Click for more.

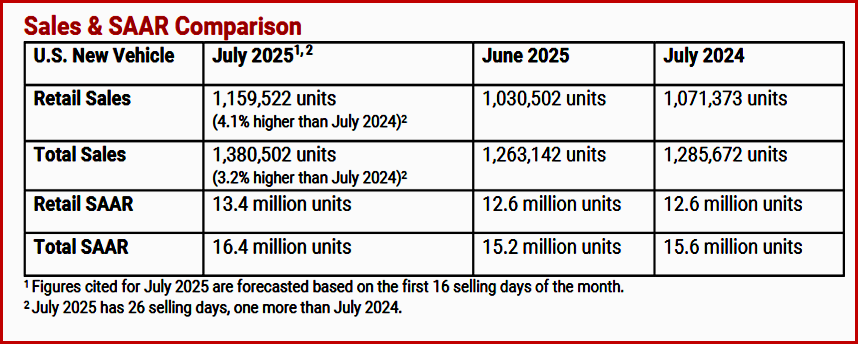

The July 2025 U.S. Vehicle Sales Forecast Details – Courtesy of and Copyright J.D. Power all rights reserved

• Fleet sales are expected to total 220,980 units in July, down 0.8% from July 2024. Fleet volume is expected to account for 16.0% of total light-vehicle sales, down 4.0 percentage points from a year ago.

• Internal combustion engine (ICE) vehicles are projected to account for 74.0% of new-vehicle retail sales, a decrease of 3.7 percentage points from a year ago. Plug-in hybrid vehicles (PHEV) are on pace to make up 2.2% of sales, up 0.2 percentage points from July 2024, while electric vehicles (EV) are expected to account for 10.9% of sales, up 1.6 percentage points, and hybrid electric vehicles (HEV) are expected to account for 13.9% of new-vehicle retail sales, up 2.9 percentage points.

• U.S. final assembly vehicles are expected to make up 54.7% of sales in July, up 3.9 percentage points from a year ago. • Trucks/SUVs are on pace to account for 82.3% of new-vehicle retail sales, up 2.3 percentage points from July 2024.

• Retail inventory levels are currently at 2.19 million units, a 28.4% increase from July 2024.

• The industry’s inventory days of supply is 60 days in July, up from 49 days a year ago.

• The average new-vehicle retail transaction price in July is expected to reach $45,063, up $938 from July 2024. Transaction price as a percentage of MSRP increased to 89.6%, down 0.5 percentage points from a year ago.

• Retail buyers are on pace to spend $49.8 billion on new vehicles, up $5.0 billion from July 2024.

• Average incentive spending per unit in July is expected to rise to $3,051, up $52 from July 2024. Spending as a percentage of the average MSRP is expected to decrease to 6.1%, down 0.1 percentage points from July 2024.

• Average incentive spending per unit on trucks/SUVs in May is expected to be $3,257, up $108 from a year ago, while the average spending on cars is expected to be $2,043, down $341 from a year ago.

• Leasing is expected to account for 22.0% of sales this month, down 2.1 percentage points from a year ago.

• The average time a new vehicle remains in the dealer’s possession before sale is expected to be 50 days in July, up from 47 days a year ago.

• 29.6% of vehicles sold in less than 10 days in July, down 2.8 percentage points from a year ago.

• Average monthly finance payments are on pace to be $742, up $12 from July 2024. The average interest rate for new-vehicle loans is expected to be 6.54%, down 0.30 percentage points from a year ago.

• So far in July, average used-vehicle retail prices are $29,514, up $896 from a year ago. Trade-in equity is trending towards $7,894, which is down $4 from a year ago.

• 25.5% of trade-ins are expected to carry negative equity this month, an increase of 1.9 percentage points from July 2024.

• Finance loans with terms greater than or equal to 84 months are expected to reach 11.6% of finance sales this month, up 2.7 percentage points from July 2024.