Click for more.

In December, Manheim Market Report (MMR) values saw above-average weekly declines in the final two weeks of the year. Over the last four weeks, the Three-Year-Old Index fell an aggregate of 1.4%, indicating values were falling faster than normal. Those same four weeks delivered an average decline of 0.5% between 2014 and 2019.

Over the month of December, daily MMR Retention – the average difference in price relative to the current MMR – averaged 99.0%, meaning market prices were just below MMR values. The average daily sales conversion rate increased to 53.8%, which indicates demand was improving and relatively strong for the time of year. For comparison, the daily sales conversion rate averaged 52.2% in December 2019.

The major market segments saw seasonally adjusted prices that remained lower year-over-year in December. Compared to December 2022, luxury, pickups, and SUVs lost less than the industry’s decline of 7.0%, down 6.9%, 6.5%, and 6.1%, respectively. Compact cars continued as the worst performer year over year, down 11.7%, followed by mid-size cars, losing 8.1%; and vans, down 7.9%. Compared to last month, luxury lost 0.4%, SUVs were down 0.3%, and mid-size cars declined just 0.1%. Pickups and vans declined by 0.8%, and compact cars lost 0.6%, all worse than the industry’s 0.5% loss.

Used and Wholesale Vehicle Market Forecast for 2024

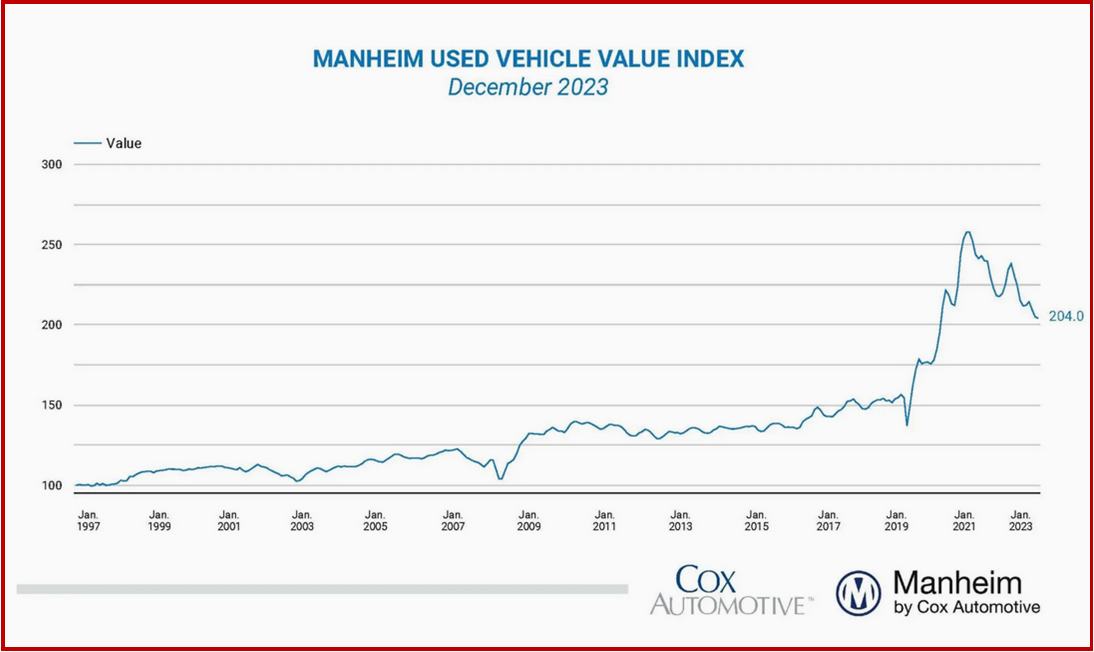

After historic value increases in 2020 and 2021, followed by stronger depreciation in both 2022 and 2023, used-vehicle values are likely to see slightly higher than average depreciation rates in 2024. Price trends should show muted fluctuations, with lower volatility than observed in 2023 as wholesale volume recovered more over the last year, moving wholesale and retail markets more toward equilibrium. The Manheim Used Vehicle Value Index is forecast to be up 0.5% year over year in December 2024, which would be roughly two points lower than a normal year, according to Manheim.

“As we move into 2024, it’s important to note that used-vehicle values increased faster than the overall rate of inflation,” said Jeremy Robb, senior director of Economic and Industry Insights at Cox Automotive.** “So, even though prices have come down over the last two years, they are still about 33% higher than at the end of 2019. More normal declines will likely be seen in the coming years, but the average value of a wholesale unit will continue to be higher than in the past.”