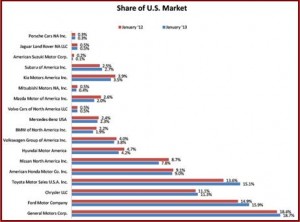

Asian brand cars from North American plants represented 36.3% of all cars sold in the U.S. in January.

U.S. vehicle sales in January were surprisingly strong, with no automaker stronger than Toyota Motor’s three brands, which increased sales almost 27% in a retail light-vehicle market that grew by 14% to more than 1 million units. The unexpected pace of the SAAR (seasonally adjusted annual selling rate) of 15.3 million during traditionally one of the weakest months of the year bodes well for automakers.

Offshore brands started 2013 with 54.4% of the U.S. market, down from the 55.3% they took in December, and the 55.8% share they occupied last January. The Detroit Three had a strong month in full size pickup sales as the housing market slowly recovers, accounting for more than 115,000 trucks, good for 11% of the market. Combined with other Detroit truck sales, this accounted for the seeming offshore brand share decline.

Korean makers Hyundai and Kia are losing share because they don’t have the capacity to keep up with an expanding market. Another plant is needed in the U.S.

This was offset in part by Toyota’s strong gains, including sales of 7,000 full-size Tundra pickups and 11,600 smaller Tacoma pickups in a space now vacated by the extinct Ford Ranger. Things get more interesting this summer when GM rolls out new Silverado and Sierra pickup trucks, which will be followed during the back half of the year by the resumption of production of redesigned midsize Chevy Colorado and GMC Canyon pickups aimed at the Tacoma and Nissan Frontier, which only sold 2,600 units in January.

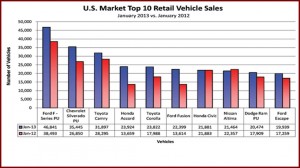

Overall, offshore nameplates sold 567,313 units, down from the 748,703 units sold in December. However, these sales are an increase compared to the 509,793 vehicles sold in January 2012 – a healthy increase. This shows in the Top Ten Seller list with Toyota Camry and Corolla, Honda Accord and Civic and the Nissan Altima holding five of the spots. Only one domestic car was in the bestseller list, Ford Fusion.

If you are keeping score, in third place behind the Ford F-Series and Chevrolet Silverado pickups, the Toyota Camry regained its position as the top selling car in the U.S. (The Honda Civic held the spot in November and December.) In fourth, the redesigned generic nolvadex online Honda Accord posted the biggest improvement of the Top Ten, with sales of the redesigned sedan up 75% year-over-year. Sales of the Toyota Corolla/Matrix in the fifth slot improved by 32.4%. In seventh and eighth place, respectively, Honda Civic and Nissan Altima rounded out the January Top Ten.

Nissan North America had a disappointing month, a combination of the Sentra changeover, and an ongoing lackluster brand image in AutoInformed’s view. January U.S. sales of 80,919 units were up only 2% y-o-y. Nissan Division sales in January totaled 73,793, up 1.8% over the prior year, although this made it the division’s best January ever. Sales of Infiniti vehicles were 7,126, an increase of 4.9% over last January.

In the ongoing Top Ten fight by adding the F-Series, Ford had three best sellers, and as a result it had a strong month, up 22%. The Fusion and Escape are apparently coated with Teflon as standard equipment. Both had reputation damaging multiple recalls during their launch last year, including engine fires affecting both. These were ignored by buyers of the European-based vehicles that were redesigned for 2013.

One area the recalls did hurt Ford is the Fusion’s loss of North American Car of the Year award to the Cadillac ATS announced at NAIAS in January. My conversations with jurors revealed a great deal of skepticism about Ford’s ongoing quality problems, which knocked the otherwise competent Fusion out of the running. (Read: Ford Changes Software to Stop New Escape and Fusion Fires and Another Ford Fire Recall on New Escape and Now Fusion Models)

“Dealers are benefiting from a combination of popular new remodels and consumers who need to replace their aging vehicles with new cars and trucks,” said AIADA President Cody Lusk. The import nameplate dealer association says that Asian brand cars sourced from North American production facilities represented 36.3% of all cars sold in the U.S. in January – an increase from 34.7% last January. Moreover, 24.3% of all trucks sold in the U.S. were produced by Asian brands’ North American facilities.

European brands have also expanded their production footprint here. In January, European North American-sourced cars represented 2.9% of all cars sold in the U.S. European nameplate trucks produced in North America captured 2.3% of the market.