Global HEV and BEV sales in 2010 are forecast at 954,500 vehicles, or 2.2% of the 44.7 million vehicle sales projected through the end of 2010.

Data continue to show that widely publicized green machines, notably hybrid and electric vehicles or EVs are losing popularity among potential buyers. The latest evidence of a hybrid sales slump comes from CNW Research in a report that suggests consumers are increasingly less willing to spend additional money for a hybrid than a conventional gasoline car or truck of the same size and use.

In its latest monthly survey, only 20% of new-car intenders said they would consider a hybrid. Worse, CNW claims that consumers are now willing to spend only $416 for a hybrid version over a non-hybrid model.

Honda recently cut the 2011 Insight hybrid price by offering a less expensive base model that starts at $18,950. It’s the latest attempt by Honda to counter Toyota’s formidable success with its Prius hybrid, which at more than 115,000 sales year-to-date far outsells Honda Insight at almost 18,000.

Toyota countered with 2.9% financing on its Prius hybrid- o% for some buyers, and what it terms “aggressive” leasing deals to counter a significant decline in Prius sales from their peak of more than 180,000 in 2007.

Both moves appear to be a tacit recognition that the number of fuel-efficient models from all automakers is growing, perhaps beyond natural demand. The days of price premiums for hybrids that Toyota has long enjoyed appear to be over.

CNW also reports that Toyota and Ford are increasingly resorting to commercial and fleet sales for hybrid vehicles. Personal use of a Toyota Prius has declined to under 55% while the Ford Escape is down below 65%.

The sales picture is also tricky and controversial for electric vehicles. Four years ago about 33% of men and 20% of women said they would add an electric vehicle to the family fleet rather than replace a current model. This year only a quarter of men and fewer than 13% of women say they will add an electric vehicle.

Weighing in on the demand debate is a report issued by J.D. Power and Associates. The consultancy claims that combined global sales of hybrid electric vehicles (HEVs) and battery electric vehicles (BEVs) are expected to total 5.2 million units in 2020, or just 7.3% of the 70.9 million passenger vehicles forecast to be sold that year.

Global HEV and BEV sales in 2010 are forecast to total 954,500 vehicles, or 2.2% of the 44.7 million vehicles projected to be sold through the end of 2010.

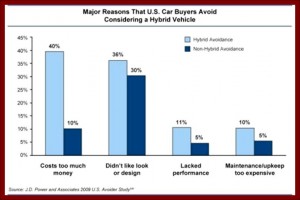

According to the Power report, it will be difficult to convince large numbers of consumers to switch from conventionally powered passenger vehicles to HEVs and BEVs. A consumer migration to alternative powertrain technologies will most likely require either one of the following scenarios, or some combination of these scenarios:

- A significant increase in the global price of petroleum-based fuels by 2020

- A substantial breakthrough in green technologies that would reduce costs and improve consumer confidence

- A coordinated government policy to encourage consumers to purchase these vehicles.

Power does not think these scenarios are likely during the next decade.

“While considerable interest exists among governments, media and environmentalists in promoting HEVs and BEVs, consumers will ultimately decide whether these vehicles are commercially successful or not,” said John Humphrey, senior vice president of automotive operations at J.D. Power and Associates.

“Based on our research of consumer attitudes toward these technologies—and barring significant changes to public policy, including tax incentives and higher fuel economy standards—we don’t anticipate a mass migration to green vehicles in the coming decade,” Humphrey concluded.

Pingback: CAR Says Electric Vehicles Will Follow the Incentives at the Federal, State and Local Levels. Budget Battles Loom? - AutoInformed