Click for more.

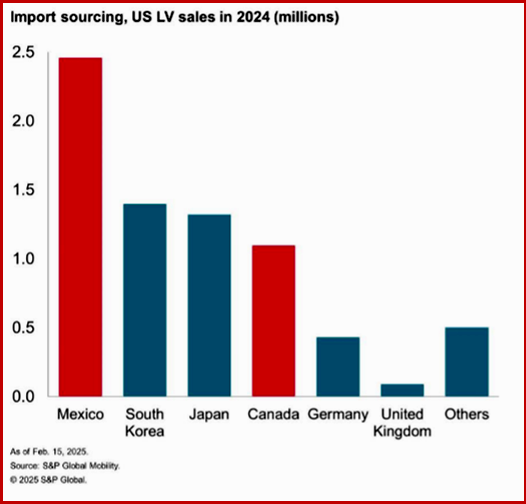

Shoot from the lip President Trump, aka Calamity Donald, today imposed tariffs of 25% across North America disrupting the North American auto market that has thrived on 30 years of free trade. Any new tariffs in place for any significant length of time will be disruptive. The tariffs at 25% are significantly higher than the profits made by the automakers and their suppliers. It is widely – if not universally – held by economists that this is an economic disaster. The tariffs are a sharp violation of the free trade deal with Canada, Mexico and the United States that Calamity Donald, renegotiated during his first administration. Using the dispute-settlement system to eliminate or adjust the tariffs could take years. Calamity Donald has already said he won’t act on any ruling against the United States. Roughly 44% of the new vehicles sold in the U.S. last year were imported from countries across North America, Europe and Asia. The automotive business involves a large and complex global supply chain, so new tariffs will challenge an industry that is already facing high costs. Higher costs mean fewer affordable vehicles for consumers. Higher costs result in lower sales volume in an industry that is central to U.S. economic health.

Stephanie Brinley at S&P Global Mobility said “The North American auto industry is super capital intensive with an extremely integrated supply chain. These are going to be hugely important for all. OEMs and suppliers will only invest capital and resources if there’s long term stability in this. It’s not clear we have that quite yet.”

Brinley Handicaps the Probability Scenarios

70% Probability: A Quick Resolution

Now that the 25% tariff scenario has been deployed, we see a 70% probability for a Quick Resolution. In that case, we would see the tariffs only in effect for 0-2 weeks. We will see some automaker production lost due to supply issues and border gridlock, and short-term OEM production halts. In this scenario, we expect that all lost sales and production is regained in short order.

S&P Global Mobility estimates that there are about 63,900 light vehicles per day across North America, with 41,700 units produced in the US, 17,6000 units in Mexico and 4,600 units in Canada. We estimate that production disruption caused by the tariffs could result in one-third of production being disrupted in the region within one week. This would equate to disruption of more than 20,000 units per day in short order.

20% Probability: Extended Disruption

However, we also see potential for an Extended Disruption if the tariffs are held in place for a six-to- eight-week duration. We see a 20% probability for this outcome. In this case, we will see several high exposure vehicles slow or cease production and for OEMs to conserve inventory and be careful to replenish with ‘tariffed’ stock. OEMs will look to protect profitability by replenishing slowly and keep incentives and discounts very low while aiming to keep pricing strong. We do see potential for product development delays during this period having a knock-on effect into future years. Slowed product development will mean that product launches in later years will be delayed, having impact in some years after this has passed. However, with a six-to-eight-week disruption, we expect most sales and production are compensated for within 12 months.

10% Scenario: Tariff Winter

The more dire scenario is a Tariff Winter. S&P Global Mobility currently puts this at a 10% probability. In this case, tariffs of 25% on Mexico and Canada are integrated long-term into the auto trade structures. This would create an environment of sub-optimal sourcing–vehicles and components produced in Mexico and Canada are currently in those locations because cost and efficiencies are optimal in this arrangement. Moving that production to the US to avoid the tariff also increases the cost of labor for manufacturing, has the potential to further exacerbate a general labor shortage, and could leave automakers with underutilized plants in Mexico or Canada. Though in a Tariff Winter we would expect to see re-sourcing, due to the sub-optimal sourcing increasing the cost of manufacturing, North American light-vehicle sales could decline by 10% for several years with a long-term decline in competitiveness. The decline is likely to be 10% in the US, 8% in Mexico and 15% in Canada. A key issue here is that OEMs and suppliers will only invest capital and resources if there is long-term stability in the trade and source planning environment; a Tariff Winter presumes some level of stability, even at higher costs. In the meantime, the uncertain trade situation may delay development of future vehicle programs. This is particularly true in light of additional emission and fuel economy regulation