General Motors Company (NYSE: GM) today announced first quarter net income attributable to common stockholders of $1.0 billion, or $0.60 per fully diluted share. Net revenue in the first quarter of 2012 was $37.8 billion, an increase of $1.6 billion compared with the first quarter of 2011. Sales and margins increased, but operating income as a percentage of revenue was a meager 2.6%.

The world’s largest automaker continues to perform far below the levels of profitability posted by its major international competitors. GM earnings before interest and tax (EBIT) were $2.2 billion or less than a 6% return. This was an increase of $200 million in earnings compared with the first quarter of 2011.

The GM results were a significant drop from Q1 of 2011 when GM’s net income for common stockholders was $3.2 billion, or $1.77 per fully diluted share, including a net gain from special items of $1.5 billion or $0.82 per share. GM 2012 Q1 results include a net loss from special items related to goodwill impairment in Europe and International Operations that reduced net income by $600 million, or $0.33 per fully diluted share. When you add back in the $0.33 share of special charges to the $0.60 of net income you get $0.93, which is above the First Call consensus of $0.85/share. Stated or spun that way, the $0.93 per share compares with $0.95/share a year go.

GM stock has been trading $22-$23 range, well down from the $33 price of GM’s 2010 initial public offering in November of 2010, to say nothing of what is happening to small investors who subsequently bid GM stock – which pays no dividend – up to $39 a share before reality took hold.

GMNA’s results for the second and third quarters of 2012 are expected to be comparable to the first quarter of 2012 due to the scheduled downtime at factories that produce full-size trucks.

While the U.S. Treasury Department sold 28% percent of GM in the IPO, Treasury still holds 32% of the common stock, acquired as part of the Obama Administration’s $50 billion taxpayer-funded bailout. Common sense would now say taxpayers should hold the stock in the hope that, eventually, GM’s financial performance and its stock price will improve as the economy slowly recovers.

CEO Dan Akerson spent considerable time during the earnings press conference talking about cost reduction plans that will in theory improve GM results in the future, including a global alliance with PSA Peugeot, and a single global advertising agency for Chevrolet. Akerson sounded defensive, leading me to wonder if the Board of Directors and the U.S. Treasury, which picked the Board, are happy with the progress.

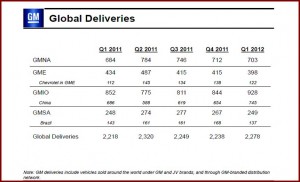

As usual, North America provided the profits. GMNA reported EBIT-adjusted earnings of $1.7 billion, including restructuring costs of $0.1 billion, an improvement of $400 million compared with the first quarter of 2011.

As usual, GM Europe lost money as it has been doing for more than a decade. GME reported an EBIT-adjusted loss of $0.3 billion compared with break-even results in the first quarter of 2011. “Europe remains a work in progress,” said Dan Akerson, chairman and CEO. The European auto market is headed for its fifth straight year of sales declines, and strong labor unions at Opel and Vauxhall are blocking GM’s attempt to restructure.

For the quarter, automotive cash flow from operating activities was $2.3 billion and automotive free cash flow was $300 million. GM ended the quarter with total automotive liquidity of $37.3 billion. Automotive cash and marketable securities were $31.5 billion compared with $31.6 billion at the end of the fourth quarter of 2011.

GM now expects that full-year 2012 U.S. light vehicle sales will be in the 14.0 million – 14.5 million range. Previously, the company expected sales to be between 13.5 million – 14.0 million units.

“We are aggressively eliminating complexity to reduce our costs, and at that same time, we are preparing for more than 20 major vehicle launches around the world in 2012 to drive revenue this year and farther into the future,” said Dan Ammann, senior vice president and CFO.

In a phone call with journalists, Ammann said he was comfortable with GM’s pricing ladder, and that recent decline of sales of the Buick Regal and Chevrolet Cruze as less entries were launched at the brands was not an internal problem. The more expensive mid-size Regal was off -37% at 2,850 in April, as the compact and less expensive Verona sold 3,000 sedans. Chevrolet Cruze dropped to 28% year-over-year to 18,250 vehicles – down about 7,000 vehicles as the new Sonic sold 6,400. Amman said such cannibalization wasn’t part of the plan, which is producing higher grosses at GM; and that those sales declines were the result of competitive actions

There were other charges, including $200 million for pensions. Here’s the breakout:

• GM North America (GMNA) reported EBIT-adjusted of $1.7 billion, including restructuring costs of $0.1 billion, an improvement of $0.4 billion compared with the first quarter of 2011.

• GM Europe (GME) reported an EBIT-adjusted loss of $0.3 billion compared with break-even results in the first quarter of 2011.

• GM International Operations (GMIO) reported EBIT-adjusted of $0.5 billion compared with $0.6 billion in the first quarter of 2011.

• GM South America’s (GMSA) EBIT-adjusted of $0.1 billion was flat compared with the first quarter of 2011.

• GM Financial earnings before tax was $0.2 billion for the quarter, a $0.1 billion increase from the prior year.

If N America made 1.7B, Europe lost 300M and the company overall earned 1B, does that mean that all other markets combined lost another 400M? That would be a real setback, given that China has been a profit horse for several years. Or maybe I just missed a set of sums…?

Good, deep analysis of GM’s financial problems and successes. For the first quarter of this year (I don’t have April’s results at hand) Cadillac was the biggest loser in the sales lineup with a minus 24%, while Buick came in as Number 3 in the Loser lineup with a minus 17%. Nobody talks about this.

And, look at the competition. Toyota has recovered, Honda is coming back and – surprise! – here’s Nissan coming with a new Altima. You have to be good to compete in that arena. Yes, I know they don’t sell in the Cadillac/Buick ranges, but even Chevy has a tough time competing with those folks. Silverado ‘way behind the F-150? And look out for Hyundai, though I think they are reaching their peak.

So, GM has its work cut out. Get Cadillac and Buick rolling. I get the feeling that GM is still in the “ride it out” mode that was common in the day. Remember those “29” pins that promised to hold to 29% of the market a few years back? Yikes.