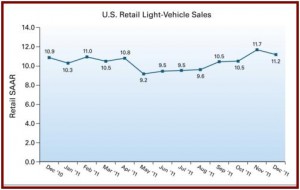

A slow and fragile U.S. auto sales recovery continues amid questions if it can be maintained in 2012.

New vehicle sales in December are predicted to be above one million units retail, the first time this has happened in the U.S. since August of 2009 when lavish taxpayer subsidies were in effect under the ‘Cash for Clunkers’ program.

While new vehicle sales will be relatively strong, if true, the auto sales volume means a seasonally adjusted annualized rate or SAAR of 11.2 million units – not near the 15-17 million rates of the middle of the last decade, which is the current rate Europe, even with its Eurozone economic crisis.

Total light-vehicle sales in December are expected to come in at 1,230,100 units, which is 8% higher than in December 2010. Fleet sales are expected to increase by 1% compared with December 2010. Fleet sales are forecasted to account for 16% of total sales, which is slightly lower than the 17% recorded one year ago, according to J.D. Power and Associates, which tracks transactions through authorized dealers on a real time basis.

“Retail light-vehicle sales in December are performing well month-to-date, even as total incentive spending averages $2,700, down 10% from December 2010,” said John Humphrey, senior vice president of global automotive operations at Power and Associates.

As a result, LMC Automotive – the owner of Power, is holding to a 2011 forecast at 10.3 million units for retail light-vehicle sales and 12.7 million units for total light-vehicle sales.

LMC Automotive’s forecast for 2012 remains at 13.8 million units for total light-vehicle sales, but has been adjusted slightly upward to 11.3 million units (from 11.2 million units) for retail light-vehicle sales.

Power says North American light-vehicle production has increased more than 9% through November 2011 from the same period in 2010. More than 1 million additional units have been built year-to-date in 2011.

Recovery efforts are nearly complete for Honda and Toyota after the earthquake and tsunami in Japan and flooding in Thailand hindered a normal production schedules. To date, production for Honda and Toyota is down by almost 16%. Japanese manufacturers, collectively, are down 7% from 2010. Hyundai Group production is up 47% with its continued North American production localization efforts. The Detroit Three automakers are experiencing a nearly 15% increase in year-to-date production, while European OEMs are up 37%.

2011 North American production remains on track at nearly 13.0 million units, an increase of almost 10% from 2010. For 2012, production volume is expected to top 13.8 million units in North America, an increase of nearly 7% compared with 2011.