Click to enlarge.

Segment Results

The company reported total segment operating income of $416 million in Q4 2025, compared to $382 million from a year ago. After adjusting for the impact of the sales of its Off-the-Road (OTR) tire and Chemical businesses of $30 million, organic segment operating income increased $64 million, or 18%. The increase in segment operating income reflects benefits from Goodyear Forward of $192 million and favorable price/mix versus raw material costs of $197 million, offset by inflation, tariffs, and other costs of $227 million, and the impact of lower volume of $92 million, Goodyear said in a release.

Goodyear Forward

Goodyear Forward delivered $192 million of benefits in Q$ of 2025. “Since inception, the program has generated $1.25 billion of cumulative segment operating income benefits, exceeding its original commitment by approximately $150 million. At the end of 2025, the company had reached a $1.5 billion run-rate over the two-year program.

“Additionally, in 2025, Goodyear generated $2.3 billion of proceeds from divestitures and other asset sales, including the sales of its Chemical and OTR businesses and the Dunlop brand, which were primarily used to reduce debt. This exceeded the Company’s asset sale proceeds target by approximately $300 million,” Goodyear said.

Full-Year 2025 Results

• Goodyear’s 2025 net sales were $18.3 billion, with tire unit volumes totaling 158.7 million.

• Goodyear net loss was $1.7 billion, or ($5.99) per share, compared to Goodyear net income of $46 million, or $0.16 per share, a year ago.

• Full-year 2025 included several significant items, including, on a pre-tax basis, gains on asset sales of $816 million and an insurance recovery of $56 million, offset by a non-cash deferred tax asset valuation allowance of $1.5 billion, a non-cash goodwill impairment charge of $674 million, rationalization charges, asset write-offs, and accelerated depreciation and leases of $354 million, pension settlement charges of $201 million, and Goodyear Forward costs of $15 million.

Full-year 2025 adjusted net income was $136 million, compared to adjusted net income of $278 million in the prior year. Adjusted earnings per share was $0.47, compared to $0.97 in the prior year.

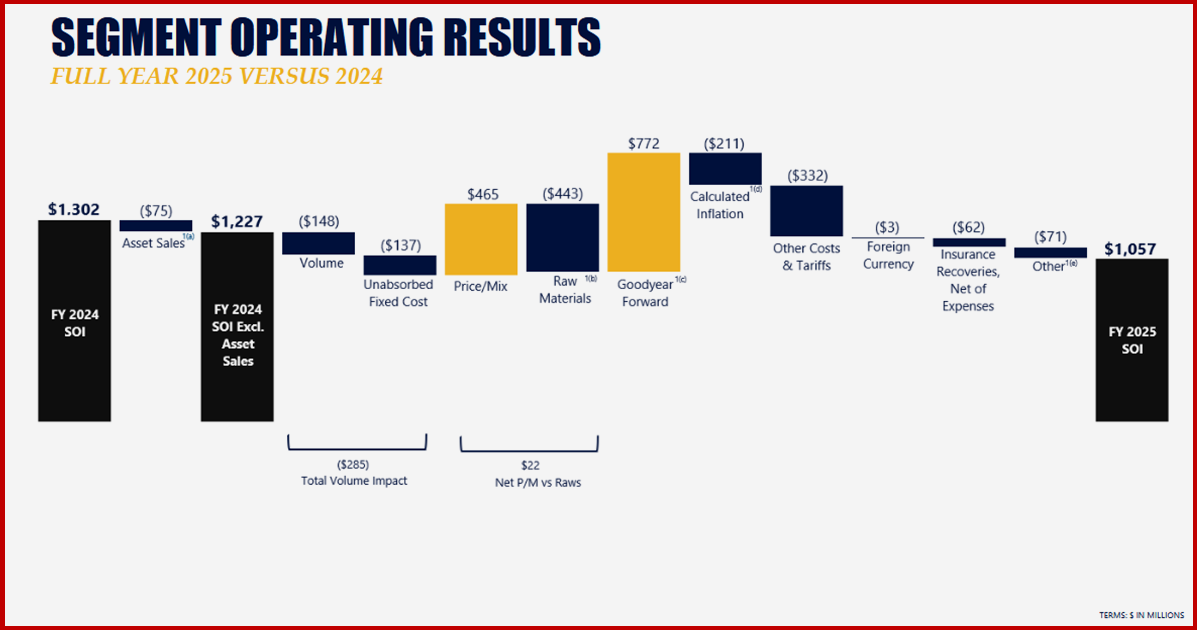

Goodyear reported total segment operating income of $1.1 billion in 2025, compared to $1.3 billion in the prior year of 2024. “After adjusting for the impact of the sales of its OTR tire and Chemical businesses of $75 million, segment operating income declined $170 million, reflecting lower volumes amid continued headwinds in the commercial industry, as well as tariff-related market dynamics. Segment operating income reflects benefits from Goodyear Forward of $772 million and net price/mix versus raw material costs of $22 million, offset by inflation, tariffs, and other costs of $543 million, lower volume of $285 million, and non-recurrence of insurance recoveries, net of expenses, of $62 million,” Goodyear said.