Click for more GlobalData.

Observations and Data

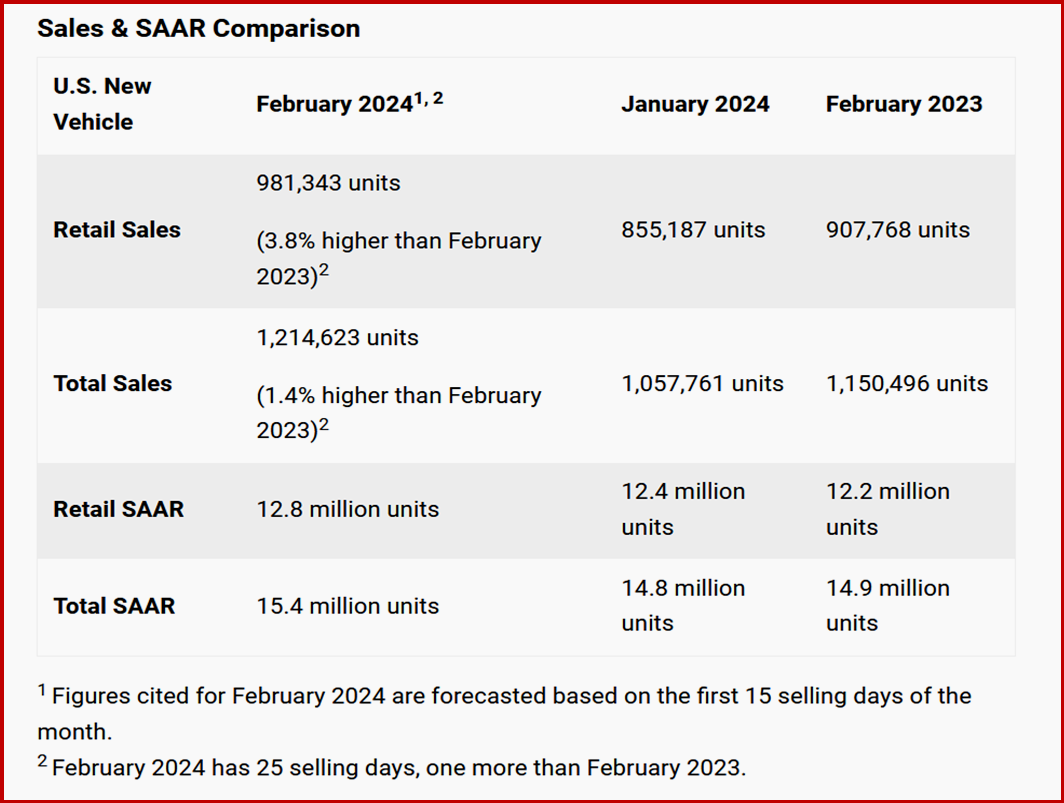

• Retail inventory levels are expected to finish around 1.7 million units, a 3.6% increase from January 2024 and a 44.7% increase from February 2023. Fleet mix is projected at 19.2%, down 1.9 percentage points from February 2023.

• Consumers are expected to spend~ $40.8 billion on new vehicles this month. This is the highest on record for the month of February, and 4.1% higher than February 2023.

• The average new-vehicle retail transaction price is declining due to rising manufacturer incentives, falling retailer profit margins and increased availability of lower-priced vehicles.

• Transaction prices in February are trending towards $44,045, down $1919 or -4.2% from February 2023.

• Trucks/SUVs are forecast to account for 79% of new-vehicle retail sales in February.

• Fleet sales are expected to total 233,279 units in February, down 7.7% from February 2023 on a selling day adjusted basis. Fleet volume is expected to account for 19.2% of total light-vehicle sales, down 1.9 percentage points from a year ago.

• Average interest rates for new-vehicle loans are expected to increase to 6.9%, 17 basis points higher than a year ago.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com