In May 2012, there were 287 models in China’s auto market competing for attention, while only 2.6 models, on average, are in the consideration set of new-vehicle intenders.

The percentage of customers in China who intend to purchase a new European vehicle has increased significantly to 35% in 2012 from 25% in 2009, claims a new study just released.

In contrast, the so-called consideration rate of Japanese models has decreased to 24% in 2012 from 32% in 2009.

Safety and quality are the top criteria among new-vehicle ‘intenders’ in China. More than three in five (66%) premium segment intenders and 72% of non-premium segment intenders consider a model because of its reputation for quality and safety. Quality of workmanship and durability and low failure rate, which relate to quality and safety, are top consideration reasons.

The data come from the J.D. Power Asia Pacific 2012 China New-Vehicle Intender Study (NVIS) released in Shanghai today.

The study, now in its fourth year, looks at pre-purchase perceptions and considerations among consumers in China who intend to purchase a new vehicle within the next 12 months. The study examines brand awareness, purchase consideration, rejection reasons and media usage, as well as consumer perceptions of various models among these new-vehicle intenders. A total of 52 vehicle brands and 171 models in 11 vehicle segments are included in the 2012 study.

The consideration rates of European models, led by German brands, have increased the most among new-vehicle intenders in China. German models have the highest consideration rates in seven of the 11 segments. German models are more popular, particularly in Tier 1 cities in China, compared with models of other European brands, a 32%consideration rate among new-vehicle intenders.

The Power study finds a high correlation between brand consideration rates and actual sales. In the first five months of 2012, sales of German models in China have increased by 221,000 units, representing a 22 percent year-on-year increase, according to LMC Automotive, owner of the research company.

Volkswagen models have the highest consideration rates in the entry mid, mid, upper premium mid and SUV segments, while Audi models are most often considered in the entry luxury, luxury and luxury SUV segments.

Roewe 550 and FAW Oley B30, both domestic brands in China, have the highest consideration rates in the lower premium mid segment and premium compact segment, respectively.

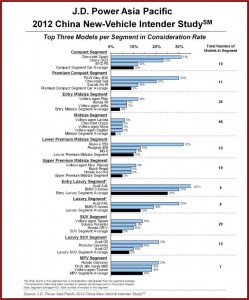

Models with the highest levels of consideration in each vehicle segment are:

- Compact: Chevrolet Spark

- Premium compact: FAW Oley B30

- Entry mid: Volkswagen Polo

- Mid: Volkswagen Lavida

- Lower premium mid: Roewe 550

- Upper premium mid: Volkswagen New Passat

- Entry luxury: Audi A4L

- Luxury: Audi A6L

- SUV: Volkswagen Tiguan

- Luxury SUV: Audi Q5

- MPV: Honda Odyssey

In May 2012, there were 287 models in China’s auto market competing for attention, while only 2.6 models, on average, are in the consideration set of new-vehicle intenders. The probability of a model being included in an intender’s consideration set is approximately 0.9% of all the models existing in the market.

The study also finds that the Internet and TV are the most effective channels for connecting with and influencing new-vehicle purchase intenders. In particular, the Internet remains the most influential communication channel. More than two-thirds (69%) of new-vehicle intenders obtain brand information from the Internet, while 58% gain information through TV commercials.