The Boards of Directors of Ford Motor (NYSE: F) and General Motors Company (NYSE: GM) have declared quarterly stock dividends, as the U.S. auto industry continues its slow financial recovery because of increasing auto sales.

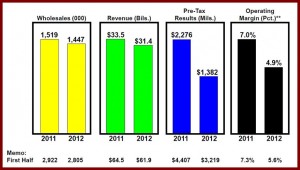

Ford Motor will be profitable for 2012, but results will decline from 2011 even as the North U.S. auto market recovers with annual sales of more than 14 million units.

With new vehicle sales on pace in 2012 to total more than 14 million – the highest since pre-Great Recession 2007- Ford Motor will pay a fourth-quarter dividend of $0.05 per share on the company’s outstanding Class B held by the Ford family – about 60 members – as well as common stock, which is languishing. The Ford dividend, payable on 3 December 2012, is for the same amount that was paid in each of the first three quarters of 2012, the first time a dividend was paid at Ford since December of 2006. More than 3.8 billion Ford shares are now outstanding because the Number Two U.S. automaker issued more shares of common during the Great Recession diluting common shares by at least 11%.

The move comes as Ford shares are trading just above $10 a share, down from a 52 week high of $13.05. On an annualized basis, this represents a return of 2%, which makes Ford look like a relative bargain in a market awash in Federal Reserve printed dollars and, as a result, record low interest rates for speculators and borrowers (See Ford Motor Q2 Profit Plummets $1.4 Billion as Europe, South American and Asia Continue to Hurt Earnings and Shareholders and Ford Family and Other Shareholders to Receive Dividends)

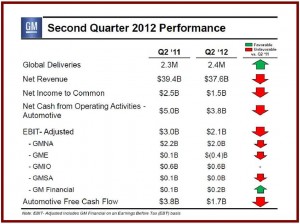

Most of GM’s proposed business plan goals in Q2 were unfavorable compared to a year ago, raising doubts about whether the reorganized company is really reformed.

General Motors will also pay a quarterly dividend of $0.59375 per share on 3 December on its Series B mandatory convertible junior preferred stock that is held by the U.S. Treasury, which still owns 32% of the reorganized automaker. The total amount of the dividend is $59.4 million. GM shareholders of common stock have received no dividend since GM returned to public trading in 2010 after a taxpayer-funded bankruptcy reorganization that saved millions of jobs across the entire U.S. auto industry and its associated suppliers.

GM’s 2012 Q2 income was $1.5 billion, or $0.90 per share of common on revenue $37.6 billion. The disappointing results compared to Q2 2011 where GM’s net income attributable to common stockholders was $2.5 billion, or $1.54 per fully diluted share. GM said the decrease was due almost entirely to the strengthening of the U.S. dollar versus other major currencies. Earnings before interest and tax (EBIT) adjusted was $2.1 billion, compared with $3.0 billion in the second quarter of 2011. (See GM Q2 Profits Drop to $1.5 Billion from $2.5 Billion as Its European Losses Grow. Revenue and Cash on Hand also Decreased and GM Europe President, Opel Head Karl Stracke Ousted over Losses and GM Posts Record $9.1 Billion Profit in 2011 – $7.6 Billion on Common )

GM common stock is selling for about $24, well down from the $33 price of GM’s 2010 initial public offering in November of 2010. Small investors subsequently bid up GM to $39 a share before reality of the company’s ongoing challenges took hold. In order for taxpayers to recoup their investment, GM stock would have to trade above $50 a share in a market strong enough for the government to sell its large stake.