Click to enlarge.

“2024 was a year of two halves,” said Jim Rowan, chief executive for Volvo Cars. “For the first six months, we recorded strong double-digit volume growth. But like the rest of the industry, we experienced a more challenging second half. Demand slowed down and this had an impact on both our sales pace and underlying profitability.”

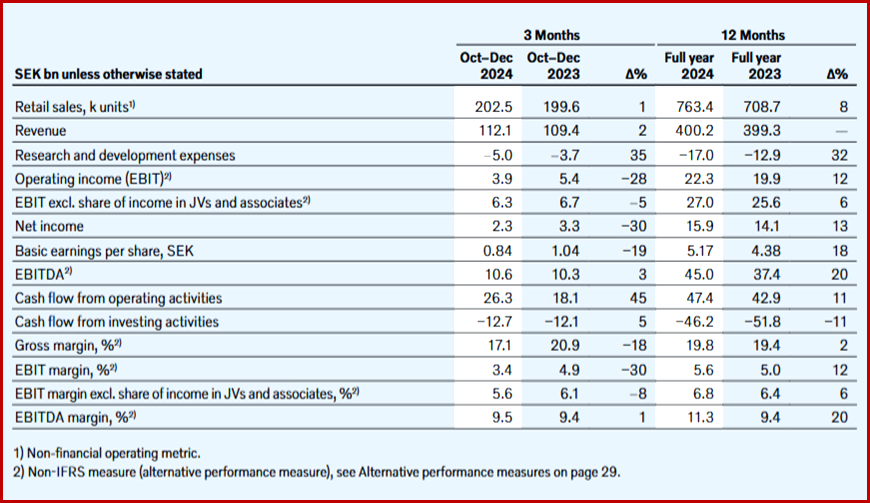

However, Group operating income in the fourth quarter was affected by a SEK 1.7 billion write-down related to assets in the NOVO joint venture, before the company took full financial control of NOVO from an accounting perspective.

“Gross margins for the fourth quarter came in at 17.1%, impacted by a one-time effect from the sale of on-balance sheet cars. This increased both revenue and cost of sales and lowered the Q4 gross margin. Volvo Cars also saw a considerably larger decrease in inventory during Q4 compared to the previous year, which further impacted gross margins. Margins were also affected by car line and sales channel mix as well as pricing pressure in the market, but this was partially offset by a more efficient cost structure for new car sales,” Volvo said.

“Naturally, the current turmoil in our industry is not only down to cyclical effects. As said, we are witnessing a fundamental rebalancing of the car industry and we stand on the precipice of profound change. This is the pivotal moment in time where the winners of next-generation mobility are defined. What we do in the next two years will shape us for the next two decades. Said Rowan.

*Volvo Cars is a subsidiary of Geely Holding, which owns ~ 78.7% of the company’s outstanding shares. Geely Holding, a Chinese multinational enterprise, bought Volvo from Ford Motor in 2010.