The real tax break fight will be in the lower house of Congress, which Republicans control. With Obama and the entire House up for reelection next year, oil is once again an explosive issue.

U.S. President Barack Obama in his weekly radio address to the nation on Saturday called for expansion of domestic oil production and the elimination of $4 billion in taxpayer subsidies that oil companies are granted each year by the U.S. Congress.

Obama directed the Department of the Interior to conduct annual lease sales in Alaska’s National Petroleum Reserve, to speed up the evaluation of oil and gas resources in the mid and south Atlantic, and to create “new incentives” for industry to develop their unused leases both on and offshore.

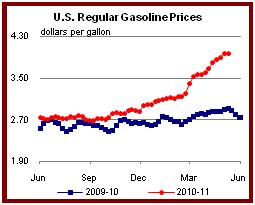

The latest political maneuvering came after what are decades of failed leadership on U.S. energy policy by both political parties. The stark reality remains that gasoline prices are a major concern to voters as prices are close to $4 gallon in many parts of the country and $5 gallon in car crazy California.

The U.S. average retail price of regular gasoline was $3.97per gallon - $1.06 per gallon higher than last year. The biggest increase came in the Rocky Mountain region as prices were up almost three cents. The East Coast saw the price rise about two cents. The West Coast registered a penny gain on last week's price, while Gulf Coast prices were half a cent higher. In the Midwest gas dropped about three cents to $3.98 per gallon.

Obama – in what is a perennial campaign issue when prices are high – also called for the elimination of huge taxpayer subsidies to oil and gas companies, saying that during the past few months the biggest oil companies made about $4 billion in profits each week.

“Before I was President, the CEOs of these companies even admitted that the tax subsidies made no sense,” Obama said. “Well, next week, there is a vote in Congress to end these oil company giveaways once and for all. And I hope Democrats and Republicans come together and get this done.”

In a ritualistic reply, Republicans dismissed the President’s plan. Senate Republican Leader Mitch McConnell said revoking billions in tax breaks would “raise the price of gas at the pump, send jobs overseas.”

The top five source countries of U.S. petroleum imports are Canada, Mexico, Venezuela, Saudi Arabia, and Nigeria. In total the U.S. imports more than half of its oil, and has for more than three decades.

The real fight – at least in words – will be in the lower house of Congress, which Republicans control. With Obama and the entire House up for reelection next year this is an explosive issue. Only one thing is certain despite the rhetoric – short of a market collapse, which would be an even bigger economic disaster than currently – gasoline prices won’t drastically drop any time soon as future contracts are still at almost $100 a barrel.

The Deloitte Consumer Spending Index (the Index) fell significantly in April, showing the largest single month decline since November 2007. The Index tracks consumer cash flow as an indicator of future consumer spending, which makes up 70% of the U.S. economy.

“A sharp deterioration in real wages coupled with a rise in jobless claims weighed heavily on the Index in April,” said Carl Steidtmann, Deloitte’s chief economist and author of the monthly Index.

“Growth in consumers’ disposable income recently accelerated following a cut in Social Security taxes, giving consumers the means to spend. However, rising food and energy prices have started to undermine consumers’ purchasing power, which may continue to lose ground to inflation in the months ahead, particularly if unemployment claims head higher.”

The Index has four components — tax burden, initial unemployment claims, real wages, and real home prices — fell to 3.16%.