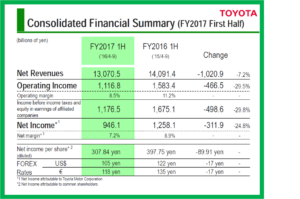

Toyota Motor Corporation (TMC) today announced that net revenues for the six-month period ended 30 September 2016 declined -7.2% to 13.07 trillion yen based on an increase of vehicle sales of 85,530 to 4,363,537 (Honda 2.431 m, Nissan 2.613 m ) when compared year-over-year. Year-to-date Toyota stock is down more than -21% to under 6,000 yen in Tokyo.

Nevertheless, TMC’s Board of Directors agreed to pay 100 yen per share (~3.6%) as the interim dividend on common shares. The Board has also resolved to buy back up to 200 billion yen, or 40 million shares, of the company’s common stock.

On a consolidated basis operating income decreased from 1.5834 trillion yen to 1.1168 trillion yen, while income before income taxes was 1.1765 trillion yen. Net income decreased from 1.2581 trillion yen to 946.1 billion yen. Major factors contributing to the decreases included currency fluctuations of 565.0 billion yen, only partially offset by an increase of 220.0 billion yen in cost reduction efforts.

“Despite the positive factors such as cost reduction and marketing efforts, operating income was down 466.5 billion yen compared to the first half of the last fiscal year, due to the significant impact of Yen appreciation. Nevertheless, operating income excluding the overall impact of foreign exchange rates, as well as swap valuation gains and losses was up 200 billion yen,” said TMC Executive Vice President Takahiko Ijichi.

In Japan, vehicle sales totaled 1,078,810 units, an increase of 94,413 units. Operating income, excluding the impact of valuation gains/losses from interest rate swaps, decreased by 473.4 billion yen to 485.7 billion yen.

In North America, vehicle sales totaled 1,400,369 units, a decrease of 12,695 units. Operating income, excluding the impact of valuation gains/losses from interest rate swaps, increased by 11.0 billion yen to 296.8 billion yen.

In Europe, vehicle sales totaled 434,381 units, an increase of 27,029 units, while operating income, excluding the impact of valuation gains/losses from interest rate swaps, increased by 2.4 billion yen to 34.6 billion yen.

In Asia, vehicle sales totaled 764,750 units, an increase of 111,184 units, while operating income, excluding the impact of valuation gains/losses from interest rate swaps, decreased by 23.1 billion yen to 219.6 billion yen.

In other regions (including Central and South America, Oceania, Africa and the Middle East), vehicle sales totaled 685,227 units, a decrease of 134,401 units, while operating income, excluding the impact of valuation gains/losses from interest rate swaps, decreased by 13.8 billion yen to 55.2 billion yen.

Financial services operating income decreased by 13.6 billion yen to 152.1 billion yen, including a gain of 14.0 billion yen in valuation gains/losses from interest rate swaps. Excluding valuation gains/losses, operating income decreased by 41.9 billion yen to 138.1 billion yen.

For the fiscal year ending March 31, 2017, TMC revised its consolidated vehicle sales forecast from 8.90 million units to 8.85 million units “in consideration of the latest sales trends worldwide.”

TMC also revised its consolidated financial forecasts for the fiscal year. Based on an exchange rate assumption of 103 yen to the U.S. dollar and 114 yen to the euro, TMC now forecasts consolidated net revenue of 26.0 trillion yen, operating income of 1.7 trillion yen, income before income taxes of 1.90 trillion yen and net income of 1.55 trillion yen.