Click to enlarge.

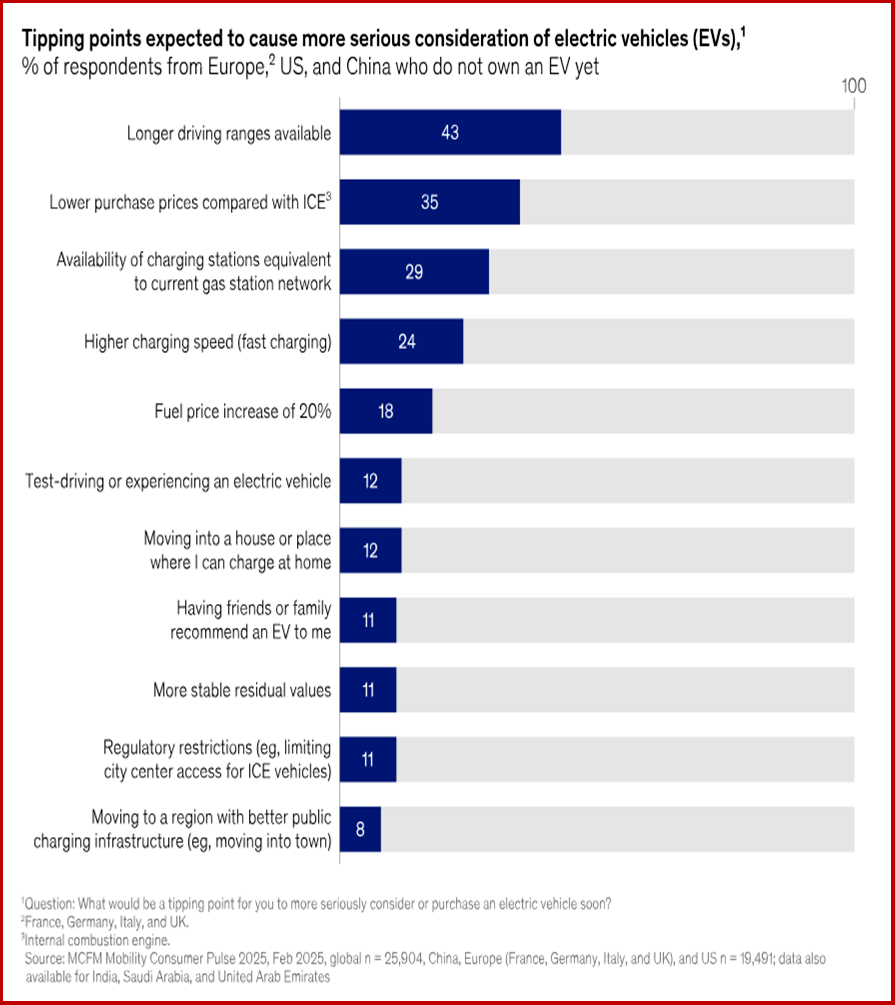

“Issues related to range, price, and charging continue to be top concerns for potential EV buyers. Factors that would convince respondents to switch to an EV include a more built-out public charging network and faster battery recharging speed. Better value stability for EVs is also a concern, especially as EV technology is still evolving.

When asked what factors would tip the balance in favor of an EV purchase, a longer driving range topped the list and was cited by almost half of respondents. Respondents also were asked to identify the average minimum real driving range4 that would convince them to consider shifting to an EV; their average response is about 500 kilometers (310 miles), up from 425 kilometers (264 miles) in the 2022 survey. Many prospective buyers are concerned about range because they think about ‘edge cases,’ such as long vacation trips, rather than their typical daily driving behavior when estimating their needs. Current BEV owners tend to have range requirements about 10% lower than those without EV driving experience.

Intent to Buy an EV Varies by Region. Differences Increasing

“Although EV uptake has increased worldwide, it has always varied by region. In 2024, for instance, about 50% of vehicles sold in China were EVs. Of these, 28% were battery electric vehicles (BEVs), 15% plug-in hybrid electric vehicles (PHEVs), and 6% extended-range electric vehicles (EREVs). China is the only market where EREVs are now available at scale. By contrast, EVs accounted for only 21% of vehicles sold in Europe – 14% BEV, 7% PHEV. EV sales were lowest in the United States, at 10% – 8% BEV, 2% PHEV, with uptake varying vastly by state and region.[Europe here refers to the four countries where The McKinsey survey was conducted: France, Germany, Italy, and the United Kingdom. Based on data from EV Volumes, S&P Light Vehicle Sales, and McKinsey Center for Future Mobility.]

“Across regions, EV purchase intent is highest among customers who already have experience with an EV. Surprisingly, this also includes multicar households that currently have an ICE and a BEV, with the majority indicating they will replace their ICE with a BEV as their next car. This finding contradicts the commonly held assumptions that BEVs are only used as the secondary household car, driven for shorter trips, and that consumers may keep an ICE as backup in their garage forever,” McKinsey observed.

“EV uptake is likely to continue to grow across regions. In China, 45% of respondents state that their next car will be a BEV; this compares with 23% in Europe and 12% in the United States. In a departure from current sales trends, customer intent to purchase a PHEV is higher than intent to buy a BEV in the United States and Europe, and it is almost as high as BEV intent in China. These findings highlight the continued relevance of hybrids in the EV transition [Stated intent in a survey cannot be directly translated to actual sales because of stated-intent bias, meaning survey respondents typically overestimate their purchase behavior because they do not have to spend real money in a survey. Most likely, actual EV sales will be below the intent-to-purchase numbers, McKinsey observes]