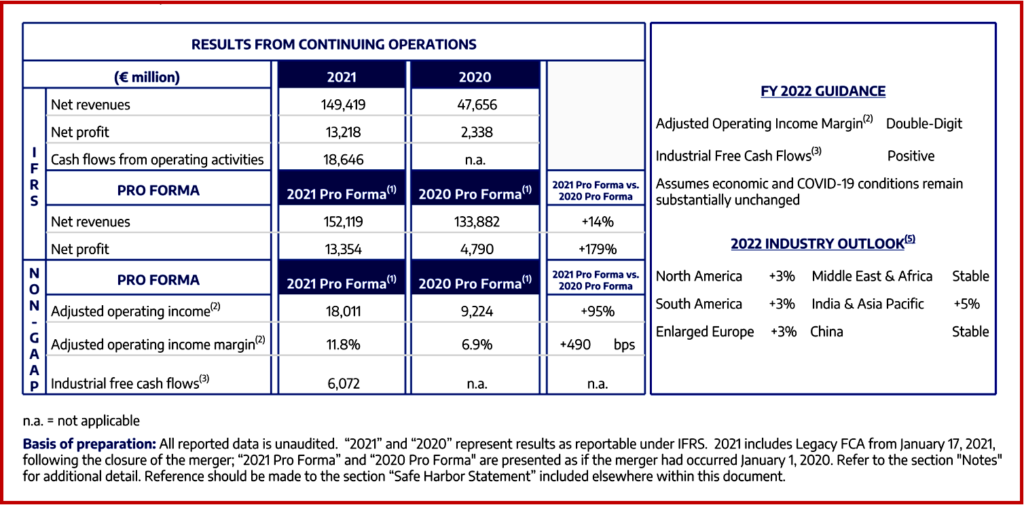

As a new company formed on 17 January 2021 by the merger of Fiat Chrysler, aka FCA, and Peugeot or PSA, Stellantis today posted what it called record results for 2021 with an adjusted operating margin 11.8% on income of €18.0 billion and €13.4 Billion ($15.2B) Net Profit on a Pro Forma* basis. Given this, net profit almost tripled year-year-on-year.

“Today’s record results prove that Stellantis is well positioned to deliver strong performance, even in the most uncertain market environments,” said Carlos Tavares, CEO. “I warmly thank all Stellantis employees … for their contribution to building our new company powered by its diversity. I take this opportunity to also thank the management team for their relentless efforts as we faced and overcame intense headwinds. Together, we are focused on executing our plans as we race to become a sustainable mobility tech company,” Tavares concluded.

Regional Performance

- In North America, the Jeep Wrangler 4xe was the bestselling plug-in hybrid electric vehicle in U.S. retail for 2021.

- In South America, Stellantis was the market leader in 2021 with 22.9% share and was also the leader in commercial vehicles with 30.9% market share.

- In Enlarged Europe, Stellantis was the EU30 market leader in commercial vehicles with 33.7% market share for 2021. The Peugeot 208 was the number one selling vehicle in the EU30 and the 2008 was number one in the EU30 B-SUV segment for 2021.

- In Middle East & Africa, consolidated shipments were up 6%, while market share grew in most major markets year-on-year.

- In India & Asia Pacific, the Company is preparing to launch the all-new Citroën C3, developed and produced in India.

- In China, Dongfeng Peugeot Citroën Automobile Co. Ltd (DPCA), more than doubled its annual sales volume of 2020 with 100,000 units sold and Stellantis became the fourth largest Independent After Market (IAM) parts distributor in China with sales growth of approximately 30% year on year.

- Maserati global market share grew to 2.4%, with North America and China market share at 2.9% and 2.7%, respectively, for 2021.

Stellantis Results at a Glance

- Net revenues (1) of €152 billion, up 14%

- Adjusted operating income(1) nearly doubled to €18.0 billion, with 11.8% margin and all segments profitable

- Net profit(1) of €13.4 billion, nearly tripled year-on-year

- Industrial free cash flows(1) of €6.1 billion, mainly driven by strong profitability and net cash synergies

- Synergies execution with ~€3.2 billion net cash benefit

- Strong Industrial available liquidity at €62.7 billion

- €3.3 billion ordinary dividend to be paid, subject to shareholder approval

AutoInformed on

- Stellantis Doubles China Sales, Bolsters and Consolidates Aftermarket as Jeep Sales Plunge

- Stellantis to Repay Early €6.3B Fiat Credit Facility

- Amazon and Stellantis to Connect Vehicles to Digital Services

- Solid State Batteries: Factorial Energy Parade Adds Stellantis

- Stellantis Has Lithium Supply Deal with Vulcan Energy

- Floorplan – Stellantis Buys First Investors Financial Services

- Stellantis Posts Q3 Net Revenues of €32.6 Billion -14%

- Stellantis, Samsung SDI JV for NA Battery Manufacturing

- Stellantis on SAE Level 3 Public Road Autonomous Driving

- Stellantis EV Trifecta – $229 Million to Three Kokomo Plants

- Christine Feuell New Chrysler Brand CEO at Stellantis

- Stellantis to Buy First Investors Financial Services

- FIH Mobile, Stellantis JV Begun on Connected Car Technology

- Stellantis Posts Record H1 Results. Full-Year Guidance Upped

- Stellantis New Credit Line €12B Tops PSA and FCA Combined

* Figures denoted with (1) are Pro Forma and are presented as if the merger was completed on 1 January 2020. All comparisons are to FY 2020 Pro Forma (1)

Pingback: Maserati – First Italian Luxury Brand to Produce EVs | AutoInformed