Click for more data.

China

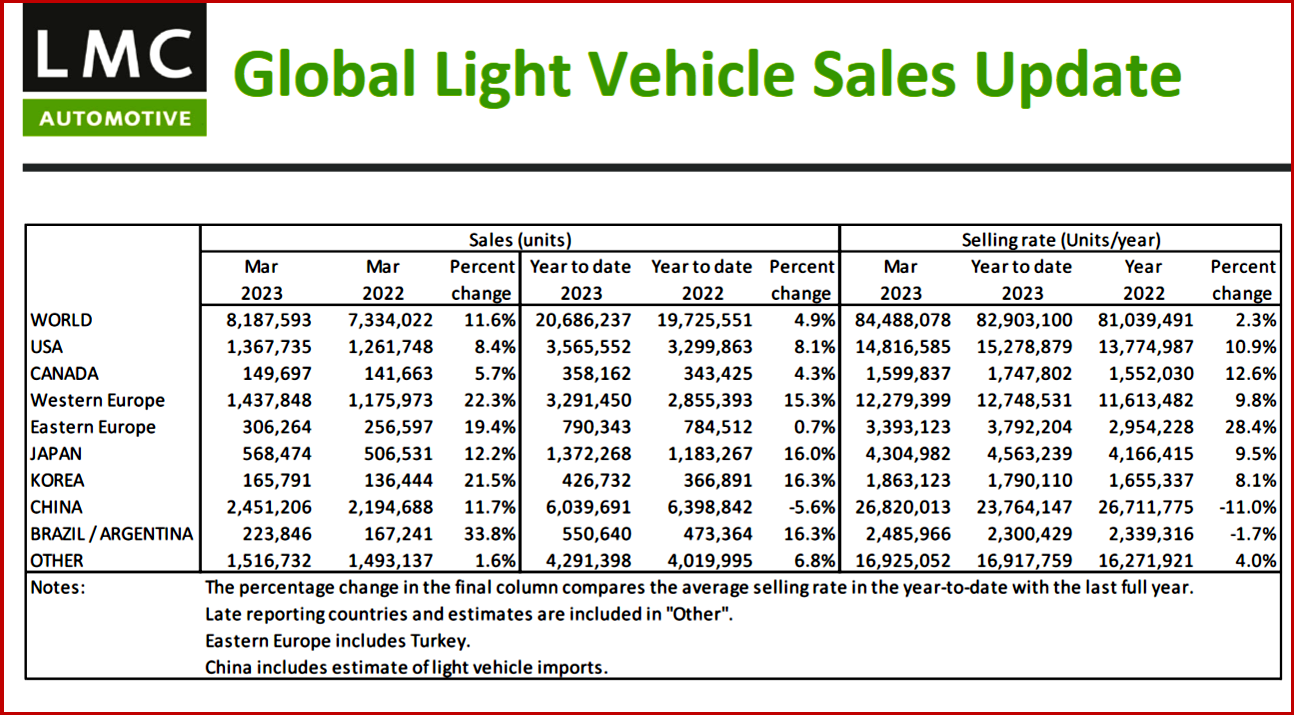

After a slow-moving January and February, the Chinese market returned in March. “According to preliminary data, the March selling rate reached a 5‐month high of 26.8 million units/year, up 28% from an abnormally weak February. That, however, brought the YTD average selling rate to only 23.8 million units/year. In YoY terms, sales increased by 12% in March, but declined by 5.6% in Q1. Light Commercial Vehicle sales accelerated at a much faster rate than those of Passenger Vehicles, as economic activity normalized after the pandemic and the Chinese New Year,” LMC said.

“Despite many consumers taking a wait‐and‐see approach amidst the price war, they apparently decided to buy vehicles in March before heavy discounts and the provincial governments’ temporary tax incentives expire (as some of them will end in April). New Electric Vehicles remain the key market factor, with their sales expanding by about 35% YoY. Yet, it is reported that dealers are still left with a large stock of vehicles that need to be sold before the implementation of the new State VI‐B emission standard on 1 July, LMC observed.

Europe

The West European selling rate dropped from 13.5 million units/year in February to 12.3 million units/year in March. “The general picture remains somewhat more positive than last year. In preliminary raw monthly terms, March registered 1.44 million units, up 22.3% YoY, helped by an easing of supply constraints strengthening the pace of deliveries to customers,” LMC said.

The East European selling rate fell considerably from February to March at 3.4 million units/year. The Ukraine war still encumbers the LV market activity in the region, with preliminary raw registrations at 306,000 units, down 19.4% YoY. Russia’s YTD raw registrations fell more than 43% YoY.

North America

The US Light Vehicle market sales increased by 8.4% YoY, to 1.4 million units. The selling rate braked to 14.8 million units/year in March, down from 15.0 million units/year in February, “but that was still an upbeat result by recent standards. As inventory levels improved and pressure from the semiconductor shortage eased, there was a MoM decline in average transaction price to US$45,837,” LMC said.

Canadian March Light Vehicle raw sales were 150,000 units, up by 5.7% YoY. This increased by more than 40,000 units compared to February, as Spring selling began. “Despite this healthy growth, the selling rate slowed from 1.7 million units/year in February, to 1.6 million units/year in March. Light Vehicle sales in Mexico continued their strong run in 2023 with another robust result of 120k units in March, this up by 25.1% YoY. Preliminary estimates for the selling rate in 2023 showed a decline to 1.2 million units/year, lower than both January and February,” LMC said.