Click for more information.

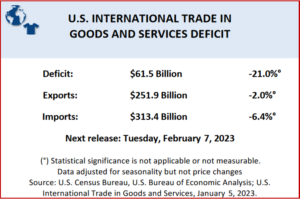

The goods and services deficit was $61.5 billion in November, down $16.3 billion from $77.8 billion in October (revised) the U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today.* However, it was because November exports were $251.9 billion, $5.1 billion less than October exports; but November imports were $313.4 billion, $21.5 billion less than October imports.

In short, the US economy stopped buying more imports at an amount greater than its exports increased. Whether this is good or bad depends on your economic ideology.

Click for more information.

The November decrease in the goods and services deficit reflected a decrease in the goods deficit of $15.3 billion to $84.1 billion and an increase in the services surplus of $1.0 billion to $22.5 billion. Year-to-date, the goods and services deficit increased $120.1 billion, or 15.7%, from the same period in 2021. Exports increased $439.4 billion or 18.9%. Imports increased $559.5 billion or 18.1%.

The average goods and services deficit decreased $1.4 billion to $71.2 billion for the three months ending in November:

- Average exports decreased $3.3 billion to $255.8 billion in November.

- Average imports increased $4.7 billion to $327.0 billion in November.

Year-over-year, the average goods and services deficit decreased $3.7 billion from the three months ending in November 2021.

The automotive business wasn’t booming in keeping with the trend. Consider Year-over-year:

- Crude oil decreased $1.7 billion.

- Automotive vehicles, parts, and engines decreased $3.3 billion.

- Passenger cars decreased $1.6 billion.

- Other automotive parts and accessories decreased $1.0 billion.

The November figures show surpluses, in billions of dollars, with South and Central America ($5.3), Netherlands ($2.4), Hong Kong ($1.6), United Kingdom ($1.2), Australia ($1.0), Singapore ($1.0), Brazil ($0.5), and Belgium ($0.1).

Deficits were recorded, in billions of dollars, with China ($20.4), European Union ($19.5), Mexico ($10.9), Vietnam ($8.5), Germany ($7.2), Ireland ($5.6), Japan ($5.6), Taiwan ($4.1), South Korea ($3.7), Canada ($3.5), Italy ($3.4), Malaysia ($3.1), India ($2.3), Switzerland ($1.3), Saudi Arabia ($0.9), Israel ($0.7), and France ($0.6).

- The deficit with China decreased $5.8 billion to $20.4 billion in November. Exports decreased $0.1 billion to $13.5 billion and imports decreased $5.8 billion to $33.9 billion.

- The deficit with the European Union decreased $3.6 billion to $19.5 billion in November. Exports decreased $0.3 billion to $28.5 billion and imports decreased $3.9 billion to $48.0 billion.

- The deficit with Switzerland increased $0.8 billion to $1.3 billion in November. Exports decreased $1.8 billion to $3.0 billion and imports decreased $1.0 billion to $4.2 billion.

*All statistics are seasonally adjusted; statistics are on a balance of payments basis unless otherwise specified.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Trade Deficit Drops $16 Billion in November 2022

Click for more information.

The goods and services deficit was $61.5 billion in November, down $16.3 billion from $77.8 billion in October (revised) the U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today.* However, it was because November exports were $251.9 billion, $5.1 billion less than October exports; but November imports were $313.4 billion, $21.5 billion less than October imports.

In short, the US economy stopped buying more imports at an amount greater than its exports increased. Whether this is good or bad depends on your economic ideology.

Click for more information.

The November decrease in the goods and services deficit reflected a decrease in the goods deficit of $15.3 billion to $84.1 billion and an increase in the services surplus of $1.0 billion to $22.5 billion. Year-to-date, the goods and services deficit increased $120.1 billion, or 15.7%, from the same period in 2021. Exports increased $439.4 billion or 18.9%. Imports increased $559.5 billion or 18.1%.

The average goods and services deficit decreased $1.4 billion to $71.2 billion for the three months ending in November:

Year-over-year, the average goods and services deficit decreased $3.7 billion from the three months ending in November 2021.

The automotive business wasn’t booming in keeping with the trend. Consider Year-over-year:

The November figures show surpluses, in billions of dollars, with South and Central America ($5.3), Netherlands ($2.4), Hong Kong ($1.6), United Kingdom ($1.2), Australia ($1.0), Singapore ($1.0), Brazil ($0.5), and Belgium ($0.1).

Deficits were recorded, in billions of dollars, with China ($20.4), European Union ($19.5), Mexico ($10.9), Vietnam ($8.5), Germany ($7.2), Ireland ($5.6), Japan ($5.6), Taiwan ($4.1), South Korea ($3.7), Canada ($3.5), Italy ($3.4), Malaysia ($3.1), India ($2.3), Switzerland ($1.3), Saudi Arabia ($0.9), Israel ($0.7), and France ($0.6).

*All statistics are seasonally adjusted; statistics are on a balance of payments basis unless otherwise specified.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.