Click for more GlobalData.

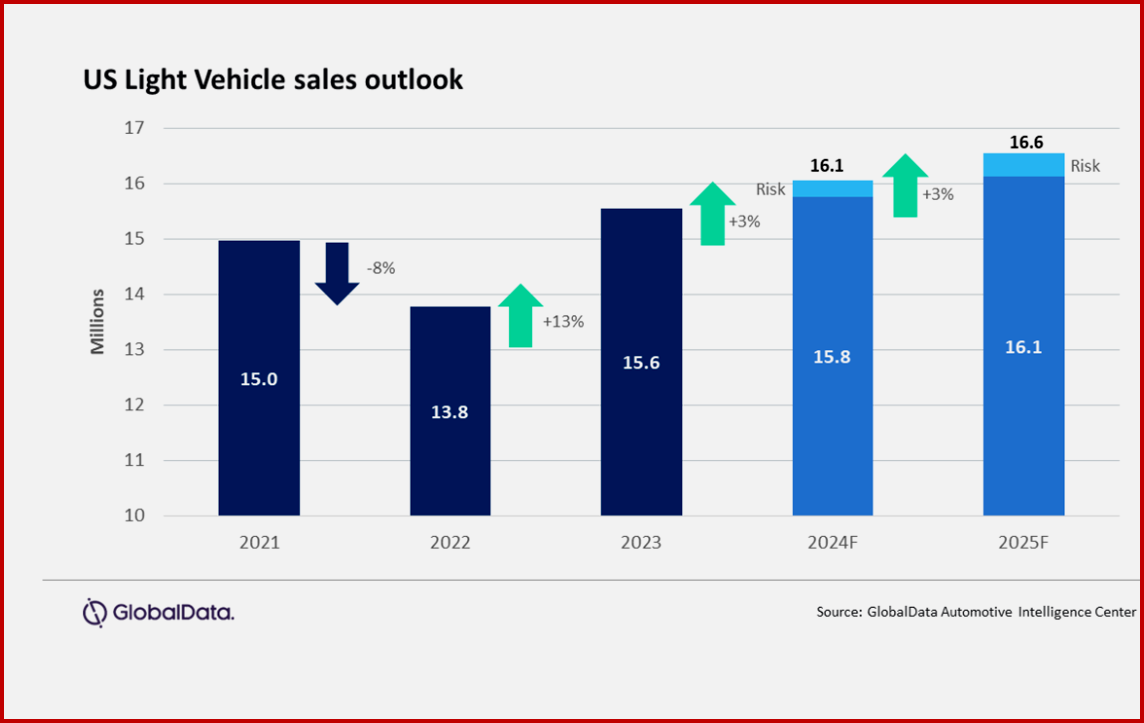

“We continue to expect 2024 to be a return to more normalized patterns of sales and pricing to stabilize, albeit at a higher-than-normal level. Growth in incentives and the eventual cut in interest rates should prove to be a catalyst for continued growth in 2024. There is no question the transition to EVs will be slower than many in the industry expected, but don’t write off EVs in 2024, there will be 47 new BEVs on the market in 2024, accounting for 10% of the total volume. Will this be the year that Tesla’s dominance is finally tested?,” said Jeff Schuster, Vice President Research and Analysis, Automotive at GlobalData.

Global Forecast

Global LV sales finished 2023 strongly, posting a selling rate of 94 million units in December 2023, an increase of 13% from December 2022. Strong domestic and export volume in China, up 24% year over year, once again led the way in increases. 2023 ended at 90 million units, an increase of 11% and the highest level since 2019. While uncertainty will continue to play a leading role for the auto market, a level of stability and more consistency is expected as we start 2024. The forecast for global LV sales in 2024 is for 92.4 million units, a nominal increase of 2% from 2023, but most of the attention may be below the topline. Regulatory pressure remains on the industry for the transition to Electric Vehicles (EVs) and GlobalData expect continued expansion of the EV market in 2024. Battery Electric Vehicles (BEVs) are forecast to account for 15% of global sales in 2024.