Click for more sales.

*Big Three Segments

In the U.S. market, the top three vehicle segments routinely account for more than 45% of all vehicle sales, according to Kelley Blue Book analysis. However, Full-size pickup trucks, where sales have been relatively soft in 2024, saw year-over-year ATPs lower in October by 1.3% at $65,389, down from $66,256 in October 2023.

ATPs for compact SUVs were mostly flat year over year. The average transaction price for a new compact SUV was $36,769 in October, nearly 30% below the industry average.

The mid-size SUV segment where 30 models are vying for attention, including some EV models, such as the new Honda Prologue and Chevrolet Blazer EV average transaction prices are at $48,977 in October, within 1% of the industry average.

“’Tis the season for automakers to make their final push for 2024 sales,” said Cox Automotive Executive Analyst Erin Keating. “While some automakers focus on managing production, many will likely maintain or even increase their seasonal incentives to attract buyers. With competition intensifying, these strategies will be crucial in maintaining market share and driving end-of-year sales. Our team is generally optimistic for new-vehicle sales to close out the year – extra incentives will certainly help.”

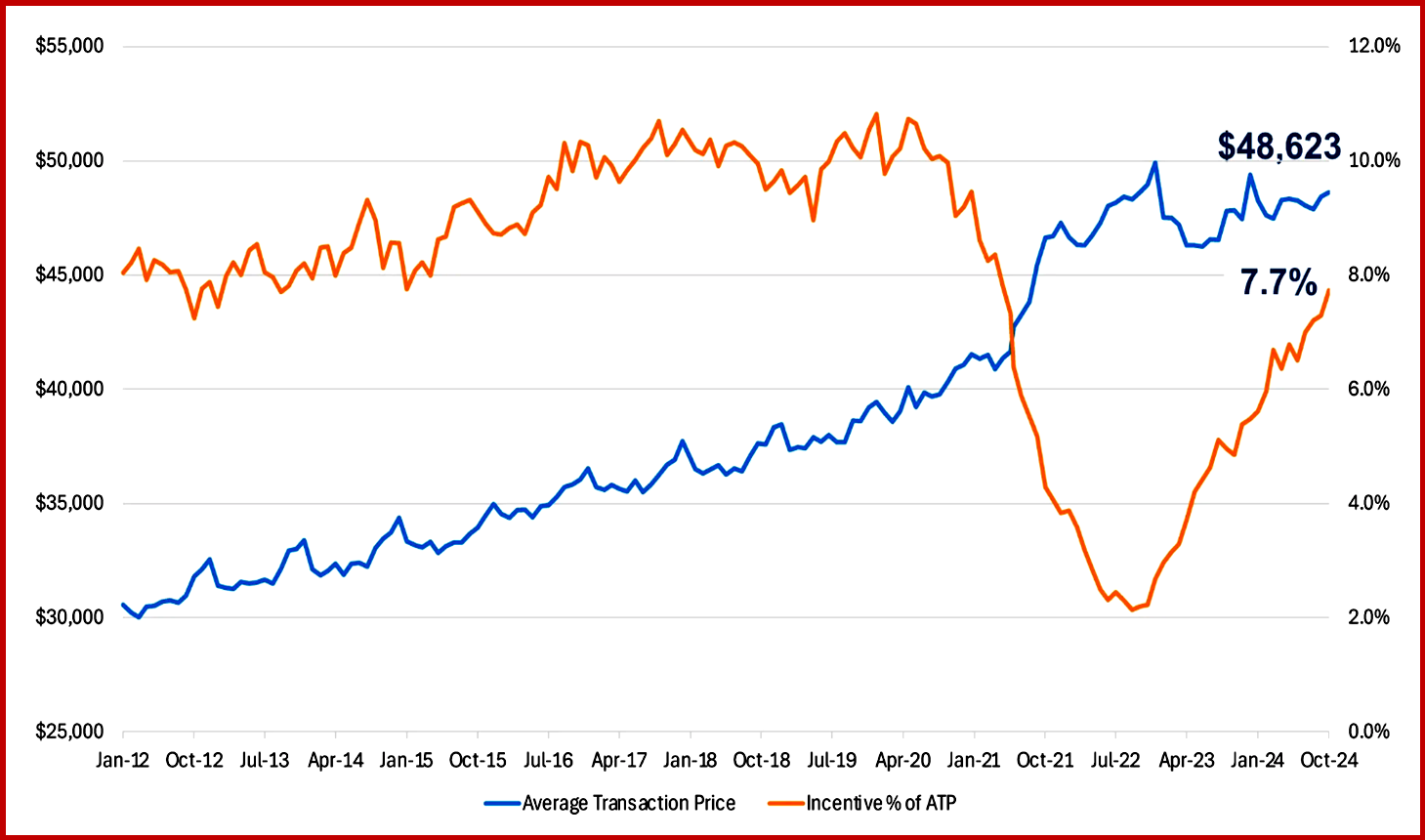

New-vehicle incentives have been climbing for more than two years after hitting a floor in the Fall of 2022. In October, eight mainstream automakers had average incentive packages above 10% of average transaction price, and all four of the Stellantis “domestic brands” – Chrysler, Dodge, Jeep and Ram – had incentive packages above the industry average, as the company works to clear inventory. Ram incentives were among the highest in the industry. Porsche, Toyota, Land Rover and Cadillac continue to have the lowest incentive spend.

Incentives Climb Higher in Major Market Segments.