Click to enlarge.

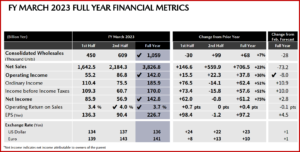

Mazda Motor (7261:JP – Tokyo) posted Fiscal Year 2023 (ended 31 March 2023) financial results of net sales at ¥4.5 trillion, operating income at ¥180 billion, and net income at ¥130 billion. This was based on a global sales volume of 1.11 million units, down 11.3% year-on-year. Sales dropped in all countries except Japan, “mainly due” to reductions in production from semiconductor supply shortages in the first half of the fiscal year and a shortage of car transport ships. China was a notable problem area.

However, Mazda said: “Under these conditions, the Mazda Group steadily improved its profit base by implementing group-wide initiatives to improve per-unit profit, curb costs, reduce marketing expenses, improve fixed cost efficiency, and redesign components to expand the use of general-purpose semiconductors as a means of mitigating semiconductor shortages.”

Financial Position As of 31 March 2023

- Total assets increased ¥291.1 billion from the end of the previous fiscal year, to ¥3,259.3 billion.

- Total liabilities increased ¥151.0 billion from the end of the previous fiscal year to ¥1,802.5 billion.

- Net Assets as of March 31, 2023 increased ¥140.1 billion from the end of the previous fiscal year to ¥1,456.8 billion, reflecting net income attributable to owners of the parent of ¥142.8 billion and others.

- Equity ratio increased 0.4 percentage points from the end of the previous fiscal year to 44.2% (Percentage after consideration of the equity credit attributes of the subordinated loan was 45.2%).

Click to enlarge.

Mazda Sales by Market – Year-on-Year %

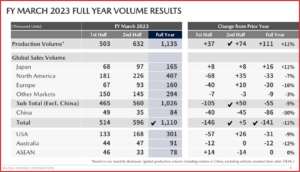

- In Japan, with the introduction of the CX-60 in September 2022 and an increase in sales of the updated Mazda CX-5 and the Mazda Roadster (MX-5), sales rose to 165,000, up 10.8% year-on-year.

- North America: In the US., sales declined 9.3% to 301,000 due to the impact of reductions in production “However, in addition to the CX-50, which went on sale in April 2022, the Mazda CX-30 and other SUV product lineups contributed to the increasing sales, with FY Q4 volume rising 7.4% to 88,000 units. Sales in North America declined 7.4% at 407,000 units, while sales of the Mazda2 and the CX-5 in Mexico increased.

- Sales in Europe decreased 15.5% to 160,000 due to a decline in sales in Russia and Ukraine, as well as the impact of reductions in production in the first half of the fiscal year. In Q4 of the fiscal year, sales increased 20.9% to 52,000, due to an increase in sales of the Mazda Hybrid and the CX-60 plug-in hybrid model.

- In China, completion of a round of key model cycles and intensifying price competition resulted in a 50.4% year-on-year fall in sales to 84,000.

Other Markets

- In Australia, another key market, sales declined 11.7% year on year to 91,000 “due to delays in logistics” stemming from stricter quarantine control at unloading ports.

- Sales in other markets fell 3.1% 294,000 units, due to the ASEAN market being at the same level as the previous year, while sales in Vietnam increased.

Dividends

The Mazda annual dividend will be ¥25/share, up ¥5 from the previous forecast. For FY ending March 2024, the dividend is forecast at ¥45/share.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Mazda Motor Posts Improving FY 2203 Financial Results

Click to enlarge.

Mazda Motor (7261:JP – Tokyo) posted Fiscal Year 2023 (ended 31 March 2023) financial results of net sales at ¥4.5 trillion, operating income at ¥180 billion, and net income at ¥130 billion. This was based on a global sales volume of 1.11 million units, down 11.3% year-on-year. Sales dropped in all countries except Japan, “mainly due” to reductions in production from semiconductor supply shortages in the first half of the fiscal year and a shortage of car transport ships. China was a notable problem area.

However, Mazda said: “Under these conditions, the Mazda Group steadily improved its profit base by implementing group-wide initiatives to improve per-unit profit, curb costs, reduce marketing expenses, improve fixed cost efficiency, and redesign components to expand the use of general-purpose semiconductors as a means of mitigating semiconductor shortages.”

Financial Position As of 31 March 2023

Click to enlarge.

Mazda Sales by Market – Year-on-Year %

Other Markets

Dividends

The Mazda annual dividend will be ¥25/share, up ¥5 from the previous forecast. For FY ending March 2024, the dividend is forecast at ¥45/share.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.