Click to enlarge.

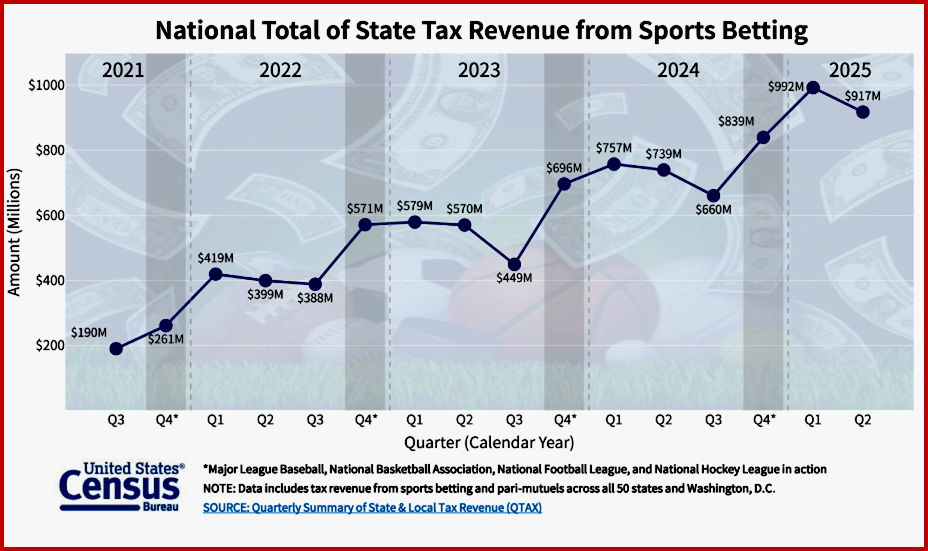

“Sports betting became possible in May 2018 when the U.S. Supreme Court struck down the Professional and Amateur Sports Protection Act. Since then, a majority of states have legalized some form of sports betting; including online, mobile, retail sports betting and pari-mutuels, such as wagers made on horse-racing,” Census said.

During the past four years, many states have eased restrictions on gambling, contributing to the explosion of sports betting sales tax revenue.

• New York’s online sports betting market went live Jan. 8, 2022. The state applies a 51% tax rate to gross gaming revenue and regularly collects over $200 million in revenue per quarter.

• Ohio’s legal sports betting market went live Jan. 1, 2023, and took in $39 million in the first quarter of that year.

• North Carolina’s sports betting market went live March 11, 2024. The state collected $38 million during the second quarter of 2024.

• Illinois increased its tax rate from a flat 15% on adjusted gaming revenue to a graduated rate between 20% and 40%. This took effect Jan.1, 2025.

• Delaware, Kansas, Maine, Massachusetts, North Carolina and Vermont adopted online sports betting in recent years; Missouri followed suit on Dec. 1, 2025.