Click for more GlobalData.

GlobalData observations

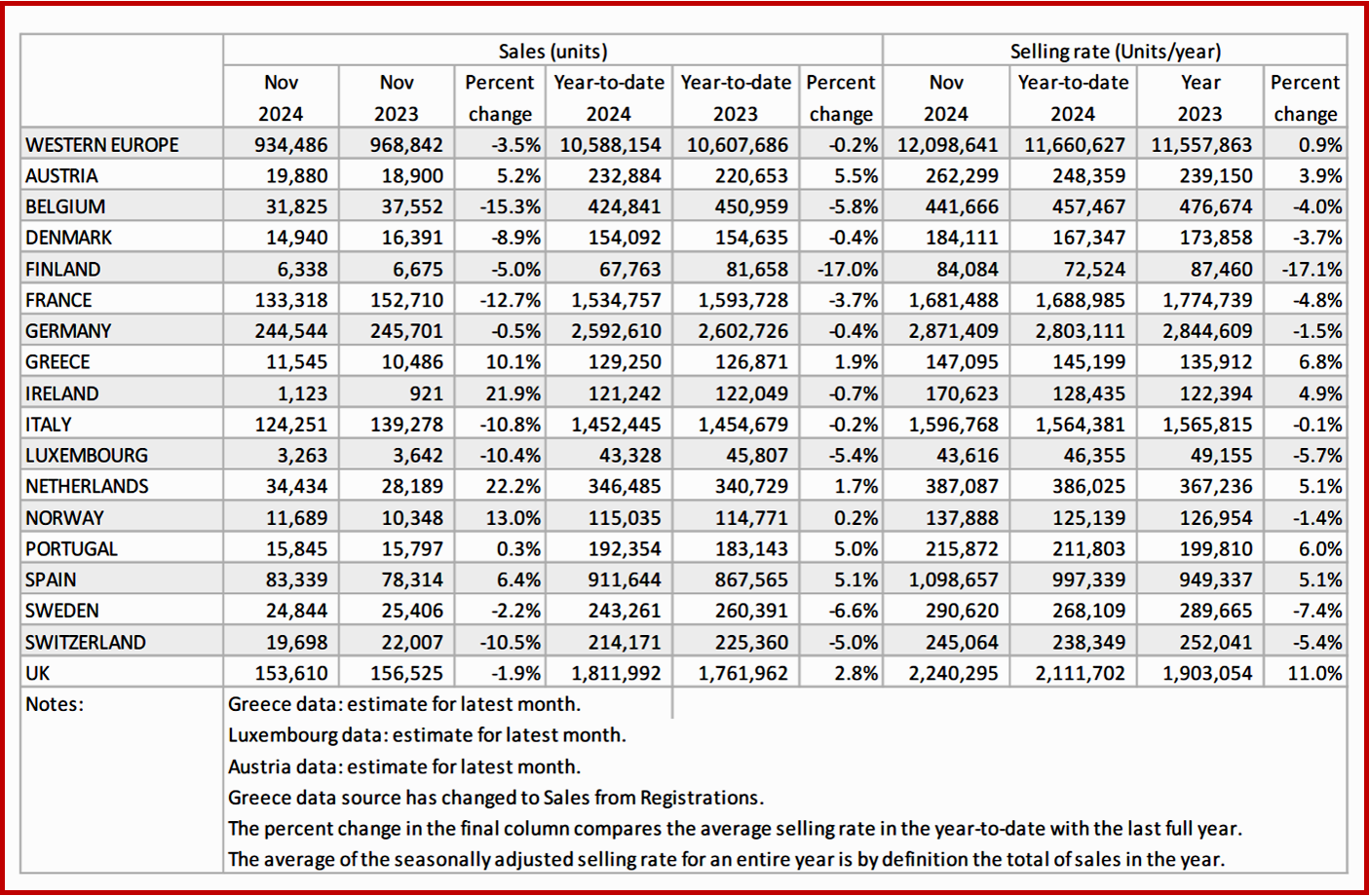

The car (PV or passenger vehicle) selling rate for Western Europe improved to 12.1 million units/year in November; however, YoY comparisons remain unfavorable, and overall sales in 2024 are set to fall short of 2023. We believe that growth should uptick in 2025 with the introduction of new models and more monetary easing. Despite this, ongoing geopolitical tensions, as well as the collapse of the German and French government, bring great uncertainty that is expected to drag on sales.

The German PV market remained broadly flat in November at 245,000 units, a 0.5% decline YoY. The selling rate improved 2.5% MoM to 2.87 million units/year. YTD sales reached 2.59 million units and almost certainly will not surpass 2023’s total sales. EV sales fell once again, down 21.8% YoY, highlighting the clear need for incentives and subsidies to stimulate sales.

Italy’s PV market fell for a fourth consecutive month in November as new car registrations fell nearly 11% YoY to 124,000 units. The selling rate rose to 1.6 million units/year, an increase of 3.8% MoM. There is now an emphasis on shifting the focus of government resources to the supply side and supporting companies as they face an energy transition. EV sales fell by17.5% YoY in November.

The French PV market declined by 12.7% to 133,000 units in November. The selling rate rose by 6.8% MoM to1.68 million units/year. PV sales have now fallen for seven consecutive months YoY. As political uncertainty reaches its peak, consumer confidence has fallen even further.

The UK PV market fell 1.9% YoY to 154,000 units in November. The selling rate improved 5.8% MoM to 2.24 million units/year. YTD sales stand at 1.81 million units, a near 3% improvement from the same period in 2023. However, demand from private buyers continued to decline, down 3.3% YoY.

The Spanish PV market registered 83,000 in November, a growth of 6.4% YoY. YTD sales now stand at 912,000 units, a 5% increase compared to the same period last year. Rental companies continue to drive demand, while purchases by individuals remain stagnant. Furthermore, EV sale remained disappointing as sales were down 7.8% YoY.