TMC now predicts 2014 FY net revenue of ¥25 trillion, operating income of ¥2.20 trillion, net income of ¥1.67 trillion, or $17 billion. Toyota’s all-time record income is ¥1.72 trillion, posted just before the 2008 financial and housing market collapses due to the reckless practices of Wall Street and the rating agencies.

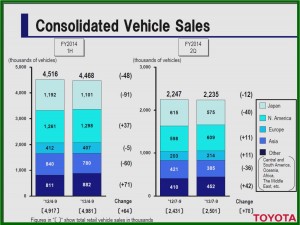

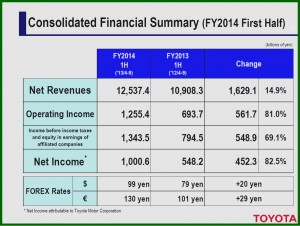

Toyota Motor Corporation today said it had net income of ¥1 trillion for the six-month period ending 30 September 2013. The huge increase from ¥548.2 billion in the same period the year earlier came with flat sales of 4,467,761vehicles, a decrease of 48,425. However, TMC, the largest automaker in Japan and the world, benefited enormously from the manipulation of the yen by the Japanese government to keep it artificially weak.

On a consolidated basis, net revenues totaled ¥12.53 trillion an increase of 14.9% compared to the same period last fiscal year. Operating income increased from ¥693.7 billion to ¥1.25 trillion, while income before income taxes was ¥1.34 trillion yen.

During Q2 of the Japanese fiscal year, TMC recorded earnings per share of ¥138.26 ($1.40) in a whopping 70% year-over-year rise. Again, favorable currency effects and cost-cutting measures helped the results. Consolidated net income surged 70% year over year to ¥438.4 billion ($4.4 billion).

“In addition to the impact of the weaker yen, operating income increased due to our efforts with our suppliers and distributors for profit improvement through cost reduction and marketing activities, such as enhancement of the model mix,” said TMC Executive Vice President Nobuyori Kodaira.

Toyota reaffirmed its guidance from last August that consolidated vehicles sales for the fiscal year ending 31 March 2014 will be 9.1 million units. TMC also now predicts consolidated net revenue of ¥25 trillion, operating income of ¥2.20 trillion and net income of ¥1.67 trillion, or $17 billion, based on an exchange rate of ¥97 to the U.S. dollar and ¥130 to the euro. Toyota’s all-time record income is ¥1.72 trillion, posted just before the 2008 financial and housing market collapses due to the reckless practices of Wall Street and the rating agencies.