Total light-vehicle sales in October are projected at 1.27 million units, a 6% increase from October 2013.

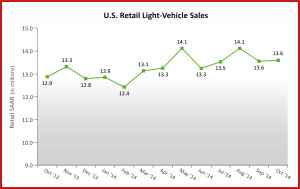

U.S. New-vehicle retail sales are expected to reach their highest level for the month of October since 2004, according to the latest forecast. Retail sales are projected to come in at 1.1 million units, a 6% increase, compared with October 2013. The retail seasonally adjusted annualized rate, aka SAAR, in October is expected to be 13.6 million units, 700,000 stronger than October 2013.

Consumer spending on new vehicles will exceed $32.5 billion in October, the highest level for the month of October since 2013 when consumer spending reached $30.7 billion.

Total light-vehicle sales in October 2014 are expected to reach 1.27 million units, a 6% increase from October 2013. Fleet volume is expected to be 203,000 units, or 16% of total light-vehicle sales.

In addition to overall better economic conditions, growth in retail sales and higher transaction prices are in part due to increasing consumer adoption of longer-term financing which makes purchases more affordable from a monthly payment perspective. Nearly one-third (32.6%) of all vehicles sold in October 2014 are financed with a term of 72 months or longer, tying the record set in July 2014, according to John Humphrey, of J.D. Power, the source of the auto sales soothsaying.

LMC Automotive maintains its 2014 U.S. light-vehicle retail sales forecast at 13.6 million units and total light-vehicle sales forecast at 16.4 million units. SUV sales have increased 12% in 2014 compared with 2013, while total new-vehicle sales have increased 5%. SUVs are expected to account for 34% of the light-vehicle market in 2014, up from 32 percent in 2013.