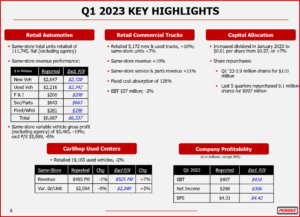

Click to enlarge.

The Penske Automotive Group, Inc. (NYSE: PAG), today announced that its Board of Directors has authorized an increase in the Company’s quarterly dividend by $0.05 per share or 8%, to $0.66 per share and delegated to management an additional $250 million in authority to repurchase the Company’s outstanding securities.

“Based on the strength of the Company’s performance and continued strong cash flow, we are pleased to provide our shareholders with an increase in the cash dividend, and we remain poised to return value to shareholders through additional securities repurchase authority as market conditions and other considerations warrant,” said Penske Automotive Group President, Robert Kurnick, Jr.

The PAG dividend is payable 1 June 2023 to shareholders of record as of 22 May 2023. The repurchase authority is in addition to the previously announced authority, of which $135.8 million remained outstanding as of 10 May, 2023. The authority has no expiration. During 2023, PAG repurchased 1.45 million shares of its common stock, representing ~2.1% of the Company’s shares outstanding at the beginning of 2023, for an aggregate purchase price of $188.4 million.

Under the securities repurchase program, PAG said it may, as market conditions warrant, purchase its outstanding common stock or debt on the open market, in privately negotiated transactions, via a tender offer, through a pre-arranged trading plan, pursuant to the terms of an accelerated share repurchase program, or by other means.

“The decision to make repurchases will be based on factors such as general economic and industry conditions, the market price of the relevant security versus the Company’s view of its intrinsic value, the potential impact of such repurchases on the Company’s capital structure, and the Company’s consideration of any alternative uses of its capital, such as for acquisitions, the repayment of existing indebtedness, and strategic investments in its current businesses, in addition to any then-existing limits imposed by the Company’s finance agreements and securities trading policy. The program does not require the Company to repurchase any specific number of securities, and may be modified, suspended or terminated at any time without further notice,” PAG said in a release.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Penske Automotive Ups Dividend, Will Buyback More Shares

Click to enlarge.

The Penske Automotive Group, Inc. (NYSE: PAG), today announced that its Board of Directors has authorized an increase in the Company’s quarterly dividend by $0.05 per share or 8%, to $0.66 per share and delegated to management an additional $250 million in authority to repurchase the Company’s outstanding securities.

“Based on the strength of the Company’s performance and continued strong cash flow, we are pleased to provide our shareholders with an increase in the cash dividend, and we remain poised to return value to shareholders through additional securities repurchase authority as market conditions and other considerations warrant,” said Penske Automotive Group President, Robert Kurnick, Jr.

The PAG dividend is payable 1 June 2023 to shareholders of record as of 22 May 2023. The repurchase authority is in addition to the previously announced authority, of which $135.8 million remained outstanding as of 10 May, 2023. The authority has no expiration. During 2023, PAG repurchased 1.45 million shares of its common stock, representing ~2.1% of the Company’s shares outstanding at the beginning of 2023, for an aggregate purchase price of $188.4 million.

Under the securities repurchase program, PAG said it may, as market conditions warrant, purchase its outstanding common stock or debt on the open market, in privately negotiated transactions, via a tender offer, through a pre-arranged trading plan, pursuant to the terms of an accelerated share repurchase program, or by other means.

“The decision to make repurchases will be based on factors such as general economic and industry conditions, the market price of the relevant security versus the Company’s view of its intrinsic value, the potential impact of such repurchases on the Company’s capital structure, and the Company’s consideration of any alternative uses of its capital, such as for acquisitions, the repayment of existing indebtedness, and strategic investments in its current businesses, in addition to any then-existing limits imposed by the Company’s finance agreements and securities trading policy. The program does not require the Company to repurchase any specific number of securities, and may be modified, suspended or terminated at any time without further notice,” PAG said in a release.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.