Click for more GlobalData.

“Recent headlines around the US auto industry have been focused on the UAW strike, but that impact will be delayed as the targeted OEMs continue to sell existing inventory. While one or two specific models are likely already seeing a negative effect on sales due to low days’ supply, on a wider scale the strikes may have spurred activity in September by nudging customers to make purchases before stocks run out. Still, sales were robust even among non-union OEMs, suggesting that longer-term trends around improved vehicle availability and a strong contribution from Premium brands – especially Tesla – also played a significant role,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData

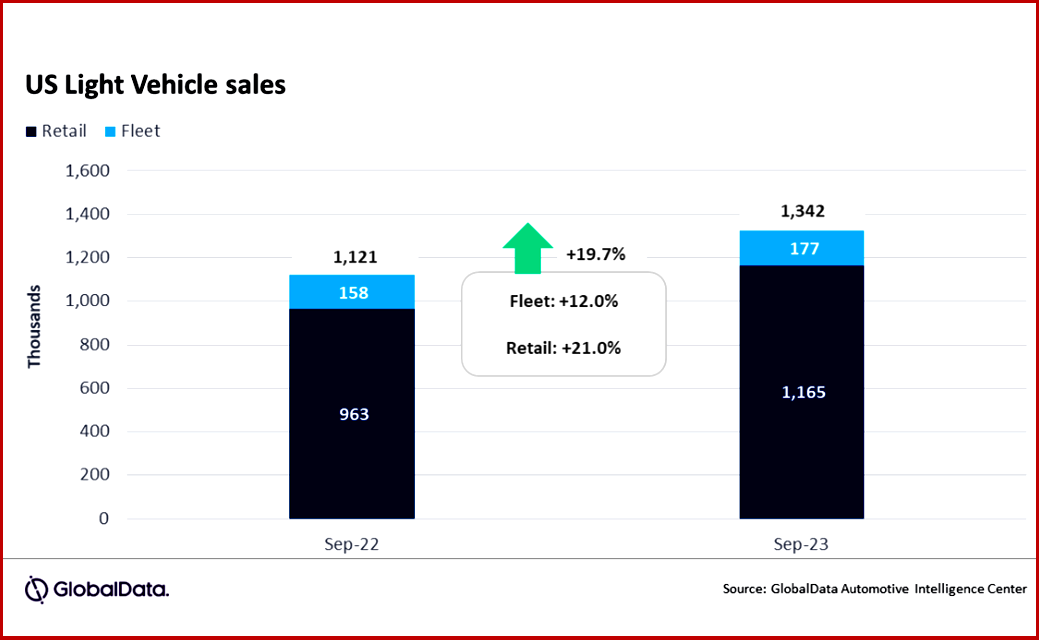

“The ongoing duration of the strike and the expected increased severity are likely to cut into inventory and demand as early as October. However, levels are holding thus far, given the limited number of affected plants. For September, vehicle days’ supply is projected to hold in the 37-39 day range, which is just below where it was in August. Volume is expected to be at 1.9 million units as October starts, Global Data said. “While there has been little impact to vehicle demand from the UAW strike, evident by September outperforming expectations, risks to the Detroit Three volume and topline increase as the strike continues. We are holding our forecast for 2023 at 15.3 mn units, despite the strong performance, given the high level of uncertainty. While 2024 could benefit from volume lost in 2023, we are currently holding the forecast at 16.0 million units as well.”

Global Data Analysis

GM was again the market leader with 225,000 units, a market share of 16.8%.

Toyota Group was the closest it has been to GM in terms of volume since October 2022, ~ 21,000 units behind. At 15.2%, Toyota Group’s market share was its highest in 11 months.

Ford Group was the third best-selling OEM in September with a modest market share of 11.9%.

Tesla Model Y is estimated to have led the market in September for the first time ever, with sales of 39,500 units, ahead of the Toyota RAV4 on 38,100 units.

The Ford F-150, normally the market-leading model, dropped to third place with sales of just under 37,000 units, with its lowest market share in 12 months.

Compact Non-Premium SUV set a new record high market share in September at 20.5%, beating the previous best that was set in July.

Midsize Non-Premium SUV was second at 15.7%.

Large Pickup was third at 13.0%.