Nissan Motor Corporation has announced financial results for the six-months ended September 30, 2022, and revised upward its full-year revenue and profit outlook for fiscal 2022. Consolidated net revenue increased by ¥715.3 billion to ¥4.66 trillion, with consolidated operating profit rising ¥17.5 billion to ¥156.6 billion, representing an operating profit margin of 3.4%. Net income (1) was ¥64.5 billion down ¥17.4 billion, from the previous year due to a one-time loss of ¥24.1 billion recorded in the second quarter because of the company’s withdrawal from the Russian market, and a decrease in equity in earnings of affiliates.

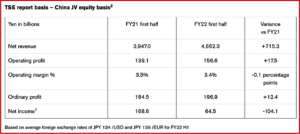

In the second quarter, free cash flow from the automobile business was a positive ¥206.6 billion. On a management pro forma basis, which includes the proportionate consolidation of results from Nissan’s joint-venture operation in China, operating profit was ¥212.6 billion, with an operating margin of 4.0%. (2)

Consistent with what other Japanese companies said during earnings week, increased revenue and operating profit were achieved despite “a severe business environment in the first half of the fiscal year, with raw material prices rising sharply and sales volume falling below the previous year’s level due to semiconductor supply shortages and the impact of COVID-related lockdowns in Shanghai, China,” Nissan said. (AutoInformed.com on Honda Posts a Profit of ¥453.4B for First Half FY Results)

Click for more information.

The increased net revenue per unit was attributed to improved quality of sales in each market and reducing selling expenses (translation: higher trim levels; lower incentives). The improved performance over the previous fiscal year also reflected recent exchange rates and a weaker than expected Japanese Yen (¥).

For the 12-month period to March 31, 2023, Nissan expects sales volume to decrease by 7.5% over the previous forecast to 3.7 million units. In the second half of the fiscal year, the company expects to face continued shortages of semi-conductor supply and increasing raw material prices. “Despite these challenges, Nissan will continue to introduce new models and improve the quality of sales. In addition, due to recent fluctuations in foreign exchange rates and the significant weakening of the, Nissan has revised its exchange rate assumptions accordingly,” Nissan said.

As a result of these factors, Nissan has revised its full year forecast for fiscal 2022. The revised forecast reflects a ¥900.0 billion upward adjustment in net revenue and a 110.0 billion increase in operating profit compared with the previous forecast. Net income1 attributable to owners of the parent has been revised upward by 5 billion to 155 billion from the previously announced forecast. This revision factors in an extraordinary loss of approximately 100 billion expected to be incurred in connection with the withdrawal from the Russian market.

“We achieved this encouraging result even though the business environment became more challenging due to the ongoing shortage of semiconductors and soaring raw material prices,” said Nissan CEO Makoto Uchida. “In this environment, all Nissan employees worked together to maintain financial discipline and improve quality of sales. In addition, our newly introduced models have been very well received by customers in their respective regions. Although we expect the business environment to remain challenging in the second half, we aim to achieve our upwardly revised forecast by continuing to implement the Nissan NEXT business transformation plan.”

Inevitable Nissan Motor Footnotes

(1) Net income attributable to owners of the parent. Based on average foreign exchange rates of JPY 134 /USD and JPY 139 /EUR for FY22 H1.

(2) Since the beginning of fiscal year 2013, Nissan has reported figures calculated under the equity method accounting for its joint venture with Dong Feng in China. Although net income reporting remains unchanged under this accounting method, the equity-accounting income statements no longer include Dong Feng-Nissan’s results in revenue and operating profit.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Nissan Motor Posts ¥156.6B Profit

Nissan Motor Corporation has announced financial results for the six-months ended September 30, 2022, and revised upward its full-year revenue and profit outlook for fiscal 2022. Consolidated net revenue increased by ¥715.3 billion to ¥4.66 trillion, with consolidated operating profit rising ¥17.5 billion to ¥156.6 billion, representing an operating profit margin of 3.4%. Net income (1) was ¥64.5 billion down ¥17.4 billion, from the previous year due to a one-time loss of ¥24.1 billion recorded in the second quarter because of the company’s withdrawal from the Russian market, and a decrease in equity in earnings of affiliates.

In the second quarter, free cash flow from the automobile business was a positive ¥206.6 billion. On a management pro forma basis, which includes the proportionate consolidation of results from Nissan’s joint-venture operation in China, operating profit was ¥212.6 billion, with an operating margin of 4.0%. (2)

Consistent with what other Japanese companies said during earnings week, increased revenue and operating profit were achieved despite “a severe business environment in the first half of the fiscal year, with raw material prices rising sharply and sales volume falling below the previous year’s level due to semiconductor supply shortages and the impact of COVID-related lockdowns in Shanghai, China,” Nissan said. (AutoInformed.com on Honda Posts a Profit of ¥453.4B for First Half FY Results)

Click for more information.

The increased net revenue per unit was attributed to improved quality of sales in each market and reducing selling expenses (translation: higher trim levels; lower incentives). The improved performance over the previous fiscal year also reflected recent exchange rates and a weaker than expected Japanese Yen (¥).

For the 12-month period to March 31, 2023, Nissan expects sales volume to decrease by 7.5% over the previous forecast to 3.7 million units. In the second half of the fiscal year, the company expects to face continued shortages of semi-conductor supply and increasing raw material prices. “Despite these challenges, Nissan will continue to introduce new models and improve the quality of sales. In addition, due to recent fluctuations in foreign exchange rates and the significant weakening of the, Nissan has revised its exchange rate assumptions accordingly,” Nissan said.

As a result of these factors, Nissan has revised its full year forecast for fiscal 2022. The revised forecast reflects a ¥900.0 billion upward adjustment in net revenue and a 110.0 billion increase in operating profit compared with the previous forecast. Net income1 attributable to owners of the parent has been revised upward by 5 billion to 155 billion from the previously announced forecast. This revision factors in an extraordinary loss of approximately 100 billion expected to be incurred in connection with the withdrawal from the Russian market.

“We achieved this encouraging result even though the business environment became more challenging due to the ongoing shortage of semiconductors and soaring raw material prices,” said Nissan CEO Makoto Uchida. “In this environment, all Nissan employees worked together to maintain financial discipline and improve quality of sales. In addition, our newly introduced models have been very well received by customers in their respective regions. Although we expect the business environment to remain challenging in the second half, we aim to achieve our upwardly revised forecast by continuing to implement the Nissan NEXT business transformation plan.”

Inevitable Nissan Motor Footnotes

(1) Net income attributable to owners of the parent. Based on average foreign exchange rates of JPY 134 /USD and JPY 139 /EUR for FY22 H1.

(2) Since the beginning of fiscal year 2013, Nissan has reported figures calculated under the equity method accounting for its joint venture with Dong Feng in China. Although net income reporting remains unchanged under this accounting method, the equity-accounting income statements no longer include Dong Feng-Nissan’s results in revenue and operating profit.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.