Click to Enlarge.

Nissan Motor Co., Ltd. has announced decent financial results for the three months ended June 30, 2021. In a filing with the Tokyo Stock exchange it also increased its full-year profit outlook for fiscal year 2021.

For the first quarter of the Japanese fiscal year, consolidated net revenue was ¥2.008 trillion, consolidated operating profit was ¥75.7 billion, and the operating profit margin was 3.8%. The net income1 in the first quarter was ¥114.5 billion.

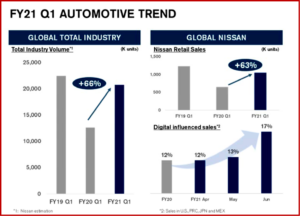

During the first three months of the fiscal year, Nissan unit sales increased sharply as the industry rebounded from the pandemic disruption of 2020. Both total industry volumes and global Nissan retail sales increased by more than 60% with keeping pace with the industry volumes. Nissan’s digitally influenced sales have further increased in quarter one.

“This is largely attributable to the online inventory search which allows for ease of shopping before customers visit dealers, given the uncertain supply situation,” said COO Ashwani Gupta.

In the US, Nissan achieved strong sales for new models, which lifted retail volumes by 68% and North America sales including Canada and Mexico by 70% to 378,000 units. In Nissan’s home market of Japan, sales were up by 7% to 90,000 units. Small kei-deliveries were hurt by supply constraints, but this was offset by the strong performance of registration cars such as the all-new Note.

In China, with a strong market recovery, unit sales were up 71% to 352,000 vehicles. In Europe, unit sales were up 69% as markets began to recover from the closure of retail networks in the first quarter of last year – with 91,000 units sold. Other markets were up almost 80%, accounting for 136,000 units in the quarter.

“We have delivered a strong performance in the first three months of our new fiscal year and continued to advance the Nissan NEXT business transformation plan,” said Nissan chief executive officer Makoto Uchida. “For the remainder of the year, we anticipate uncertainties will remain across our operating environment. We will carefully monitor and manage potential risks as we continue to improve quality of sales and maintain financial discipline. We expect a recovery in the second half supported when several new models will go on sale in core markets. Nissan will firmly pursue our goal of achieving a 2% operating margin in fiscal year 20213 , which is an important milestone under Nissan NEXT.”

FY2021 outlook

The shortage of semiconductor supply is expected to have a significant impact on Nissan’s sales volume in the second quarter. Nissan expects the issue will continue. However, sales volume will contribute to the operating profit supported by new vehicle launches. For the full fiscal year, Nissan is forecasting net revenue of 9.75 trillion yen and an operating profit of ¥150.0 billion yen. A net income1 of ¥60.0 billion yen is expected, which is ¥120.0 billion yen above the previous outlook.

Click to Enlarge.

The company has filed the fiscal year outlook to the Tokyo Stock Exchange. Calculated under the equity accounting method for Nissan’s joint venture in China, the forecasts for the fiscal year ending March 31, 2022, are:

Nissan Footnotes

- Net income or net loss attributable to owners of the parent

- Since the beginning of fiscal year 2013, Nissan has reported figures calculated under the equity method accounting for its joint venture with Dong Feng in China. Although net income reporting remains unchanged under this accounting method, the equity-accounting income statements no longer include Dong Feng-Nissan’s results in revenue and operating profit.

- On a management pro forma basis

AutoInformed.com on:

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Nissan Motor Posts ¥75.7B Operating Profit for Q1 FY

Click to Enlarge.

Nissan Motor Co., Ltd. has announced decent financial results for the three months ended June 30, 2021. In a filing with the Tokyo Stock exchange it also increased its full-year profit outlook for fiscal year 2021.

For the first quarter of the Japanese fiscal year, consolidated net revenue was ¥2.008 trillion, consolidated operating profit was ¥75.7 billion, and the operating profit margin was 3.8%. The net income1 in the first quarter was ¥114.5 billion.

During the first three months of the fiscal year, Nissan unit sales increased sharply as the industry rebounded from the pandemic disruption of 2020. Both total industry volumes and global Nissan retail sales increased by more than 60% with keeping pace with the industry volumes. Nissan’s digitally influenced sales have further increased in quarter one.

“This is largely attributable to the online inventory search which allows for ease of shopping before customers visit dealers, given the uncertain supply situation,” said COO Ashwani Gupta.

In the US, Nissan achieved strong sales for new models, which lifted retail volumes by 68% and North America sales including Canada and Mexico by 70% to 378,000 units. In Nissan’s home market of Japan, sales were up by 7% to 90,000 units. Small kei-deliveries were hurt by supply constraints, but this was offset by the strong performance of registration cars such as the all-new Note.

In China, with a strong market recovery, unit sales were up 71% to 352,000 vehicles. In Europe, unit sales were up 69% as markets began to recover from the closure of retail networks in the first quarter of last year – with 91,000 units sold. Other markets were up almost 80%, accounting for 136,000 units in the quarter.

“We have delivered a strong performance in the first three months of our new fiscal year and continued to advance the Nissan NEXT business transformation plan,” said Nissan chief executive officer Makoto Uchida. “For the remainder of the year, we anticipate uncertainties will remain across our operating environment. We will carefully monitor and manage potential risks as we continue to improve quality of sales and maintain financial discipline. We expect a recovery in the second half supported when several new models will go on sale in core markets. Nissan will firmly pursue our goal of achieving a 2% operating margin in fiscal year 20213 , which is an important milestone under Nissan NEXT.”

FY2021 outlook

The shortage of semiconductor supply is expected to have a significant impact on Nissan’s sales volume in the second quarter. Nissan expects the issue will continue. However, sales volume will contribute to the operating profit supported by new vehicle launches. For the full fiscal year, Nissan is forecasting net revenue of 9.75 trillion yen and an operating profit of ¥150.0 billion yen. A net income1 of ¥60.0 billion yen is expected, which is ¥120.0 billion yen above the previous outlook.

Click to Enlarge.

The company has filed the fiscal year outlook to the Tokyo Stock Exchange. Calculated under the equity accounting method for Nissan’s joint venture in China, the forecasts for the fiscal year ending March 31, 2022, are:

Nissan Footnotes

AutoInformed.com on:

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.