The relatively high prices of pickup trucks should bolster the profits of the Detroit Three when Q2 results are in because they dominate the segment.

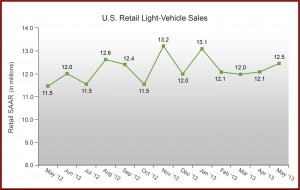

New vehicle sales in May are projected to be about 1 million retail units higher than one year ago, resulting in a seasonally adjusted annualized rate or SAAR of 12.5 million. This is the highest annual rate since January of 2013, and May, if the forecast is accurate, will be the third consecutive month with retail sales in excess of 1 million. More than 3 million used vehicles will change hands in May.

Relatively affluent new vehicle buyers are taking advantage of cheap interest rates as the Federal Reserve continues to print money in a desperate attempt to revive a sluggish economy where 16 million people remain unemployed or under-employed because of the ongoing effects of the Great Recession.

The expansion of extended-term loans — 72 months or longer, reducing monthly payments, as well as strong used vehicle trade-in values and strong new-vehicle residual values, which also lower new-vehicle lease payments, are all propping up demand for new vehicles.

The full-size pickup truck segment is also helping increase the sales pace in May, accounting for 11.4% of auto industry retail sales, an increase from 11% in April and up from 9.7% in May of 2012. The relatively high prices of pickup trucks should bolster the bottom lines of the Detroit Three when Q2 results are announced, because they dominate the segment.

“Collectively, these components mean that while industry new-vehicle transaction prices have risen by 19% during the past six years ($28,921 in May 2013 from $24,404 in May 2008), the average monthly payment for new-car buyers and lessees has increased only 3% ($455 in May 2013 vs. $443 in May 2008),” said John Humphrey, of J.D. Power & Associates, the source of the forecast.

Total light-vehicle sales in May 2013 are expected to increase to 1,439,400, up 8% from May 2012. Fleet sales are weaker than expected in 2013, but continue to average nearly 21% of total sales, with fleet sales in May 2013 projected at 281,000 units, representing less than 20% of total sales.

LMC Automotive is holding the total light-vehicle sales outlook for 2013 at 15.4 million units. The 2013 outlook for retail light-vehicle sales also remains the same, at 12.5 million units.

“This is the time of year when the automotive industry holds its collective breath as the recent past has dealt with a spring slowdown in demand; however, the current pace suggests full steam ahead for the second half of 2013,” said Jeff Schuster of LMC Automotive.

North American light-vehicle production year-to-date through mid-May is up 4%, compared with the same period in 2012. Most major manufacturer volumes are either flat or up slightly, with the exception of General Motors, down 4% on the transition of the Impala and weaker large SUV sales ahead of the new model introductions next year.

Vehicle inventory levels in early May are at 3.2 million units — a 63-day supply — and consistent with the current level of demand. Inventory was at a 55-day supply in May 2012.

LMC Automotive is increasing its forecast for 2013 North American production to 16.0 million from 15.9 million units. With this increase, 2013 will mark the first time production in the region has been at the 16 million-unit level since 2002.