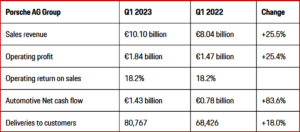

Porsche AG achieved solid results in its first quarter after becoming a public company. Sales revenue rose by 26% compared to Q1 last year at €10.10 Billion (previous year: €8.04B). Group operating profit rose by 25.4% from €1.47B to €1.84B. Group operating return on sales at 18.2% was about the same for Q1 last year.

Q1 automotive net cash flow was €1.43B (€778 million). The cash flow margin for the automotive segment rose to 15.3% (10.6 %). Net cash flow for the previous year was of course hurt by disruptions in the supply chain that hurt virtually all global automakers. Porsche increased deliveries to customers by 18% year-on-year in Q1 at 80,767 vehicles (68,426).

Click chart for more information.

Porsche reaffirmed its targets for the full year 2023. The assumption for Group sales revenue ranges from €40 to €42B. “In the event that global challenges do not significantly worsen, we expect a Group operating return on sales for fiscal year 2023 in the range of 17%-19%,” said Lutz Meschke, Deputy Chairman of the Executive Board and Board Member for Finance and IT at Porsche AG. “In the long run, we are aiming for a Group operating return on sales of more than 20%.

Porsche Financial Services (PFS) also grew in Q1. Sales revenue rose to €803M (€776M). However, interest rate increases hurt financing products. The share of leased and financed new vehicles declined to 41.5% (45.7% percent). PFS’s operating profit declined to €86M (€102 M). The downturn is primarily the result of the valuation of interest rate hedges and derivatives.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Porsche Posts €1.8B Operating Profit in Q1 2023

Porsche AG achieved solid results in its first quarter after becoming a public company. Sales revenue rose by 26% compared to Q1 last year at €10.10 Billion (previous year: €8.04B). Group operating profit rose by 25.4% from €1.47B to €1.84B. Group operating return on sales at 18.2% was about the same for Q1 last year.

Q1 automotive net cash flow was €1.43B (€778 million). The cash flow margin for the automotive segment rose to 15.3% (10.6 %). Net cash flow for the previous year was of course hurt by disruptions in the supply chain that hurt virtually all global automakers. Porsche increased deliveries to customers by 18% year-on-year in Q1 at 80,767 vehicles (68,426).

Click chart for more information.

Porsche reaffirmed its targets for the full year 2023. The assumption for Group sales revenue ranges from €40 to €42B. “In the event that global challenges do not significantly worsen, we expect a Group operating return on sales for fiscal year 2023 in the range of 17%-19%,” said Lutz Meschke, Deputy Chairman of the Executive Board and Board Member for Finance and IT at Porsche AG. “In the long run, we are aiming for a Group operating return on sales of more than 20%.

Porsche Financial Services (PFS) also grew in Q1. Sales revenue rose to €803M (€776M). However, interest rate increases hurt financing products. The share of leased and financed new vehicles declined to 41.5% (45.7% percent). PFS’s operating profit declined to €86M (€102 M). The downturn is primarily the result of the valuation of interest rate hedges and derivatives.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.