Click to Enlarge.

After the first nine months of the fiscal year 2020, Porsche Automobil Holding SE (Porsche SE), Stuttgart is making money again, albeit only at €437 million after tax (prior-year period: 3.52 billion euro). After the first six months of the fiscal year 2020, this figure had been negative at minus -€329 million.

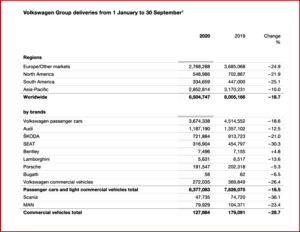

Porsche SE’s positive result after tax basically comes from the profit from an investment accounted for at equity in Volkswagen AG of €505 million (prior-year period: €3.58 billion. Porsche Se is the largest holder of VW common stock). The business of the Volkswagen Group was affected by the Covid-19 pandemic in the first nine months of 2020 but made a recovery in the third quarter. Nonetheless both groups remain in difficult if not precarious financial positions.

Net liquidity of the Porsche SE Group came to €492 million euro as of 30 September 2020 (31 December 2019: €553 million). Due to the record date, this figure did not include either the dividend inflow to Porsche SE from Volkswagen AG of €756 million or the dividend distribution to the shareholders of Porsche SE of €676 million. Both cash flows occurred in October 2020. AutoInformed at the time questioned the wisdom of the distributions given the ongoing Covid pandemic. (Volkswagen Group Closes 2019 Books)

The board of management of Porsche SE is “still of the opinion that it is currently impossible to give a reliable and realistic forecast for the group result after tax for the fiscal year 2020. However, overall the Porsche SE Group expects a positive group result after tax for the fiscal year 2020.”

The forecast of the group net liquidity of Porsche SE remains unchanged. Without taking additional investments into account, it lies in a corridor of €0.4 billion to €0.9 billion as of 31 December 2020.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Porsche Q3 in Black at €437 Million Because of VW

Click to Enlarge.

After the first nine months of the fiscal year 2020, Porsche Automobil Holding SE (Porsche SE), Stuttgart is making money again, albeit only at €437 million after tax (prior-year period: 3.52 billion euro). After the first six months of the fiscal year 2020, this figure had been negative at minus -€329 million.

Porsche SE’s positive result after tax basically comes from the profit from an investment accounted for at equity in Volkswagen AG of €505 million (prior-year period: €3.58 billion. Porsche Se is the largest holder of VW common stock). The business of the Volkswagen Group was affected by the Covid-19 pandemic in the first nine months of 2020 but made a recovery in the third quarter. Nonetheless both groups remain in difficult if not precarious financial positions.

Net liquidity of the Porsche SE Group came to €492 million euro as of 30 September 2020 (31 December 2019: €553 million). Due to the record date, this figure did not include either the dividend inflow to Porsche SE from Volkswagen AG of €756 million or the dividend distribution to the shareholders of Porsche SE of €676 million. Both cash flows occurred in October 2020. AutoInformed at the time questioned the wisdom of the distributions given the ongoing Covid pandemic. (Volkswagen Group Closes 2019 Books)

The board of management of Porsche SE is “still of the opinion that it is currently impossible to give a reliable and realistic forecast for the group result after tax for the fiscal year 2020. However, overall the Porsche SE Group expects a positive group result after tax for the fiscal year 2020.”

The forecast of the group net liquidity of Porsche SE remains unchanged. Without taking additional investments into account, it lies in a corridor of €0.4 billion to €0.9 billion as of 31 December 2020.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.