Click for more information.

From the DOJ filing:

JetBlue first considered buying Spirit as early as 2017 and again in 2019, but ultimately abandoned those plans. But after Spirit announced a merger agreement with Frontier in February 2022, JetBlue reinstated its plan. JetBlue had previously informed its Board of Directors that a Frontier-Spirit merger would “limit any potential major inorganic growth opportunity,” i.e., consolidation via merger, for JetBlue. And JetBlue had made it clear that it also feared another airline merging with Spirit because that would leave JetBlue a “smaller and less relevant player in the industry.”

As a result, on April 5, 2022, JetBlue made an unsolicited offer to acquire Spirit. JetBlue’s bid to take over Spirit occurred against the backdrop of the Northeast Alliance, JetBlue’s de facto merger in Boston and New York City with American Airlines, the largest airline in the United States.

In response to JetBlue’s offer, Spirit’s Board of Directors retained “top-tier aviation and economic consultants,” who engaged for four weeks with “JetBlue and its advisors” to develop an “informed view” of the proposed transaction. Based on that assessment, Spirit’s Board of Directors recognized the antitrust and regulatory risks of mergers in an already- consolidated airline industry, and recommended that Spirit shareholders vote to adopt the merger agreement with Frontier instead, concluding that “consummation of the proposed JetBlue combination, with the [Northeast Alliance] remaining in place, seemed almost inconceivable.”

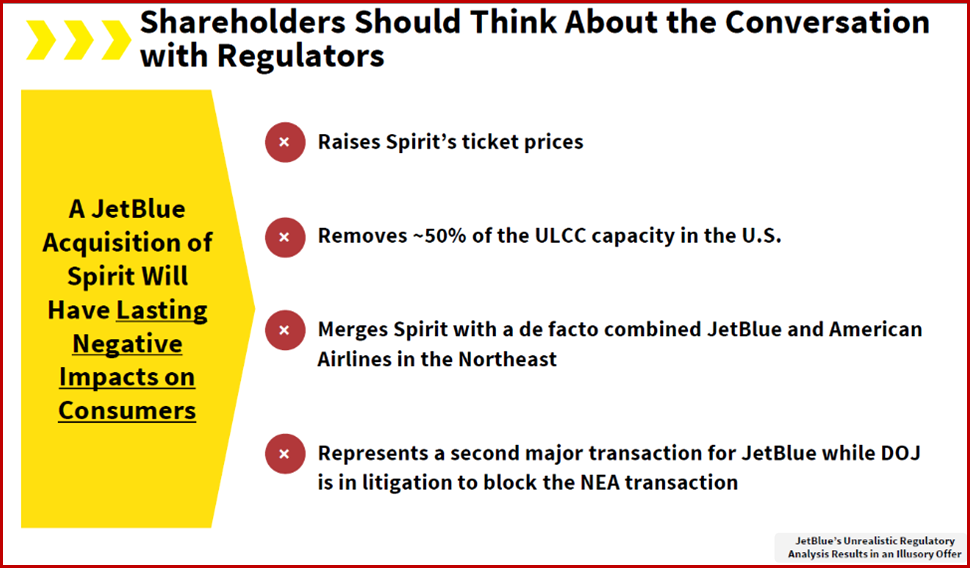

“Even putting aside the Northeast Alliance,” Spirit warned that JetBlue’s stated plans to reconfigure Spirit’s planes would “significantly diminish[] capacity” and “result in higher prices for consumers.” Accordingly, “a court . . . will be very concerned that a JetBlue-Spirit combination will result in a higher-cost/higher fare airline that would eliminate a lower-cost/lower fare airline and remove about half of the [ultra-low-cost] capacity in the United States.”

JetBlue, for its part, was not ready to give up its plans to acquire Spirit, and so it launched a hostile takeover bid. On May 16, 2022, JetBlue announced a tender offer for $30 per share — a significant cash premium over Frontier’s existing offer — and urged Spirit shareholders to reject the proposed Frontier merger. Spirit characterized JetBlue’s proposal as a “cynical attempt to disrupt Spirit’s merger with Frontier, which JetBlue views as a competitive threat.” Spirit later published a presentation, one slide of which is excerpted , highlighting the harm to competition that would result from an acquisition by JetBlue.