Click to enlarge.

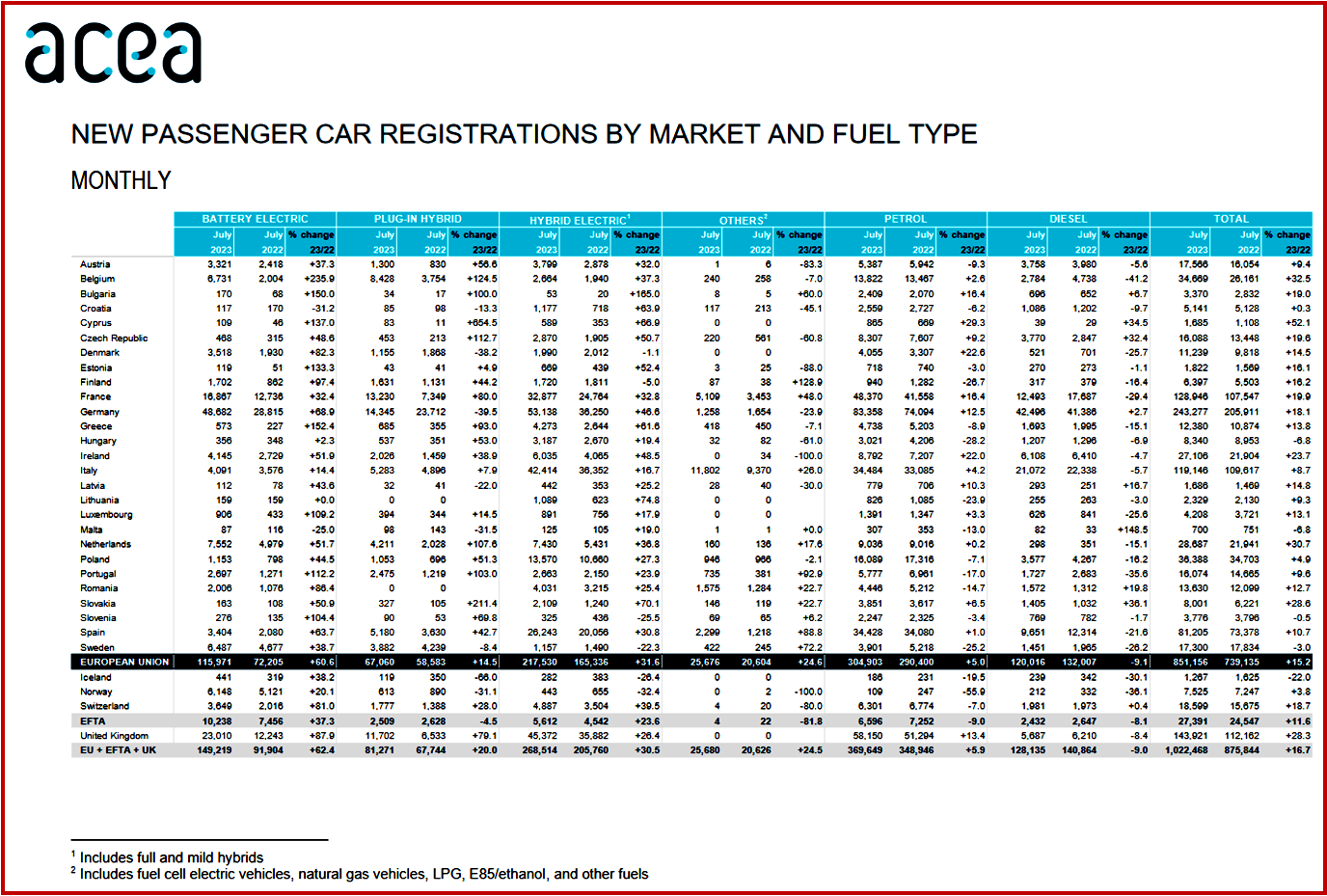

Electric cars: In July, new EU battery-electric car registrations substantially increased by 60.6%, reaching 115,971 units while accounting for 13.6% of the market. Most EU markets grew significantly by double- and triple-digit percentage gains, including the two largest, Germany (+68.9%) and France (+32.4%). Notably, Belgium recorded the highest sales with 235.9% growth. Cumulatively, battery-electric car sales recorded a significant 54.7% increase from January to July, with 819,725 units registered.

New EU hybrid-electric car registrations surged by 31.6% in July, primarily the result of strong growth in the region’s largest markets: Germany (+46.6%), France (+32.8%), Spain (+30.8%), and Italy (+16.7%). This led to a cumulative 28.5% increase, with almost 1.6 million units sold between January and July, equivalent to one-quarter of the market share.

New EU plug-in hybrid car registrations increased 14.5%, reaching 67,060 units. Strong performance in major markets like the Netherlands (+107.6%), France (+80%), and Spain (+42.7%) was offset by a decline in Germany (-39.5%), the largest market for this fuel type. Despite this growth, the market share of plug-in hybrid cars remained stable at 7.9% in July. Petrol and diesel cars

New EU gasoline car market increased 5%, reaching 304,903 units. However, market share decreased from 39.3% to 35.8% compared to last July. This growth was primarily driven by a solid performance in major markets, notably France (+16.4%) and Germany (+12.5%). Over 2.3 million petrol cars were sold in the first seven months of this year, a substantial 14.3% increase compared to 2022.

However, the EU’s market for diesel cars continued to decline (-9.1% in July) despite growth in Germany (+2.7%) and Central and Eastern European markets, particularly Slovakia (+36.1%) and Romania (+19.8%). Diesel cars now account for a market share of 14.1%, down from 17.9% in July last year.