It’s the same old North American song, as Ford Motor struggles with its global operations, especially Europe. If double-digit North American margins can be achieved elsewhere, FMC will be printing money, mucho money.

Ford Motor Company said today that Q3 profits were $1.6 billion based on revenues of $32.1 billion. Q3 pre-tax profit was $2.2 billion, or 40 cents per share, an increase of $200 million from Q3 2011. Ford Credit reported a pre-tax profit of $393 million, a decrease of $188 million from Q3 2011.

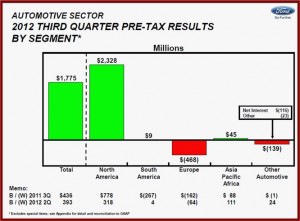

The slightly positive results, as they have for years, came almost entirely from North America, which achieved its highest quarterly profit, pre-tax $2.3 billion and operating margin 12%, since 2000 when the Ford Motor started reporting the region as a separate business unit. Europe continued to hurt earnings. (October U.S. Sales Forecast Sunny at more than 12 million SAAR)

FMC Q3 net income, including favorable special items of $83 million, was $1.6 billion, or 41 cents per share, about the same as third quarter 2011. Revenue and volume were down compared to Q3 2011 though.

The $200 million profit improvement compared with Q3 of 2011 came from higher net pricing and lower contribution costs, and mainly favorable commodity hedging effects. Ford North America’s pre-tax profit through the first nine months of 2012 exceeded its 2011 full-year profit.

In Europe, Ford said once again that because of “the deteriorating environment,” as well as elements of its latest recovery plan, the company now expects Ford Europe’s pre-tax loss for full year 2012 to exceed $1.5 billion. The decline is the result of lower volumes, including lower industry, lower share and unfavorable dealer stock changes. Ford said lower costs and favorable exchange will be partial offsets.

Ford maintains that the European business environment changes are “structural, rather than cyclical,” in nature. Ford last week announced a series of actions to accelerate its European transformation and restore its European operations to profitability by mid-decade, targeting a long-term operating margin for Ford Europe of 6% to 8%, which would be an almost unbelievable turnaround after decades of losses and failed recovery plans. (Ford to Shut Genk as part of latest European Turnaround Plan)

Automotive operating-related cash flow was $700 million, the 10th consecutive quarter of positive performance. Ford finished the third quarter with Automotive gross cash of $24.1 billion, exceeding debt by $9.9 billion. This is a net cash improvement of $1.8 billion compared to a year ago, and an increase of $400 million from the second quarter. Automotive debt of $14.2 billion at the end of the third quarter was unchanged from the end of the second quarter. Ford completed its last drawdown of $5 billion of U.S. taxpayer subsidized low-cost loans for advanced technologies in August, and began repayment in September.