Click for more.

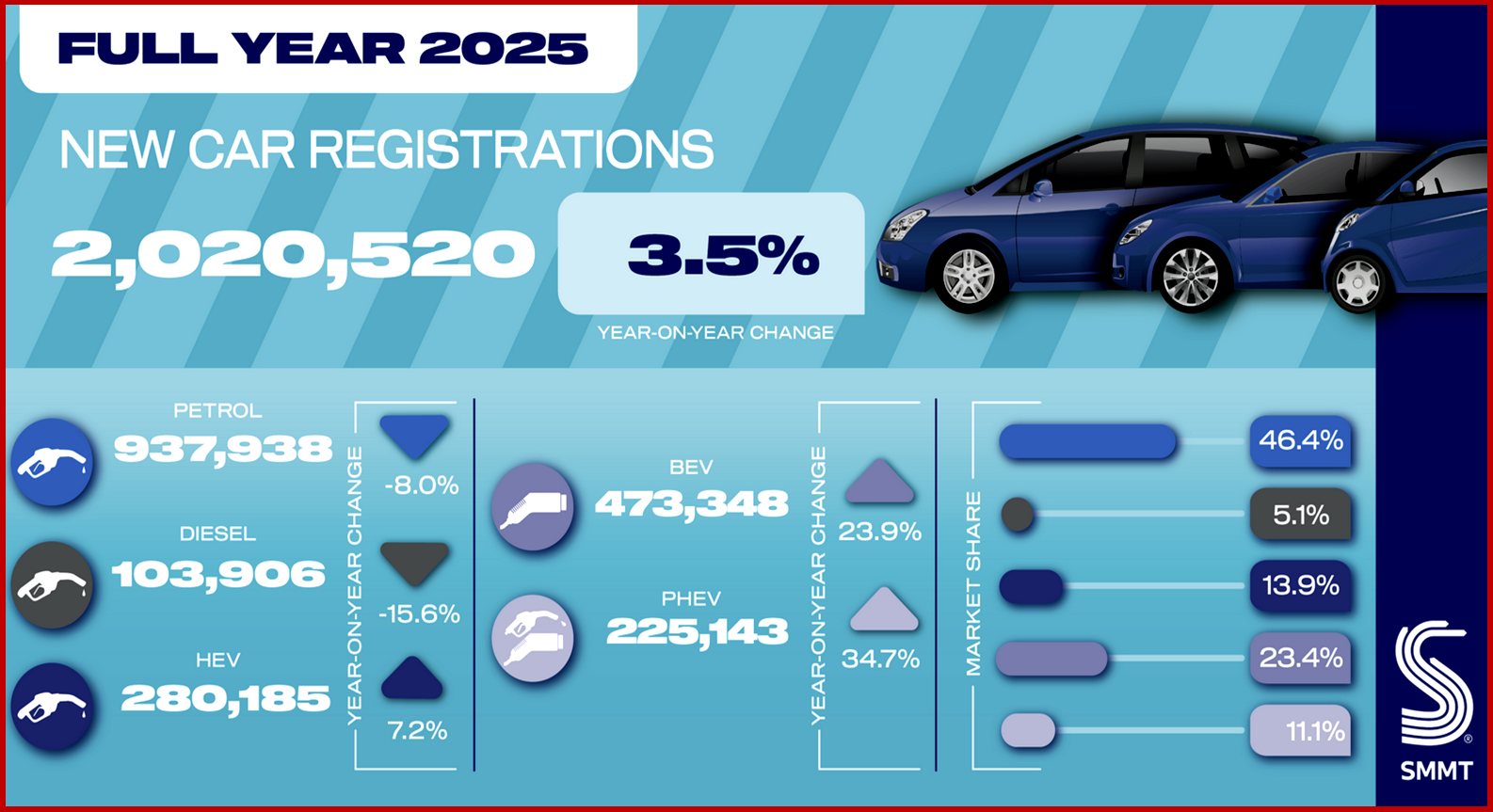

“Electrified vehicles narrowly missed becoming the majority of the market despite a surge during the last quarter. Hybrid electric vehicle (HEV) volumes rose by 7.2% to achieve a 13.9% market share, while plug-in hybrids were the fastest growing powertrain, with volumes increasing 34.7% to take 11.1% of registrations.

“Meanwhile, almost half a million (473,348) new BEVs were registered during 2025 – more than in the whole of 2021 and 2022 combined. This huge volume, which is likely to place the UK as the second biggest EV market in Europe by volume, saw BEV market share rise to reach 23.4% – a strong uplift, but with a mandate target of 28% the gap between demand and ambition is increasing rather than diminishing. (footnote 3)**

“Massive manufacturer investment now provides a choice of more than 160 BEV models – up from just over 130 at the start of 2025 – with at least 60 more due in 2026. However, EV uptake has risen by only 23.9%. The long-awaited return of a grant for EV purchase has helped, although only around a quarter of models are currently eligible for the incentive at any level. It is manufacturers, therefore, that continue to shoulder the burden of driving up demand, subsidizing their sale by more than £5 billion in 2025, equivalent to a massive £11,000 per BEV registered. (footnote 4)** Such subsidies are clearly unsustainable. Furthermore, the announcement of a new ‘eVED’ tax on EVs purchased from 2028 sends a confusing message to consumers, undermining rather than encouraging market confidence.

“The average new car CO2 has fallen by -10.1% from 2024 to 91.8 g/km, which will assist some manufacturers with mandate compliance, the UK’s zero emission sales target will next year require BEVs comprise one in three new car registrations. The UK already has the most ambitious transition trajectory of any major market and, with the EU’s proposal to revise its end of sale date from 2035, divergence between the UK and the much larger market on its own doorstep is broadening.

“Action is needed from government to ensure the British market remains attractive for investment, and one which supports consumers, the industry and the economy. The forthcoming review of the ZEV Mandate will be a crucial opportunity to ensure the transition supports the UK’s international competitiveness and prosperity, as well as its shared decarbonisation goals,” SMMT said.