Click to enlarge.

Seasonality of Sports Betting

Sports betting revenue is typically higher in the winter – which includes the fourth quarter of one calendar year and the first quarter of the next – than in the summer.

The fourth quarter of the calendar year includes some of the most popular sporting events:

• Major League Baseball (MLB) playoffs.

• Start of both the National Basketball Association (NBA) and National Hockey League (NHL) seasons.

• Prime portion of the National Football League (NFL) season.

“The first quarter of the calendar year has the remainder of the NBA and NHL regular seasons, as well as the NFL playoffs and Super Bowl. It also includes the March Madness college basketball tournament. Revenue wanes in the summer months when MLB is often the only major sport in action,” Census said.

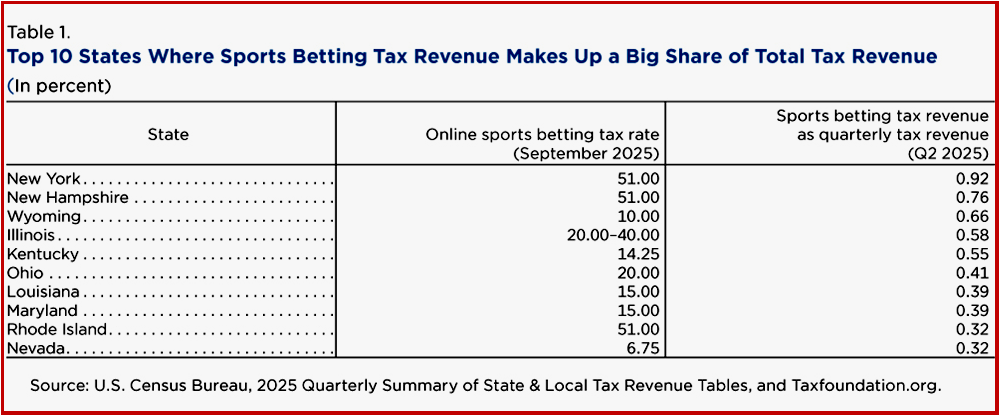

Percentage of State Tax Revenue

States have varying tax rates on sportsbook revenues, ranging from 6.75% (Iowa, Nevada) to 51% (New Hampshire, New York, Rhode Island). Typically, the higher the rate, the larger the portion of a state’s total tax revenue that comes from sports betting.