While it’s the job of historians to accurately weigh and assess current events years after the fact as more documents, memoirs, special pleadings and perspective are available, journalists have no such option. Here is AutoInformed on the Top Ten Auto Stories of 2012 presented with our wry awareness that columnists conduct their education in public as we most certainly did last year and will continue to do so in 2013:

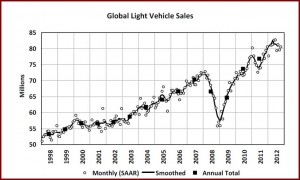

A return to pre-Great Recession sales trends is occurring in most markets with a couple of exceptions.

The most significant story of 2012 is (1) the return of global auto sales to pre-2007 rates (Global Light Vehicle Sales in October at 80.6 Million) just before the reckless, unregulated and illegal practices of Wall Street sent the global economy into a graveyard spiral that resulted in worst economic downturn since the Great Depression. While it’s not clear that the ruling money class has learned anything from their criminal abuses that caused the crisis, or that the resulting Dodd-Frank reform bill lobbyists are currently picking apart will prevent another meltdown of even worse consequences, good old pent-up demand has spurred a sales revival as vehicles continue to age and wear out. On a seasonally adjusted annual basis or SAAR, 2012 Global Vehicle Sales are tracking at a rate of 80.6 million units a year.

This means that the trend line of growing global sales now looks to be restored to its pre-crash slope, before the collapse of the financial and real estate markets created a Grand Canyon-sized dip in the trend line (pictured above) from more than 70 million units in 2007 to a trough of ~55 million in 2008 and 2009.

China, remains by far the largest auto market, and is now tracking at 19.1 million units annually. The Number Two Global market, the U.S., is continuing its modest recovery with sales 12.2 million or more retail units likely. Total sales will be in the range of 14.5 million. (December U.S. Auto Sales Forecast to Close the Best Year Since 2007)

While this remains still well below the annual rates of 16 to 17 million cars and light trucks during the pre-2008 years of the last decade, December’s SAAR was 500,000 vehicles higher than predicted for the 2012 full-year pace. Buyers are apparently ignoring the dire media predictions and the political posturing from that tawdry cast of cliff dwelling and big-money-bought politicians inhabiting the banks of the Potomac river. The ruling class is living in a taxpayer-subsidized socialist paradise, but not the people who drive a vehicle to work and pay 30% or more on their 1099 from earnings while hedge funds and capitalists pay 15%, if they pay taxes at all.

Along with rising sales come two related stories: Our number (2) is the return of solid profitability of the Detroit Three, or Detroit Two depending how you view Chrysler Group, now controlled by Fiat. GM and Ford posted record profits in 2011, and will do so again in 2012 when the final numbers are tallied late in January, even though Europe is hurting both. (see GM Posts Record $9.1 Billion Profit in 2011 and Ford Motor Company Posts 2011 Profit of $8.8 Billion and GM is World’s Largest Automaker Led by Chevrolet Sales)

Fiat, despite the Eurozone crisis, will also have a good year because of the ongoing strong sales revival at Chrysler Group and the profitability of growing Jeep and Ram truck sales. (Fiat Group Doubles Q3 Profit to €286 Million. Revenue €951 Million and Chrysler Group Posts Q3 Profit of $381 Million) Europe, no matter how you count it, remains troublesome for the Detroit Three – EU Car Sales Continue to Evaporate – and remains a grave threat to wealth creation.

The bailouts as controversial as they were worked at least to some degree and re-elected President Obama.

The fact is the bailouts, as controversial and ill thought out as they were, worked at least to some degree as demonstrated in these 2012 headlines – U.S. Treasury Sells Final Shares of AIG Common Stock. Taxpayers Earn $22.7 Billion! More Profits to Come from the Bailout or Ally Financial Pays Off Last $4.5 Billion of Debt Issued Under TLGP, among others. Republican party opposition to saving the economy at the time the U.S. financial system collapsed under President Bush and continuing during the 2012 Presidential campaign – compounded by Mitt Romney’s Big Lie in Ohio that the auto bailout was moving jobs offshore (among other weak or demonstrably false Republican assertions made all year such as the EPA should be abolished or it’s God’s will that our wives and daughters be raped) cost them the election by six million votes. Hence, story (3) the auto bailouts, aka – Bin Laden is Dead, General Motors is alive. No wonder President Obama was re-elected in spite of a jobless recovery. Look at U.S. Treasury to Sell GM Stock at a Loss During the Next 15 Months and UAW to Demonstrate During Romney Speech at Ford Field and General Motors Posts Q3 Profit of $1.5 Billion. Ideologues Out in Full Force for Halloween and the Election. This means the beginning of the end of the Government Motors slur, as well as the phasing out of Treasury restrictions on GM management. Bye, bye Treasury dictated Board of Directors.

Nonetheless, it appears that Treasury is making a bad sell decision here based on ideology, not good old American pragmatism. Consider that it was ideologues who opposed the successful TARP bailouts. (It was also ideologues that opposed proven industry fee-based regulation and supported the disastrous repeal of Glass-Steagall, aka the Banking act of 1933, thank you FDR.) Now the U.S. Treasury – the government agency that is supposed to understand money and stock markets, and heaven forbid actually regulate them – is also taking an impractical position based on ideology. Since the end of September, taxpayers earned more than $1.5 billion from the increase in value of GM stock, and GM continues to pay high interest rates on the 300.1 million shares of its stock Treasury still holds. The U.S. auto industry is recovering, and sales and profits are increasing in what remains a leveraged business – in both directions. Record profits and rising stock prices are on the way. Why dump and run now? No surprise here at AutoInformed that most working Americans are disgusted with government’s management of their money.

In a “must read” on this whole distasteful TARP matter, an important book was published in 2012 by a person who appears to be the last Republican standing who is not bought and sold by the rich, and thinks for herself instead doing the biding (or is it Baining?) of plutocrats who are working to put the middle class into minimum wage slavery. Read Bull by the Horns: Fighting to Save Main Street from Wall Street and Wall Street from Itself by Sheila Bair. While the former FDIC commissioner from 2006-2011 under Presidents Bush and Obama might have been running for a position in an expected Romney cabinet when she published back in April, (or Obama’s, this is cut-throat Washington after all) here is Harry Truman like plain talk from a tough woman banker who comes from the state of Kansas, adjoining Truman’s Missouri. Seems to us that we need more of this Prairie Populism in Washington right now. Well, at least she has been spared the shame of serving with the current dysfunctional Republicans who can’t even say what it is they want from economic policy other than a free ride for Wall Street and the rich, and whose House “leadership” can’t deliver their own caucus in fiscal cliff negotiations. Bair remains in our view an ideal candidate for President Obama to move forward with change we can all believe in, as ideologue Treasury Secretary Tim Geithner – a proponent of Wall Street Socialism for the rich – returns to what no doubt will be a lucrative multimillion dollar position in New York.

It’s not likely that the Toyota Unintended Acceleration fiasco is over since there are there are still hundreds of wrongful death and personal injury lawsuits pending.

Our next top pick (4) Toyota Settles Lawsuits for $1.1 Billion and Will Modify Millions of Vehicles with Electronically Controlled Gas Pedals to Stop Runaways is also a tale of ideology and arrogant insular group think. In an engineering lapse of monumental consequences that included dozens upon dozens of alleged deaths, the computer programming on affected Toyota, Lexus and Scion vehicles when confronted with both brake and accelerator inputs did not favor the brake input for its electronic engine controls. Such over-ride software is in widespread use at other automakers. If it is not, it will soon be implemented on all electronic throttle control systems because of this expensive and reputation damaging settlement. The plea deal absolves Toyota of any admission or concession by Toyota of any liability or wrongdoing. However, it does not absolve Toyota of guilt in several hundred wrongful death and injury lawsuits that are pending as separate matters. Closely related is (4A) Toyota to Pay Record $17.35 Million for Lexus Safety Cover-Up. This is the third – record – fine at Toyota for unintended acceleration cover-ups and reflects a corporate culture that ignored real safety and quality issues affecting its customers. Asian “face saving” via these cover-ups has deeply embarrassed the largest Japanese automaker resulting in the unintended shredding of Toyota’s reputation. Unfortunately, this disgraceful episode hasn’t hurt Toyota sales, so there is no economic instinctive, only moral ones, for changes in management behavior at Toyota.

While we are on the subject of what remains necessary consumer protection regulations in the U.S., we have another Asian company that flouted U.S. regulations during 2012 – (5) EPA Catches Hyundai and Kia in Mileage Rating Fraud, and the related EPA to Review Consumer Reports Data Claiming Ford C-Max and Fusion MPG Claims are Bogus in Real World Driving. Here, the offense is merely commercial, but it raises yet again the, well, unintended consequences of EPA publishing and publicizing fuel economy ratings (EPA Releases 2013 Vehicle Model Fuel Economy Guide) in an attempt to help consumers choose vehicles that are more efficient. The core problem is that automakers are self-certifying EPA mileage, so the foxes are indeed guarding the chicken house. Anyone who is shocked that ratings from automakers push the boundaries of credibility and are carefully calibrating vehicles to maximize results on the EPA test cycle, must also think the earth is flat and probably could write science textbooks for Texas. BMW got caught early 2012 for a 3 mpg difference on the highway rating of the 3-Series, (a story AutoInformed missed) and it was the leading indicator of what will be an ongoing controversy. Heretical thought: Shouldn’t the Federal Trade Commission be regulating the EPA published claims since they are a form of advertising? We are thinking about it.

For the greater good of the country, though – specifically our economy, our defense, our trade deficit, our future, our very independence – it’s tough to argue against (6) DOT and EPA Issue Record 54.5 MPG Fuel Economy Standards, and the related Iran Threatens to Close Strait of Hormuz, Shut Off Oil Supply. Here We Go With Another Oil Crisis Caused by Despots?, and Reducing Oil Imports – Assumptions in New Independence Plan. Yes, it’s true the real world economy number drivers will obtain will be much lower because of adjustments and credits written in the regulation by the automakers before and during the rulemaking process (another example of regulators being captive of the industry they are allegedly regulating), but this is still progress of a sort, maybe a grand sort. There are no lobbyists working specifically for American Energy Independence, but armies upon armies of them for special interest, multi-national corporations and Wall Street traders benefiting from the status quo – and they care not a sack of tea about our independence.

On the new product side, there were many positive developments during 2012 with the safest most sophisticated array of vehicles ever offered in the history of the industry. Our bias toward the practical as American Pragmatists has (7) Family Car Wars Revived as Nissan Ships New 2013 Altima or First Drive: Honda’s 2013 Accord – a Comeback Car? or Ford Debuts Mondeo Based, Mexican-Built Fusion at NAIAS or Dodge Dart Debuts Using First Fiat Architecture. More on Way among the numerous significant new car developments of the year. The family car market has never been more competitive, nor have the products been as sophisticated – good news for buyers but not automakers or their shareholders, where the bulk of sales transactions are in the $22,000 to $30,000 range.

In a related significant product story (8) is Hybrid Nation Grows. See Nissan to Add 15 Hybrid Models by 2016 and First Look 2014 Honda Accord Plug-In Hybrid Sedan and Ford Fusion Hybrid Sedan Said to Top EPA Fuel Economy Ratings and Honda Hybrid Sales Top 1 Million. 3 Million More to Catch Toyota and Chevrolet Volt Leads New Owner Satisfaction Report. Again and GM to Increase Electric Vehicle Development in China and Chevrolet Spark EV $25,000 after Federal Subsidy of $7,500 are among the many developments in the slowly expanding electric vehicle segment. The problem remains cost. While existing buyers of electric vehicles are true EV believers, the vast majority of budget constrained car shoppers are not. Nearly half of current EV buyers claim the best benefit of their ac/dc wheels is lower emissions when compared with emissions from gasoline- or diesel-powered vehicles, but it’s not clear if they know how their electricity is generated and 40% of the electricity in the U.S. comes from dirty coal.

However, once you get past this “puddle” of EV buyers – and they don’t even form a “pool” since they comprise only about 2.5% of the U.S. new vehicle market of 14 million (and that’s if you include hybrids as EVs; pure EVs have less than a 1% share) other people need to be brought into the clan. This assumes auto manufacturers are interested in recouping the billions invested so far in electric modes of transportation, prompted almost entirely by government regulations – dictating designs not results, always a regulatory mistake – with the hope that a market will appear. Compared with sales prices for similarly-sized gasoline-powered vehicles, owners of all-electric vehicles pay a premium of $10,000, on average, while plug-in hybrid electric vehicle (PHEV) owners pay, gulp, a $16,000 premium on average. Based on annual fuel savings, it would take an average of 6.5 years for EV owners to recoup the $10,000 premium. The payoff point for plug-in hybrid ownership is 11 years, hence (8A) Green Talk from EV Makers Ignores Key Buyer Concern – Cost

The Chevy Silverado above and GMC Sierra need to claw back some sales from Ford F-Series and Ram pickups.

One segment where there is a clearly defined market with strong demand remains pickup trucks, those most American of vehicles. Therefore (9) GM to Face F-Series, Ram with New 2014 Silverado, Sierra Pickups. Year-to-date through November, GM has sold a combined 506,088 Silverado and Sierra pickups. Ford Motor with its dominant F-Series, revised for the 2009 model-year, sold 576,529, which guarantees that F-Series will retain its leadership during 2012 as the best selling vehicle in the United States since 1982. Ram has also been posting strong sales results at a revived Chrysler Group at 263,152 or +20% ytd. An initial analysis by AutoInformed indicates that the GM trucks delayed by the bankruptcy are good, but the question lingers – will they be good enough against Ford’s F-Series and Dodge’s Ram line, both having considerable marketplace momentum, and both with their own unique selling points from their own recent revisions. This story line will carry over into 2013, and pickup sales will increase for the first time since 2007.

BP stockholders will pay fines and suffer loss of business, while senior BP executives walk away from criminal charges after 5 billion gallons of oil were spilled.

Sadly the last pick this year is the distasteful (10) BP in Plea Deal Pays $4 Billion for Deepwater Horizon Gulf Oil Spill. Highest Execs Free from Criminal Charges as Stockholders Pay Fines and the related Former BP Engineer Arrested for Obstruction of Justice in Ongoing Deepwater Horizon Criminal Investigation and BP Barred from Federal Contracts as Oil Spill Costs Mount). BP shareholders will pay more than $4 billion in criminal fines and penalties because of the Deepwater Horizon Oil spill that killed 11 people and caused the largest environmental disaster in U.S. history. The highest BP executive are now clear of future criminal charges as the result of the plea bargain where stockholders will pay fines for causing the monumental oil pollution that is still despoiling the Gulf Coast environment. During the disaster, BP publicly maintained that 5,000 gallons of oil were spewing forth daily into the Gulf, when in fact 60,000 gallons a day were gushing into the water and destroying the ecosystem.

BP lawyers arranged or agreed to a plea deal with the federal government admitting to criminal conduct though. BP was charged with 11 counts of felony manslaughter, one count of felony obstruction of Congress, and violations of the Clean Water and Migratory Bird Treaty Acts. As part of its guilty plea, BP has agreed to pay the largest criminal fines in United States history. Nevertheless, the penalty remains a small fraction of the actual damage caused by pumping at least 5 billion gallons of crude oil into the Gulf of Mexico. This means that BP is paying less than $1 a gallon for the criminal spill and destruction of the environment.