Click to enlarge.

China Leads

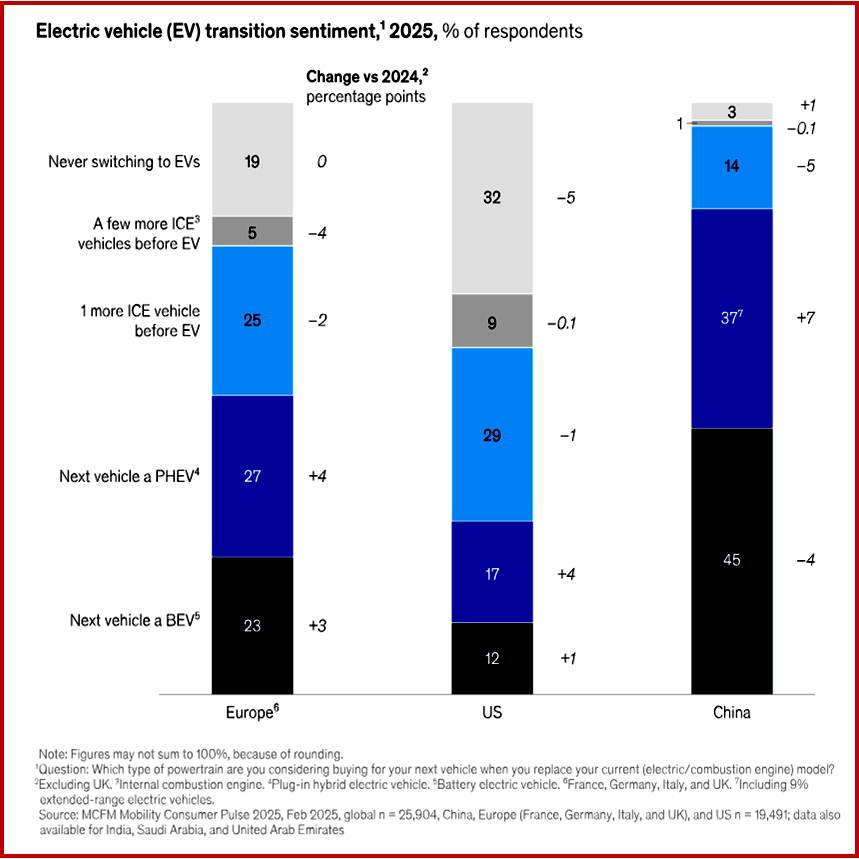

“China has been experiencing EV growth at unbroken high levels, with sales accounting for more than 50% of all vehicles sold in some months. Globally, China’s EV sales are by far the largest. Sales and customer data suggest that the future of China’s market will be electric, with more than 80% of Chinese respondents stating that their next car will likely be electric. This demand suggests that the market has transitioned from “regulatory push” to “consumer pull.” In the short term, hybrids (both PHEVs and EREVs) will likely play an important role in supporting the transition to BEVs.

Moderate growth in Europe

“In Europe, the EV share of new-car sales declined slightly over the past 18 months, going from 24% in 2022 to 21% in 2024. The recent survey shows an increase of five percentage points in the number of people who plan to buy a PHEV or BEV as their next vehicle, compared with the 2024 survey. Despite this rise, European EV sales are unlikely to be high enough to satisfy the mid-to-long-term regulatory targets in the European Union.

When looking at specific European countries, different trends emerge:

• Germany. Demand fell after the government ended purchase subsidies at the end of 2023, but it has recently picked up. (The 2025 survey shows an increase of eight percentage points in EV purchase intent compared with February 2024.) Germany is also the only European country in the survey where BEV purchase intent, at 30%, outweighs PHEV intent, at 18%.

• Italy. EV purchase intent is growing moderately in Italy. Consistent with past years, more Italian respondents want a PHEV than a BEV: 41% versus 17%.

• United Kingdom. Of British respondents, 25% state that they plan to get a BEV as their next vehicle, and 22% want a PHEV, both of which exceed the UK purchase intent levels in previous years.

• France. EV purchase intent is growing moderately, with 21% of French car buyers planning to get a BEV and 29% opting for a PHEV.

Slow transition in the United States

“In the United States, EV sales and consumer interest in EV purchases have remained flat over the past few years, but the results vary significantly by location (by state and by specific location within a state). In states that have adopted the rules of the California Air Resource Board (CARB), for example, 38% of respondents state that their next car will be electric (BEV or PHEV), compared with 25% in non-CARB states. EV purchase intent is highest in California (above 50%) but is well below 20% in about 25 other states, mostly in the South and Midwest.

“The contrast between residents of urban and rural areas is equally stark: EV transition sentiment in urban areas (51%) is more than 2.5 times higher than that in rural areas (18%). Purchase intent for hybrid EVs—both plug-in and full hybrids—is higher than that for BEVs. These trends suggest that the overall EV transition in the United States will continue at a slow pace, and ICE and hybrid-electric-vehicle (HEV) technology will remain relevant over the longer term. OEMs should review their portfolios accordingly,” McKinsey recommended.

However, “lower prices could help tip the balance in favor of EVs. To maintain healthy margins at lower average price levels, OEMs need to evaluate their cost structures and eventually optimize them. New EV start-ups have achieved a cost base per vehicle that is 30 to 50% below that of established OEMs. Overall product costs are particularly low for Chinese OEMs, both new entrants and domestic incumbents. This occurs because they have lower factor costs (such as those for battery components) and more cost-effective vehicle architecture, including streamlined electrical-electronic architecture, among other reasons. China’s competitive landscape is still maturing and may consolidate in the future,” McKinsey observed.