Click to Enlarge.

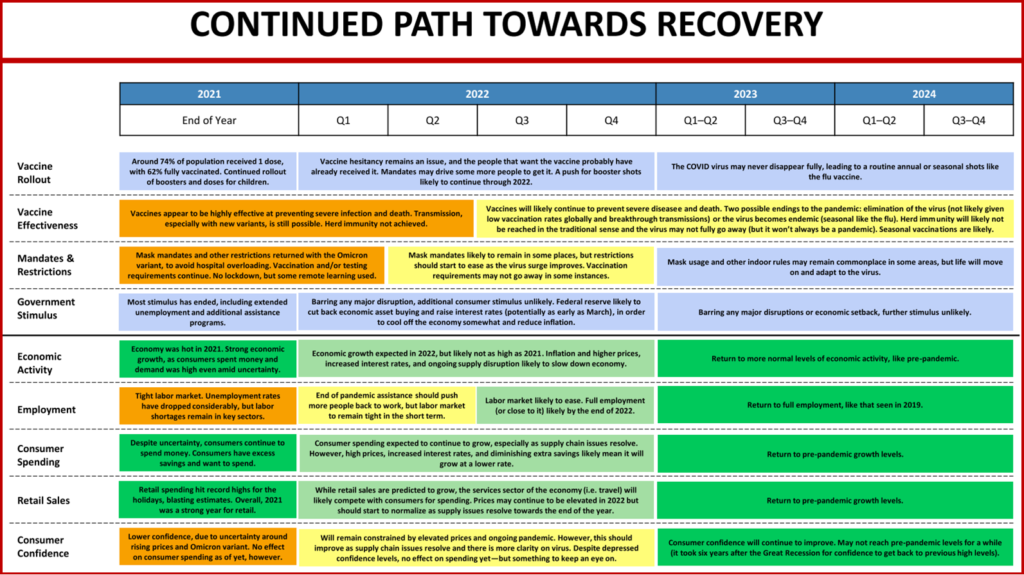

SEMA, Specialty Equipment Manufacturers Assn, has released its “Future Trends – January 2022” report today. It says 2021 was a strong year for the industry amid high demand, with many companies reporting record growth. The specialty-equipment market should continue to grow in 2022, but at more muted levels, before returning to more normal (pre-pandemic) growth for 2023 and beyond, said the trade organization. According to the report, nearly three-quarters (74%) of industry companies expect sales growth in 2022. Key effects for the industry will be consumer demand, supply-chain disruption, rising costs and automotive sales.

SEMA report also reflects the ongoing Biden economic recovery as 2021 was a strong year for the U.S. economy amid record demand and consumer spending. Currently, the automotive industry has 2.91 million employees, only 4% below employment levels from before the pandemic in February 2020, making the automotive industry one of the best recoveries of any sector in the economy.

Supply-chain disruptions will continue in 2022, but SEMA Market Research projects that most issues should improve to more normal levels by the end of the year. Prices are likely to remain “somewhat elevated for longer, however, likely into 2023.” Product shortages, shipping and transport delays and higher rates (shipping container rates are up 400% compared to October 2019), along with elevated input and commodity prices (steel is up 262% from October 2019), will be factors to watch in the automotive market.

“The U.S. economy will continue to grow in 2022 but at lower levels than in 2021 due to significant headwinds. By 2023, however, the economy should be back to pre-pandemic growth levels,” SEMA said.

Consumers interact with the automotive aftermarket industry differently depending on their stage of life. “Despite popular misconceptions, many young people care about their vehicles and are accessorizing. Even as the population changes, consumers under 40 will continue to make up the majority of specialty-equipment spending over the next decade. In fact, nearly 70% of specialty-equipment sales in 2020 came from consumers under the age of 40,” SEMA said.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

SEMA – 2021 Strong Year for Specialty-Equipment Market

Click to Enlarge.

SEMA, Specialty Equipment Manufacturers Assn, has released its “Future Trends – January 2022” report today. It says 2021 was a strong year for the industry amid high demand, with many companies reporting record growth. The specialty-equipment market should continue to grow in 2022, but at more muted levels, before returning to more normal (pre-pandemic) growth for 2023 and beyond, said the trade organization. According to the report, nearly three-quarters (74%) of industry companies expect sales growth in 2022. Key effects for the industry will be consumer demand, supply-chain disruption, rising costs and automotive sales.

SEMA report also reflects the ongoing Biden economic recovery as 2021 was a strong year for the U.S. economy amid record demand and consumer spending. Currently, the automotive industry has 2.91 million employees, only 4% below employment levels from before the pandemic in February 2020, making the automotive industry one of the best recoveries of any sector in the economy.

Supply-chain disruptions will continue in 2022, but SEMA Market Research projects that most issues should improve to more normal levels by the end of the year. Prices are likely to remain “somewhat elevated for longer, however, likely into 2023.” Product shortages, shipping and transport delays and higher rates (shipping container rates are up 400% compared to October 2019), along with elevated input and commodity prices (steel is up 262% from October 2019), will be factors to watch in the automotive market.

“The U.S. economy will continue to grow in 2022 but at lower levels than in 2021 due to significant headwinds. By 2023, however, the economy should be back to pre-pandemic growth levels,” SEMA said.

Consumers interact with the automotive aftermarket industry differently depending on their stage of life. “Despite popular misconceptions, many young people care about their vehicles and are accessorizing. Even as the population changes, consumers under 40 will continue to make up the majority of specialty-equipment spending over the next decade. In fact, nearly 70% of specialty-equipment sales in 2020 came from consumers under the age of 40,” SEMA said.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.