayer-funded bailout ensued, one that has not been paid back.

GM Financial has acquired Ally’s international operations in Europe and some other countries in Latin America. These international acquisitions, announced in November 2012, also cover partial ownership in a joint venture in China, which is awaiting regulatory and other approvals, but is still expected to close in 2014.

Upon the completion of all the international acquisitions, GM Financial will be present in 19 countries, lending to more than 16,000 dealers and providing auto finance products in markets that cover ~80% of GM’s worldwide sales volume.

Read:

- Ally Financial Pays Treasury $5.9 Billion, 70% of Taxpayer Debt

- GM Financial Buys Ally Assets in Brazil

- Ally Closer to IPO as it Plans to Buy Back Treasury Stock

- Ally Financial Declares Dividends on Preferred Stock

- Taxpayer Held Ally Bank to Sell Mortgage Servicing Rights

- Ally Leads in U.S. Consumer and Dealer Auto Financing

- Taxpayer Owned Ally Financial Earns $1.2 Billion in 2012