The Board of Directors of the Ford Motor Company today declared Q2 dividend of $0.10 per share on the company’s outstanding preferred Class B and common stock. This is the same dividend paid in the first quarter of 2013, and twice the amount paid in Q2 last year. The second quarter dividend is payable on June 3, 2013 to shareholders of record on May 3, 2013.

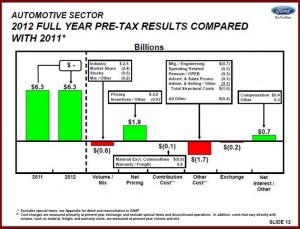

Ford Motor reported a 2012 full year pre-tax profit of $8 billion because of strong sales results from North America and resulting revenue from Ford Credit. Ford sold 5.7 million vehicles globally during the year. Full year pre-tax profit at $1.41 per share, and net income of $5.7 billion, or $1.42 per share, were each lower than a year ago, though as Ford struggled with European operations.

The latest dividend comes as Ford remains heavily dependent on the slowly recovering North American auto market, where it earned $8.3 billion during 2012, with an operating margin of 10% on sales of 2.8 million vehicles. Because of Ford’s 2012 financial performance, the company will make profit sharing payments to 45,800 U.S. hourly employees of $8,300 each. Ford expects similar North American results in 2013, with perhaps a profit increase if the pickup truck market – where it is the sales leader – continues to recover.

Ford Europe lost a breathtaking $1.8 billion during 2012, with an operating margin of -6.6% on sales of 1.35 million vehicles. The loss was much higher than Ford had forecast and the result of the continuing deterioration of the European economy, which is outpacing Ford’s efforts to trim costs. Ford now expects full year 2013 results for Europe to be a loss of about $2 billion, compared to prior guidance of a loss about equal to 2012. The European market is now tracking sales volumes last seen in 1995. Ford said it expects the European market to hit bottom this year at about 13-14 million units. Worrisome is the pushing back of the launch of the New Mondeo until 2014 in an attempt to trim costs.

In the bizarre world of 0.1-percenters, Ford Motor Company cut CEO Alan Mulally’s compensation by almost 30% because the company missed its 2012 profit, cash flow and market share goals.

Even so Mulally earned $2,000,000 in salary and $3,950,000 in cash bonus in 2012. His total listed compensation in 2012 – including the grant date value of long-term stock options and other performance-based equity awards – was $20,995,806. This is a drop from his $2 million in salary, $5.46 million in bonus and $22 million in other compensation for 2011. Ford Motor pretax profit dropped 9% last year to $8 billion as European losses grew. (Read AutoInformed on Ford Makes $8 Billion in 2012 – Almost all in North America)

Bill Ford, executive chairman and the great-grandson of Henry Ford, earned $2,000,000 in salary and $1,125,000 in cash bonus in 2012. Bill Ford’s total listed compensation – including the grant-date value of long-term stock options and other performance-based equity awards – was $14,836,013. While a grand total of only 63 people bothered to attend the Ford Motor Company annual meeting of shareholders last year, 29.5% of Ford investors voted against Ford family control of the company through their holdings of Class B stock. The Ford family gets 16 votes per share of B. Common stockholders get one vote per share. The disparity allows the Ford family to retain control of the publicly held automaker. The proposal is bound to resurface. The Ford Motor Company Board of Directors reinstated a dividend in 2012 and doubled the dividend during the first quarter of 2013, providing a financial return to the family and other investors. (Read AutoInformed on Ford’s Mulally to Remain as President CEO through at Least 2014 and Thirty Percent of Ford Shareholders Vote against Family Control)

The Ray T. and Veronica G. Chevedden Family Trust of Los Angeles, California will present a proposal at the Ford Motor Company Annual Meeting that seeks to end the Ford family control of the automaker via their special voting rights of Class B stock. “It is time that the 57-year practice (1956-2013) of disenfranchising Ford public shareholders is changed for the common benefit of all shareholders,” the proposal says.

While a grand total of only 63 people bothered to attend the Ford Motor Company annual meeting of shareholders last year in Delaware, 29.5% of all Ford investors voted against Ford family control of the company through their holdings of Class B stock. The Ford family gets 16 votes per share of B. Common stockholders get one vote per share. The disparity allows the Ford family to retain control of the publicly held automaker. (Read AutoInformed on Thirty Percent of Ford Shareholders Vote against Family Control)

This proposal topic previously earned the highest support for any Ford shareholder proposal — more than 1.4 Billion votes. In fact, it appears to have received more than 50% of the independent vote of the non-family stock.

Not surprisingly, the Ford Motor Company Board of Directors, vetted by the Ford family, is opposed to what will be proposal 7 on the ballot. In the proxy statement just filed with the U.S. Security and Exchange Commission, the Board said it is not in the best interests of Ford or common stockholders.

The Board said, “The Company’s founding family has over a 100-year history of significant involvement in the affairs of Ford Motor Company. During that time, all shareholders have benefited from this involvement. Through their actions over the past century, the Ford family has proven that the long-term success of the Company for the benefit of all shareholders has been, and continues to be, the primary purpose of their involvement. Never has this been more evident than during the recent financial crisis, which resulted in the bankruptcies of our two major domestic competitors.”

Ford Motor’s share capital structure, with both common and Class B stock outstanding, has been in place since Ford became a public company in 1956. The Board says that each shareholder purchasing a share of Ford stock is aware of this capital structure, and “many are attracted to Ford stock by the long-term stability the Class B shareholders provide to the Company.”