“We will respond to big or small issues as quickly as we can. And in doing that with the speed of responding, allows us to I think really minimize the impact as you get to a smaller population,” said Mary Barra, CEO.

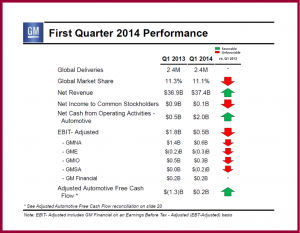

General Motors Co. (NYSE: GM) today announced Q1 net income of only $100 million, or $0.06 per diluted share. Earnings in every GM region were down. Simply put, GM’s Q1 was a disaster with its net loss from special items of $400 million, or -$0.23 per diluted share, and a whopping $1.3 billion pre-tax charge for the cost of recall-related repairs, or -$0.48 per diluted share. This is a negative swing of -$1.7 billion year-over-year. The stock closed today at just over $34 per share.

In the first quarter of 2013, GM’s net income attributable to common stockholders was $900 million, or $0.58 per diluted share, including a Q1 net loss from special items of $200 million or $(0.09) per diluted share.

GM Q1 earnings before interest and tax (EBIT) was $500 million and this included the impact of a $1.3 billion pre-tax charge for ignition switch and other recall-related costs on 7 million vehicles and $3 million in restructuring costs. This compares – negatively – to Q1 of 2013, when GM posted EBIT-adjusted earnings of $1.8 billion, which included a relatively minor pre-tax charge of $1 million for recalls and $1 million in restructuring costs.

Net revenue in Q1 of 2014 was $37.4 billion, compared to $36.9 billion in the first quarter of 2013. General Motors dealers sold 2,416,028 vehicles globally during Q1, an increase of 2% compared with a year ago. GM’s global market share was 11.1%, down two-tenths of a point from last year.

GM’s Q1 automotive cash flow from operating activities of $200 million and automotive free cash flow of $200 million improved compared with Q1 of 2013. GM ended the quarter automotive liquidity of $37.4 billion. Automotive cash and marketable securities was $27 billion compared with $27.9 billion at year-end 2013.

GM Operation Results

- GM North America reported EBIT-adjusted of $0.6 billion, which included the impact of a $1.3 billion pre-tax charge for recall costs in the quarter. This compared with EBIT-adjusted of $1.4 billion in the first quarter of 2013.

- GM Europe reported EBIT-adjusted of – $300 million, which includes

- $200 million for restructuring costs. This compares with EBIT-adjusted of $200 million in the first quarter of 2013.

- GM International Operations reported EBIT-adjusted of $300 million, compared with EBIT-adjusted of $5 million in the first quarter of 2013.

- GM South America reported EBIT-adjusted of $200 million, compared with EBIT-adjusted of $0.0 billion in the first quarter of 2013.

- GM Financial earnings before tax was $200 million for the quarter, compared with $200 million during the first quarter of 2013.