Click for more data.

Global Data Observations

• With May 2022 having been such a low point for the industry, many manufacturers saw double-digit YoY percentage gains in May 2023.

• We estimate Tesla to have seen a 72.8% YoY increase, while Mazda’s sales were up by 117.2% YoY, and Honda Group enjoyed a 58.2% YoY uplift.

• In market share terms, GM accounted for 16.6% of May sales, down marginally from April’s result, but up by 0.3 pp YoY. Toyota Group’s share was down by 2.1 pp YoY, to 13.8%, but last year’s share was unusually high as its competitors struggled more intensely with inventory shortages.

• Compact Non-Premium SUV continued to be the bestselling segment in May, with an 18.5% market share, up by 2.1 pp, YoY, although this was down by 0.7 pp from April’s result.

• Midsize Non-Premium SUV once again came in second, on 16.4%, down by 1.0 pp YoY.

• Large Pickups, the third largest segment, had a similar share to recent months, on 13.8%, though this was down by almost 0.5 pp, YoY.

• For the third consecutive month, Cars likely outsold Pickups, although the difference was marginal. We estimate Cars to have come out ahead by only around 500 units.

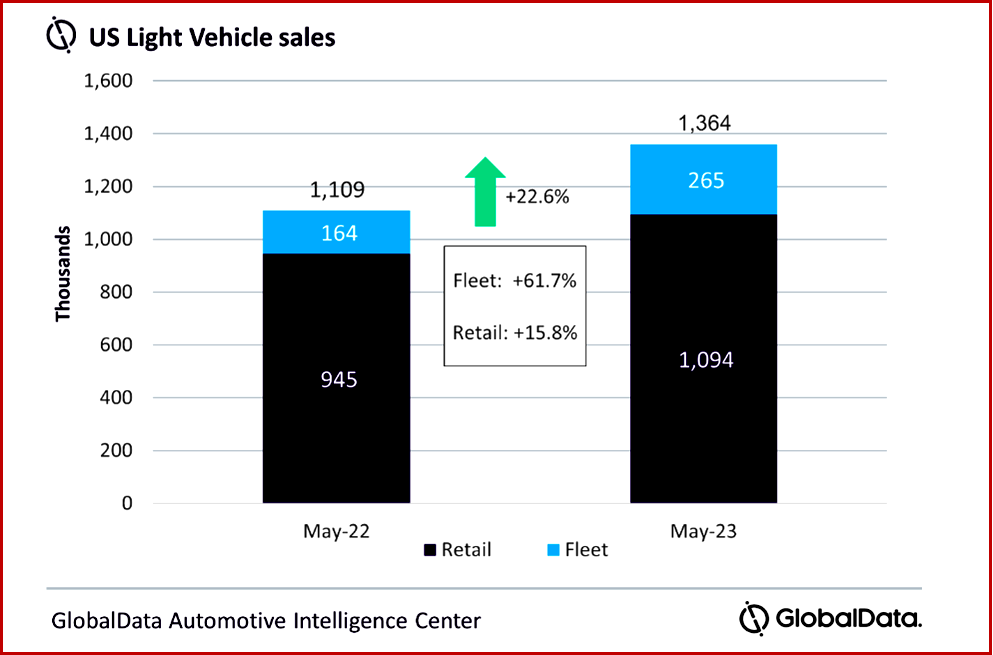

• With May continuing the robust level of US Light Vehicle sales, YTD sales in May are up 11% from the same period last year. The selling rate is averaging 15.4 million units through May 2023, up from 13.9 million through May 2022.

• While the stronger than expected performance in May could signal a marked increase in the outlook for 2023, we have decided to keep the forecast at 15.3 million units, though it has been increased by 50,000 units since last month. Uncertainty in the second half of the year given the recession risk is tempering our view for now.

• The forecast for 2024 remains at 16.0 million units.

• Light Vehicle inventory ended April at 1.8 million units, up 55% YoY. Days’ supply rose to 35 days, while the sales pace increased, a good overall sign for better inventory health. May is expected to fall slightly by 50,000 units of inventory, but on a YoY basis, overall volume should be up between 55-60%. Days’ supply is projected to be 32-34 for the month.

GlobalData – GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.”