Click for more.

The Stellantis Spin

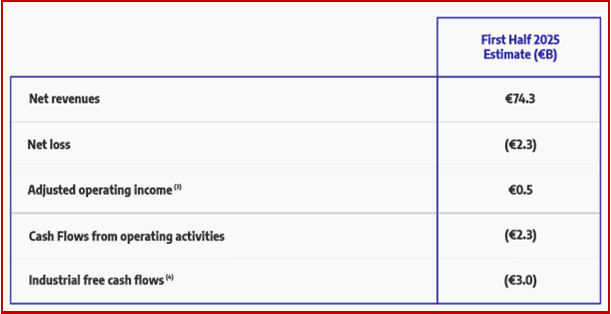

“The following factors had a significant impact on results in the first half of 2025:

• The early stage of actions being taken to improve performance and profitability, with new products expected to deliver larger benefits in the Second Half of 2025.

• Approximately €3.3 billion of pre-tax net charges, primarily related to program cancellation costs and platform impairments, net impact of the recent legislation eliminating the CAFE penalty rate, and restructuring, which are excluded from Adjusted Operating Income(3) consistent with the Company’s definition of AOI.

• Adverse impacts to AOI from higher industrial costs, geographic and other mix factors, and changes in foreign exchange rates.

• The early effects of US tariffs – €0.3 billion of net tariffs incurred as well as loss of planned production related to implementation of the Company’s response plan,” Stellantis claimed.