Click to Enlarge.

The Details

• The average new-vehicle retail transaction price in August is expected to reach $44,039, down $1895 from August 2023. The high for any month – $47,329 – was set in December 2022.

• Average incentive spending per unit in August is expected to reach $3,035, up $1,132 from August 2023. Spending as a percentage of the average MSRP is expected to increase to 6.2%, up 2.3 percentage points from August 2023.

• Average incentive spending per unit on trucks/SUVs in August is expected to be $3234, up $1254 from a year ago, while the average spending on cars is expected to be $2242, up $639 from a year ago.

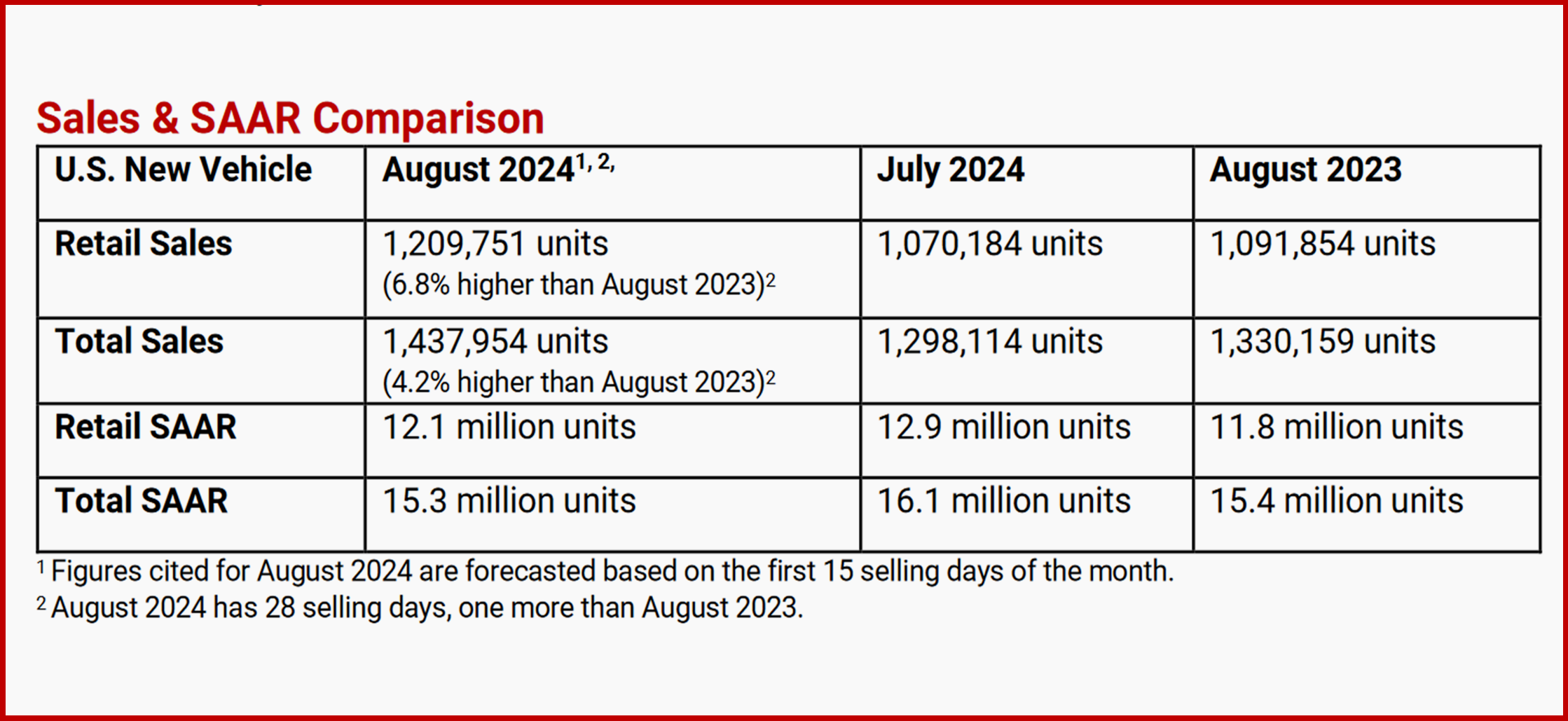

• Retail buyers are on pace to spend $50.7 billion on new vehicles, up $3.0 billion from August 2023.

• Trucks/SUVs are on pace to account for 80.0% of new-vehicle retail sales in August.

• Fleet sales are expected to total 228,202 units in August, down 7.7% from August 2023. Fleet volume is expected to account for 15.9% of total light-vehicle sales, down 2.0 percentage points from a year ago.

• Average interest rates for new-vehicle loans are expected to be 6.87%, down 36 basis points from a year ago.

EV Outlook

Elizabeth Krear, vice president, electric vehicle practice at J.D. Power:

“The J.D. Power EV Index, which tracks the path to parity of EVs with gas-powered vehicles, reached a historic high score in July of 56 on a 100-point scale. July marked the fifth consecutive month that the EV Index rose but it’s the six factors that make up the index that tell the real story of the EV ecosystem’s dynamics.

“One factor – interest – reached a high for the year with 28% of new-vehicle shoppers saying they are ‘very likely’ to consider a battery electric vehicle for their next purchase, but the industry seems to be struggling to attract more buyers than a year ago, even with the tremendous improvements in another factor, availability. Availability has increased 22 points year over year, with 66% of shoppers now having a viable alternative to a gas-powered equivalent.

“Incentives have helped align prices in popular compact and midsize mass market segments, making them more affordable. Mass market and premium BEVs are at and above parity with gas-powered alternatives—from a total cost of ownership standpoint—and this is driven by aggressive manufacturer incentives; federal and state incentives; and lower operating costs. BEV monthly retail sales have held steady at 9.2% of the market for two consecutive months. While infrastructure remains insufficient, customer satisfaction with charging in the second quarter improved for a second consecutive quarter. Especially noteworthy is the satisfaction experienced by Ford and Rivian owners now having access to the Tesla charging network. An increase in the transition to EVs will take time, with several interdependent variables affecting adoption, but the foundation is growing as consumers try to match vehicle options with their lifestyle.”

Global Sales Outlook

Jeff Schuster, vice president of research, automotive at GlobalData:

“The global light-vehicle selling rate rose again in July 2024, increasing 200,000 units from June to 89.9 million units. While the sales pace remains at a healthy level, July decreased from 92.2 million units in July 2023 as the early inventory recovery supported pent-up demand a year ago.