Click for more.

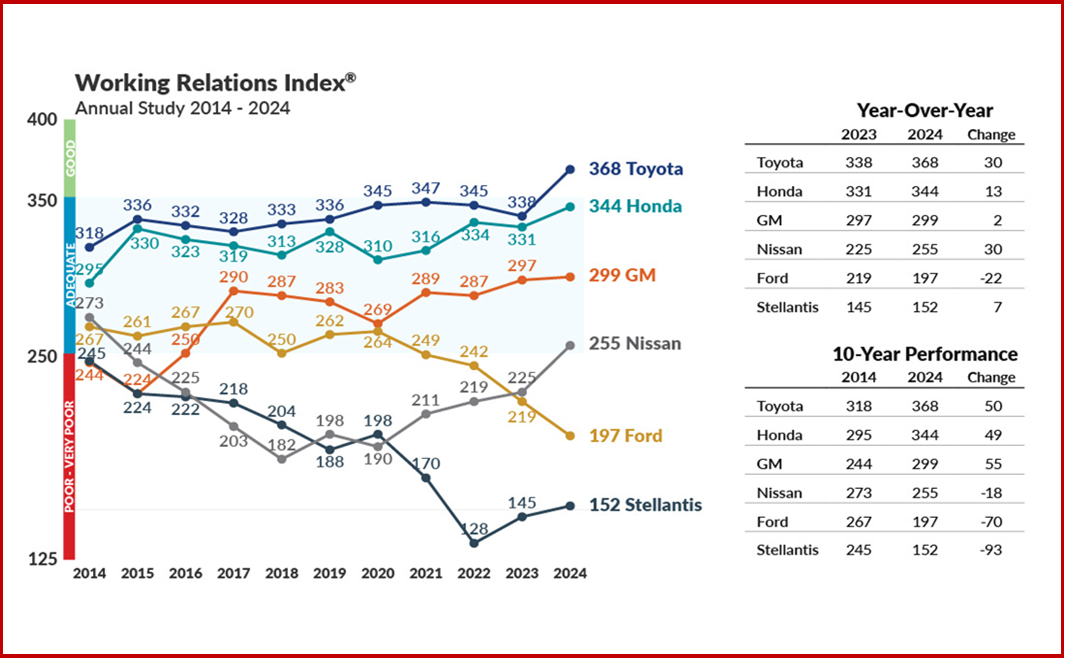

“With all the challenges and conflicts facing suppliers this past year, it’s not surprising that some automakers dropped even further in their scores. But what might be surprising to some is that several automakers improved their scores significantly during the past year. This shows that piece price economics alone is not what drives the automakers’ WRI score but that the score also reflects the tangible and intangible costs to serve the OEMs,” said Dave Andrea, principal in Plante Moran’s automotive and mobility strategy consulting practice.

The primary driver behind the largest WRI® point gains is sharing risk and cost in an equitable manner while relentlessly pursuing cost reduction,” says Andrea. “This will enhance the mutual long-term financial and innovative capability of the customer and the supplier. OEMs doing this best integrate the suppliers into their corporate strategy and keep WRI-related principles front and center in their dealings.”

WRI Study – Quick Takes

• Automakers need to revise outdated contract terms and conditions and purchasing practices built over decades for the new realities of the EV transition and beyond.

• There must be more flexibility. OEMs can’t simply say, “no material cost recovery” when suppliers are dealing with unused capacity due to delayed programs.

• Contract structures need to be updated to deal fairly with the risks inherent in transitioning into EVs, adopting new safety and infotainment technologies, sourcing scarce new materials, and increasing competition from China.

• In uncertain, high-risk times there needs to be more trust, transparency, and flexibility, not less. Fixed terms and conditions must be restructured to deal with new market conditions.

• Corporate leadership beyond purchasing – especially finance and engineering – need to cooperate in managing supplier cost and risk reduction requests.

• The best OEMs know fast responses, new cost recovery formulas, and the like are needed if they expect suppliers’ best efforts on their behalf.

• Suppliers have a choice as to who they work with and can make decisions to manage down business with specific OEMs.

• Annual price reduction “productivity” demands by OEMs must incorporate the cost of the total supplier relationship. Suppliers and OEMs must look for annual cost reductions through true productivity gains – getting more output with fewer input resources. This takes investment which comes from adequate returns on investment for suppliers.

• Faster, more flexible cost-reduction suggestions made by suppliers can be adopted by OEMs if design, engineering, and purchasing are working together. This would expedite revalidation of parts using lower-priced materials; reduce complexity; and lower parts count by part consolidation. Better cost estimating and target pricing by OEMs and suppliers would help correct this.